Shorting Bonds Investing for Inflation

Post on: 23 Июль, 2015 No Comment

We have advocated a long-term, diversified approach as the investing methodology that will produce the best results for the majority of your portfolio for a long time. However, mixing some shorter-term positions, options strategies and even a few speculative bets into your portfolio can often improve your overall returns and reduce portfolio volatility.

The current market environment is the perfect example of why investors need to be thinking about investing strategies beyond a generic buy-and-hold methodology. (Learn more about strategic diversification .)

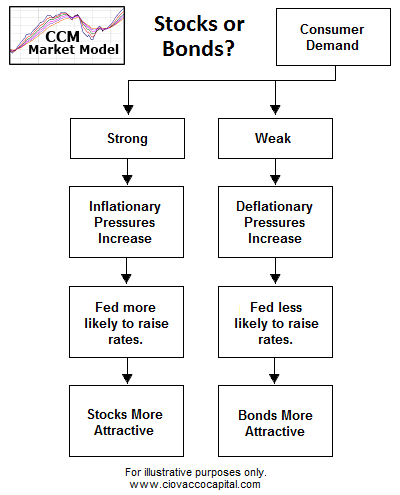

The economy in late 2008 and early 2009 has been in a tug-of-war between the threats and serious risks of deflation and the disadvantages of high inflation. (See Investing for Inflation vs. Deflation .)

The extraordinary deficits planned by the U.S. government and the massive intervention in the U.S. Treasuries market by the Fed to fight deflation have shifted investor expectations more toward high inflation over the next several quarters.

Savvy traders observing this shift toward inflation expectations are likely getting their inflation-based investing plans ready to deploy. When traders talk about opportunities in a market like that, they will often mention short bonds or Treasuries positions.

There are three ways investors can go about this:

1. Short Bonds

A short bonds position has the potential to produce big profits during high inflationary periods, but how does an individual trader do that within their regular stock account?

2. Short Bond ETFs

Shorting an actual bond is complicated, and probably outside the scope or interest of most individual traders. However, shorting a bond ETF could accomplish the same thing with a lot less hassle.

As bond prices drop (due to inflation), bond ETFs will also decline in value. There are many bond ETFs to choose from, but the iShares Barclays 7-10 Year Treasury Bond Fund ( IEF ) is an ideal instrument for this short strategy.

However, what if you are not interested in the complexity of shorting a stock?

3. Buy Short Bond ETFs

There is an even easier way to take advantage of a decline in bond prices buy a short bond ETF. That means that the ETF itself is investing in short bonds, and by buying the ETF you will profit when bond prices drop.

For example, the ProShares UltraShort 7-10 Year Treasury ( PST ) is a leveraged ETF that has become very popular as a way to execute this strategy.

The Risks Involved With Shorting Bonds

There are some inherent risks in shorting bonds that you should be aware of:

1. Bonds are mean-reverting, which means that they dont trend for long periods of time. This makes your holding period fairly short term.

2. Leveraged positions using margin and leveraged ETFs include higher costs.

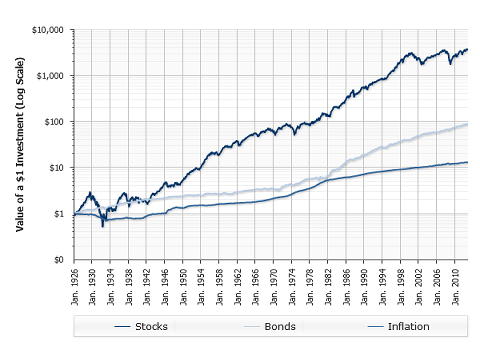

3. Leveraged funds will underperform in the long run because they lose some of the benefits of compounding. (Learn more about leveraged ETFs for stocks, bonds and currencies .)

You will notice that the disadvantages of this strategy mostly concern the fact that a short bond strategy is a short-term strategy. Short-term trading costs more and is more difficult than longer-term investing.

However, when faced with an extraordinary market and an evolving economic environment, looking outside the long-term box for new opportunities can be quite attractive.