Should I Borrow Against a PaidOff House to Invest

Post on: 23 Июль, 2015 No Comment

Many people spend all of the money that they make. Therefore, despite handling millions of dollars during their lifetimes, they have little or no savings with the exception of the equity in their home at the end of the day. It is therefore very tempting to look at using that money for investing or for other expenses.While mathematically it may make sense to borrow and invest (take money out at 5% and invest it with a 15% return), emotionally this is a poor idea. Stocks do not provide regular returns. How would you feel if you took out a $100,000 loan on your house only to see it worth $70,000 after the first year? While remote, if you do not have another source of income you could even end up facing a foreclosure if things went really bad with your investments. Why put yourself through that emotional roller coaster?

Paying off your house comes before investing. It gives you a sense of peace that allows you to make rational investment decisions. If you have a paid-for house and you lose your job or your investments go South for a while, the emotional toll is nowhere near what it is when you have the mortgage payment due each month.

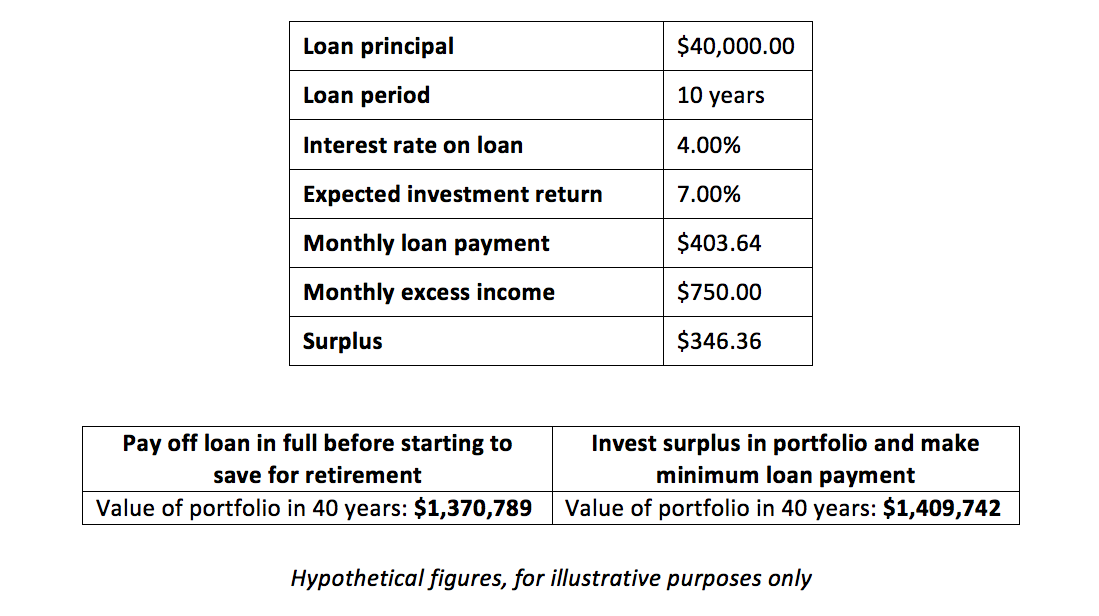

Instead of borrowing against your house, look for ways to free up income for investing. In general it is best to minimize recurring expenses so that you have the freedom to spend or save your money as you wish each month rather than having it all spoken for before the month even begins. Maybe see if you need that wine club membership or extra cell phone line. Maybe order water when you go out and go out a little less often. Even if you can only find a couple of hundred dollars a month to put away, equivalent to eating 4-6 extra meals in each month, this will build up over time.

If you have paid off your mortgage recently and other expenses have not already replaced the money your were using for payments, direct that money into an investment account before they do. Simply make a mortgage payment to yourself. The best way to invest is in regular installments. That way stocks can be bought over time, such that a lower overall cost basis can be achieved, rather than dumping in the funds all at once and risking the purchase of stocks right at a peak in prices from which it will take years to recover.

To ask a question, email vtsioriginal@yahoo.com or leave the question in a comment for this blog.

Disclaimer: This blog is not meant to give financial planning advice, it gives information on a specific investment strategy and picking stocks. It is not a solicitation to buy or sell stocks or any security. In addition the writer of this blog is not an accountant and writings should not be taken as tax advice which should be left to a CPA. Financial planning advice should be sought from a certified financial planner, which the author is not. All investments involve risk and the reader as urged to consider risks carefully and seek the advice of experts if needed before investing.