Should Investors Reconsider Metal Mining ETFs

Post on: 18 Апрель, 2015 No Comment

Exclusive FREE Report: Jim Cramer’s Best Stocks for 2015.

NEW YORK ( ETF Expert ) — Precious and industrial metal mining stocks were huge gainers during the bond-buying rumor rally.

From European Central Bank chief Mario Draghi’s do-whatever-it-takes hint on July 26 through Federal Reserve Chairman Ben Bernanke’s QE3 announcement on Sept. 13, mining ETFs rocketed more than nearly any other economic sub-segment.

Here are how some did and their percentage yield between those two dates:

- Global X Silver Miners (SIL ). 37.3%

- Global X Copper Miners (COPX ). 25.3%

- Market Vectors Gold Miners (GDX ). 25.2%

- SPDR S&P Metals & Mining (XME ). 25.0%

- Market Vectors Steel ETF (SLX ). 17.9%

By way of comparison, the S&P 500 SPDR Trust (SPY ) was up 9.4% in the period.

Since respective peaks in mid-September, however, the metal mining sub-sector has come under increasing pressure. The run-up in the shares of these particular hard asset producers may have followed a classic buy the rumor, sell the news pattern.

For example, the first instinct for investors on rumors of central bank bailouts has typically resulted in declining developed world currencies and rising metal prices. If the prices of various metals stay high or move higher, the miners have even more incentive to increase production. Moreover, the profits should presumably benefit the shareholders of mining stocks. The presumption leads to buy-the-rumor speculation.

Then comes a dose of economic reality. The global economy is still weak. Mining firms that collectively produce tons and tons of stuff may find themselves oversupplying a world where the demand is lackluster. Investors in mining ETFs may choose to cash in while they still can. This activity is akin to selling-the-news trading.

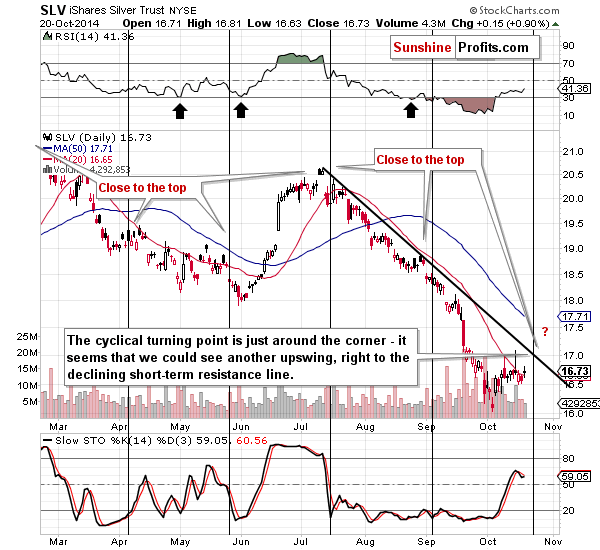

In spite of the 10% pullback off of the September highs, SPDR Metals and Mining has demonstrated remarkable resilience. In the chart above, XME has bounced off 50-day support on several occasions. Moreover, the proxy for metal miners has been notching a pattern of lower lows, suggesting that a genuine uptrend may soon follow.

By the same token, one should probably curb his/her exuberance until there is a sustained breakout above the 200-day long-term trendline, After all, the plunge in iron-ore prices since 2010 has yet to support the idea that emergers like China are back in the economic saddle. (Note: The sketchy performance of SLX reflects this uncertainty.)

Still, the world’s most used metal may be suggesting that there is light at the end of the tunnel. Copper demand may be returning. as Global X Copper Miners is towing the line on its longer-term, 200-day moving average.

This article was written by an independent contributor, separate from TheStreet’s regular news coverage.