Should You Invest in Commodities

Post on: 25 Июль, 2015 No Comment

Speculation in agricultural commodities is back in a big way. According to a recent article in Der Speigel, the price of cocoa reached a 33-year high recently. Anthony Ward, aka Choc Finger of the Armajaro Hedge Fund has bought a large number of futures contracts for the delivery of 241,000 tons of cocoa worth $1 billion. That amounts to about 7% of the world annual production. Instead of reselling the contracts, Armajaro took delivery of the beans and now they are stored in warehouses across Europe.

From the article:

Cocoa isnt the only commodity that has become significantly more expensive in recent months. The price of wheat has gone up by 17 percent since April, and soybeans by 12 percent. At the beginning of the year, sugar prices climbed to their highest level in three decades in the space of only a few months and then plunged by almost half. But now sugar prices are back up, climbing by almost 6 percent since April.

The food price index of the United Nations Food and Agriculture Organization (FAO), which aggregates price movements for key agriculture products, climbed to 163 points in June. This is only 15 percent lower than the all-time high of 191 points in 2008, the year of the financial crisis.

Price Explosion

At the time, rice prices rose by 277 percent within only six months, and corn became so unaffordable that millions of Mexicans could no longer afford tortillas, a staple in the country. Hunger riots erupted in Haiti, Egypt and more than 30 other countries.

Driving the price explosion was the growing use of agricultural commodities to produce biofuel. But 2008 was also the year in which, for the first time, the public realized that grain merchants were no longer the only ones trading on the exchanges (in their case, by buying grain futures to hedge against poor harvests), but that the major players in the financial markets had discovered the lucrative trade in agricultural commodities.

Last year, Goldman Sachs earned $5 billion in profits with commodities alone. Other major players include the Bank of America, Citigroup, Deutsche Bank, Morgan Stanley and J.P. Morgan.

Columnist Bill Carrigan of The Star wrote a piece about adding commodities to ones portfolio. He noted:

Commodities can best be described as “things†that are components of different categories such as the hard commodities (copper, gold, silver), the soft commodities (cotton, lumber, sugar) and the grains (soybeans, corn, wheat).

Aside from the assumption of risk, the other impediment is the physical challenge of placing a bulky and perishable “thing†into a portfolio. Gold was probably the first commodity to be placed into a modern portfolio because of its infinite shelf life and its acceptance by investors and portfolio managers as a financial asset.

As far as risk is concerned, the reality is that 5,000 bushels of wheat, 80,000 board feet of lumber or 25,000 pounds of copper may carry less risk than many mid- to small-cap corporations. Commodities do not go insolvent and they do not have “earnings surprises,†Commodities do not have accounting and CEO scandals. As far as I know, no commodity has ever become worthless in modern times.

When it comes to valuations, investors can apply both fundamental and technical analysis studies to any commodity. Fundamental studies would focus on supply and demand and technical analysis would focus on trends and turning points.

Bill used the following chart to show that commodities belong in ones portfolio as an asset class.The CRB index is a benchmark designed to track commodities.

Chart Monthly closes of the Reuters/Jefferies CRB index Vs. S&P500 stock Index:

We can infer from the chart that in the past decade commodities have performed much better than equities.

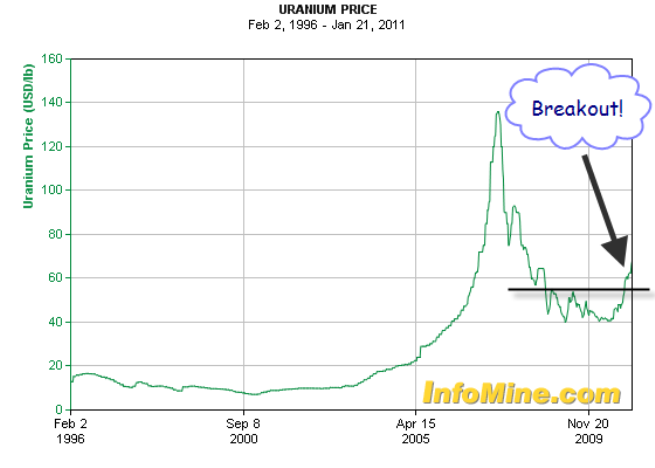

In the cover story titled Amber Waves of Pain Bloomberg BusinessWeek discussed how commodity ETFs have burned investors. The article explained some of the fundamental flaws behind commodity ETFs that investors failed to notice until it was too late. Some of the charts from the BusinessWeek piece are shown below:

Click to Enlarge

Despite the better performance of commodities over the past decade I do not believe commodity investing is for the small investor.Unlike holding stocks in a corporation, investing in commodities in any form such as futures contracts, ETFs, etc. carry a multitude of risks that are beyond the control of ordinary investors and the risks involved are extremely large. As noted in the Der Speigel article during 2007-2008 prices of items such as sugar, oil, rice, etc. shot up dramatically in many emerging and low-income countries. However later the prices fell quickly returning to normal levels.

Related ETFs:

United States Oil Fund LP (USO )

United States Natural Gas Fund (UNG )