Should I Invest in Commodities

Post on: 4 Июнь, 2015 No Comment

You’ve got stocks, bonds, ETFs and cash in your portfolio — but what about commodities? Do they belong alongside your other investments, and if so, how much money should you allocate to them?

This can be a very confusing question, especially for inexperienced or young investors. Some might also believe that you have to trade risky futures contracts just to invest in commodities. However, there are actually a wide range of available investment options available, making it much easier.

While commodities probably shouldn’t make up the majority of your portfolio, they can be a great way for investors to diversify their portfolios, lowering overall risk.

What are Commodities and Why Invest in Them?

A commodity is a raw material or a basic good that is used in commerce. For example, oil is one of the best-known commodities because it has so many uses, from transportation to heating to electricity. Crude oil is also the most commonly traded commodity. Other commodities include wheat, orange juice, copper, gold, silver, platinum, cattle and sugar.

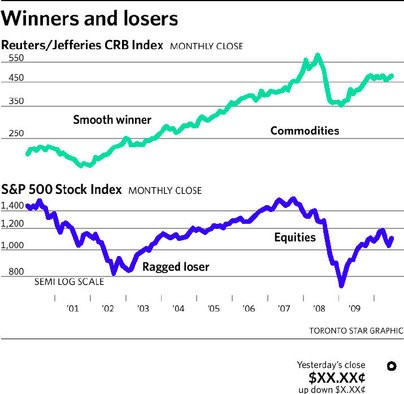

Why would an investor want to consider buying these commodities? The price of commodities, such as oil and gold, tend to rise during periods of inflation, as the nation’s currency loses value and investors seek to preserve their purchasing power. Additionally, commodity prices can move in the opposite direction of other asset classes, such as stocks and real estate. So, if your equities aren’t performing well, your portfolio might not suffer nearly as much if you have some exposure to commodities.

For example, inflation was a big problem in the U.S. during the late 1970s. topping out at 13.5% by 1980. While the Dow Jones industrial average remained relatively flat during that period, the price of oil rose more than 1,000% in the decade — jumping from $3.39 a barrel in 1970 to an average price of $37.42 a barrel in 1980. The price of gold also increased dramatically, rising from $35 an ounce in 1970 to more than $800 an ounce by 1980. Had you been invested in oil or other commodities like gold during this period, your portfolio would have been much better off.

But be cautious — commodity prices tend to fall harder during periods of deflation. An example of this was seen in 2008 during the Great Recession. The price of crude oil started in July 2008 around $140 a barrel and just four months later, the price plummeted to $40. Therefore, you might want to be more conservative with your portfolio allocation to commodities.

How Can I Invest in Commodities?

Commodities have traditionally been traded in the futures market, which can be risky due to the amount of leverage involved. For example, an investor will enter into an agreement to buy or sell a set amount of a commodity at a predetermined price and at a future date. That means that just a small amount of cash can control a large amount of a commodity with a small price increase or decrease leading to a huge gain or loss.

But you don’t have to risk your money directly in the futures markets to gain exposure to commodities. Instead, you might want to take a more conservative approach by investing in commodities through ETFs and stocks.

There are a number of ETFs designed to track the price of a specific commodity or a basket of commodities. Examples include the United States Oil Fund LP (USO ), which tracks the price of oil; the United States Natural Gas Fund (UNG ), which tracks the price of natural gas; the SPDR Gold Trust (GLD ), which tracks the price of gold; the Power Shares DB Agriculture Fund (DBA ), which tracks the price of widely traded agricultural commodities such as corn, wheat, soy beans and sugar; and the iShares GSCI Commodity-Indexed Trust (GSG ), which tracks a basket of commodities.

Besides investing in ETFs, you can also invest in individual companies that produce a certain commodity. For example, if you want to invest in oil, you might want to invest in Exxon Mobil (XOM ) or Chevron (CVX ). However, you should understand that investing in individual stocks introduces a number of other risks, as the price of oil is just one of many factors affecting a company’s stock price.

Do Commodities Belong in My Portfolio?

In conclusion, investors should consider commodities to diversify a portfolio and also as an inflation hedge. An allocation of 5-10% of your portfolio could be a good benchmark, but it really depends on the investor and how much risk you are willing to handle.