Should You Buy an Emerging Market High Yield Bond Fund

Post on: 24 Июль, 2015 No Comment

You can opt-out at any time.

In today’s low-yield environment. any investment that offers an above-average yield is bound to attract attention. That’s the case with emerging market high yield bond funds, which offer investors better yields than just about other any type of fund. But there’s a reason for that: these funds also tend to have the highest risk. Before you consider such a fund, be sure that you understand exactly what you’re getting.

Emerging Market High Yield Bond Funds: The Basics

“Emerging markets ” is the term that’s generally used to describe economies outside of the largest, most established markets such as the United States, the United Kingdom, core Europe, Japan, Australia, etc. The asset class can encompass anything from larger, more established markets such as Brazil to smaller economies such as Ghana or Vietnam. In the past, the investment options in these nations were largely “sovereign,” or government, bonds. In recent years, however, the corporate bond market has exploded in size, leading to a proliferation of mutual funds and exchange-traded funds that invest in the debt of corporations.

Within the realm of corporate debt are “high yield” bonds, which invest in the debt of smaller, less financially stable corporations that are rated below investment grade. Since the issuers have below-average financial strength (indicating that they may have more difficulty making their interest or principal payments than the Coca-Colas of the world), they need to offer higher yields in order to compensate investors for the risk .

The Benefits of Emerging Market High Yield Bonds

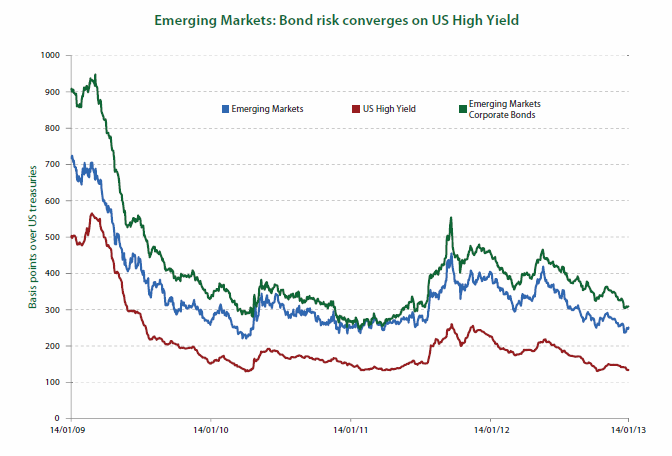

The benefit of owning such a fund is the yield: they yield more than U.S. corporate or high yield funds, and they certainly offer an income advantage over lower-yielding options such as short-term bond funds. They also have the potential for an attractive total return. or capital appreciation above the yield. Emerging market high yield bonds typically trade at a discount to similarly-rated bonds in the developed market. As this gap gradually closes over time, these bonds have the potential to reward investors with long-term outperformance. And having an above-average yield certainly provides emerging market corporates with a favorable starting point compared to other asset classes.

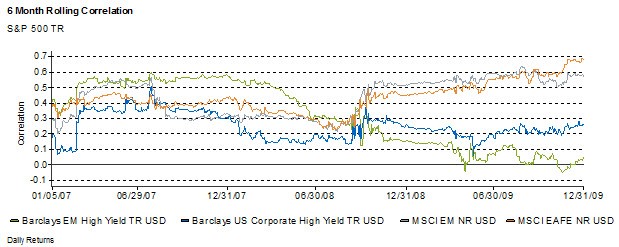

Emerging market high yield bonds also provide an element of diversification for investors whose portfolios are heavily tilted toward the developed markets. Not only do they provide geographic diversification, but they also tend to have a low correlation with U.S. investment-grade bonds.

One reason for this low correlation is their lower degree of interest-rate risk. or in other words, their below-average sensitivity to developed-market interest rates. While a sharp upward spike in U.S. Treasury yields (and a corresponding decline in prices ) will cause the asset class to underperform – as was the case in the second quarter of 2013 – a gradual upward drift in Treasury yields isn’t necessarily a headwind for emerging market high yield bonds. This could prove to be an important positive attribute if developed-market bonds do indeed enter a bear market in the years ahead, as many experts are anticipating.

The Pros Need to Be Weighed Against the Cons

While emerging market high yield bonds have a number of potential benefits, investors need to be extremely mindful of the risks. This is the highest-risk segment of the global bond markets, which means that it can exhibit stock-like volatility and saddle investors with sizeable losses in the short term. In the brief interval from May 2 to June 24, 2013, for example, the iShares Emerging Markets High Yield Bond ETF (EMHY) lost 13.8% of its value. If you can’t stomach that kind of downturn, these funds aren’t for you.

It’s also important to keep in mind that emerging high yield, like stocks, are subject to investors’ shifting appetite for risk. When headlines disrupt the markets, certain segments of the bond market – most notably U.S. Treasuries – can benefit from a “flight to quality .” Emerging high yield bond funds, on the other hand, will experience meaningful downside in that scenario. In this sense, they may be effective in diversifying an investment-grade bond portfolio, but not a portfolio heavily tilted toward equities .

There’s also the issue of currency risk. If a fund holds some or all of its portfolio in local-currency bonds (as opposed to those invested in U.S. dollars) they can experience even higher volatility when investors become jittery.

Who Should Invest in Emerging Market High Yield Bonds?

These funds are appropriate for someone with a high tolerance for risk and a sufficiently long-term time frame (ideally five years or more) to dampen the impact of short-term volatility. On the other hand, an investor who needs to keep their money safe, who has a short-term time horizon, who has a low degree of experience with volatile investments should look elsewhere. High yields often draw investors into inappropriate products, a mistake that should be avoided at all costs. Remember: it’s never a good idea to invest in the highest-yielding option without taking the risks into account.

How Can You Invest in This Asset Class?

While many mutual funds own emerging market high yield debt, there aren’t yet any products that invest exclusively in the asset class (see Morningstar’s full list of emerging market bond funds here ). However, there are two options among exchange traded funds. Market Vectors Emerging Markets High-Yield ETF (HYEM), with an expense ratio of 0.40%, and iShares Emerging Markets High Yield Bond Fund (EMHY), which has an expense ratio of 0.65%. You can learn more about these ETFs at their respective web pages here and here .

Disclaimer. The information on this site is provided for discussion purposes only, and should not be construed as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities. Always consult an investment advisor and tax professional before you invest.