Should I Invest My Money in a Savings Account Mutual Funds or 401(k)

Post on: 24 Июль, 2015 No Comment

If you're mulling whether to invest some of your hard-earned money, you'll need to take a moment to think about your short-term and long-term goals. Since you're a unique person, you'll need to craft a unique investment strategy that takes your specific needs into account. If you want to speed the process along and take some of the pressure off of your own shoulders, consider hiring an investment manager or wealth advisor. On the other hand, you might not have the time, money or inclination to talk to one of these professionals. Over the decades, you'll save thousands of dollars by self-investing your own money in a judicious manner.

There are many different savings and investment vehicles that you can use to protect and grow your money. There are also plenty of investment vehicles that you can leverage for a short-term capital gain. The exact strategy that you employ will depend upon your appetite for risk and your long-term personal goals. It's important to remember that poor investing decisions can have far-reaching ramifications. In addition to the financial losses that they can produce, bad investments might cause marital strife, depression and other unforeseen consequences.

If you're committed to making safe, conservative investment decisions that won't expose you to a lot of risk, you may wish to consider three different types of savings and investment vehicles.

The first is the old-fashioned savings account. Savings accounts are deposit accounts that accrue and disburse interest at regular intervals. Most savings accounts make interest payments on a monthly basis. In the past, these savings vehicles have yielded as much as 10 percent per year. Unfortunately, this is no longer the case. These days, most savings accounts pay interest rates of between .5 and 1.5 percent. In other words, they barely compensate for the effects of inflation.

Mutual funds are baskets of stocks or other equities. Like stocks, they rise and fall with the broader market. Unlike stocks, they're diversified. As such, mutual funds are somewhat insulated from the risk that characterizes the stock market. At the same time, mutual funds tend to produce relatively modest gains during periods of financial exuberance.

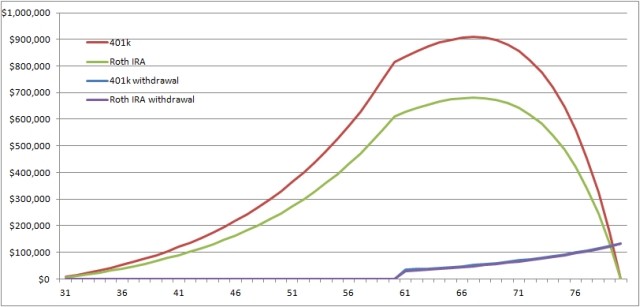

Typically offered by employers, 401(k) plans are retirement vehicles that can be stocked with a wide range of investment instruments. Your 401(k) contributions might function like tax-deductible IRA contributions and should come directly out of your paycheck. To ensure that your 401(k) remains risk-averse, use a basket of stable, dividend-paying stocks to build it.