Short Term Investments and Marketable Securities

Post on: 4 Май, 2015 No Comment

If read a balance sheet, you will find an item under the current asset group named “Short-term Investments”. Short-term Investments and Marketable Securities are generic terms used to describe a variety of investments a company may hold.

Advertisement

An investment generally is considered marketable if it can be purchased or sold in the public financial markets, but a company may hold other types of investments too.

The general category may include investments in stocks and bonds of other companies, U.S. Treasury bills and bonds, mutual funds, money market funds, certificates of deposit, and commercial paper. Many of these types of investments can be classified as either short-term or long-term, some may be classified as cash equivalents and combined with cash on the balance sheet, and others may be underlying investments held in a fund to repay long-term debt or pension obligations.

Equity securities and debt securities are other terms used to describe some investments. So what are equity and debt securities? Let’s start it with that. Read on…

Equity Securities

An equity security generally represents some form of ownership in another company, such as owning the common stock of a corporation:

Equity Security = Ownership = Common Stock

You are not guaranteed to make money on a common stock investment. In theory, the market price of that investment should rise if the company does well, although there are many other factors which influence stock prices, not all of which are based on a company’s performance.

At its discretion, the board of directors may declare a cash dividend to be paid to the stockholders, distributing a portion of the corporation’s profits to its owners, with the remaining earnings retained or reinvested in the company.

Debt Securities

A debt security represents a borrower-lender relationship:

Debt Security = Borrowing = Bonds Payable

If you purchase a debt security such as a corporate bond, you are directly or indirectly making a loan to the company for which it has promised to pay a stated amount of interest, usually semiannually, and to repay the amount loaned on a specific maturity date, often many years in the future.

In the meantime, the market value of the bond investment may change over time with changes in interest rates caused by general economic conditions and changes in investor perceptions of risk for a particular company.

Equity, debt, and other forms of securities are publicly traded on a daily basis in the financial markets, with regulated mechanisms bringing together parties with money to invest and companies that need to raise capital via stockholder investments or borrowings.

When you (or a company) purchase a marketable debt or equity security, you can hang on to it for years, sell it later the same day, or sell it at any other time of your choosing, based on its current market value.

Investments in Equity and Debt Securities (Balance Sheet Classification)

It is important to note that most of these investments could be classified as either current assets or long-term investments. In part, the distinction between the two classifications is based on the company’s judgment regarding the nature of these investments.

If the investments are included among the current assets, you generally would conclude that these are investments of idle cash, with the expectation that the investments will generate dividends or interest income and/or increase in value and be sold at a profit when the idle cash later is needed to finance ongoing business activities.

However, if these investments are classified as long-term, the company may be taking a longer-term view and hoping to maintain an ongoing business relationship with another company (perhaps a supplier) or to support a joint venture with another company when neither company can provide adequate financing or assume the full risk of a particular business venture, whether a domestic or a foreign endeavor.

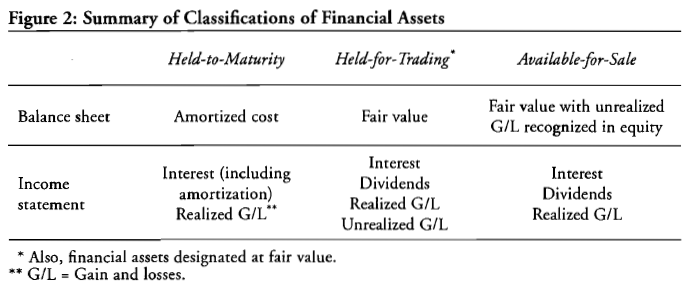

Although specific types of investments may be classified as either short-term or long-term, the purpose and intent of such investments is a key factor in deciding under which classification the investments will be reported. The purpose and nature are revealed further by specific financial statement terms; investments in marketable securities may be presented in the balance sheet as trading, available for sale, or held to maturity securities.

Trading Securities

The term trading securities typically is applied to companies which invest in and actively manage a portfolio of equity and debt security investments, with frequent purchase and sales transactions (trading), taking advantage of short-term changes in market price to produce earnings, along with the earnings from dividends and interest.

Those investments are classified as current assets and appear immediately below cash and cash equivalents because they can be sold readily to generate cash if needed. The dividends and interest earned, along with the gains or losses from the sale of these investments, are reported as other income or expense in the income statement.

Trading securities initially are valued at their cost but later are presented on the balance sheet on the basis of the current market price of the portfolio of investments, even if that price is higher than cost. This treatment is a rare exception to the concept of conservatism; most assets are reported at cost or at less than cost if their value has declined, but are not adjusted above cost if their value has increased. However, this practice may be justified because the investments can be sold readily.

Let’s assume that the investments a company owns at year end were purchased for $100,000 but the current market value is $130,000. If the investments were sold at this current market price, the company would report a gain on the sale of its investments of $30,000. But it still owns the investments, and the balance sheet value reported is $130,000. Where is the $30,000 increase in market value reported?

In the income statement, almost as though the investments had been sold. Assume that the company also earned $10,000 in dividends and interest on its trading securities portfolio during the year, sold some investments at a $2,000 loss, and adjusted its year-end investment portfolio to market value. The financial statements would present the information as follows:

On the Balance Sheet :

Investments in Trading Securities

($130,000 market value; $100,000 cost) = $130,000

On the Income Statement :

Other Income and Expense

Loss on Sale of Investments = $(2,000)

Unrealized Gain on Trading Securities = $ 30,000

The increase in market value is considered an unrealized gain (or unrealized holding gain) because the investments were not sold. Similarly, if the market price of the investments had declined, an unrealized holding loss would be reported in the income statement. Even though the gain or loss is unrealized, it was largely a matter of discretion whether to sell or hold the investments at this time; they could have been sold readily if the company desired.

Available for Sale Securities

Although some companies hold trading security portfolio investments, a more common purpose for investments in marketable securities is to generate dividend or interest income or to gain from market price appreciation rather than carrying excessive cash balances during low points in the business cycle.

If necessary, such investments can be sold, but they also can be held for months or even years and are referred to logically as available for sale securities. The current versus the long-term classification of these investments provides an indication of the company’s purpose and intent.

Just as with trading securities, available for sale securities are valued and presented on the balance sheet on the basis of current market prices, and the dividends and interest earned and gains and losses from sales are reported in the income statement.

However, in the case of available for sale securities, an unrealized (holding) gain resulting from the increase in the market price of the investments is not included in the income statement; instead, it is reported as accumulated other comprehensive income, which is a unique and separate component of stockholders’ equity.

When gains and losses are reported in the income statement and included in net income for the period, they ultimately are reflected in the year-end retained earnings included in total stockholders’ equity.

However, the unrealized gain in our example was excluded from net income and from year-end retained earnings; as a result, the unrealized gain must be reported as a separate component of year-end stockholders’ equity. We will discuss these concepts again in the last section of this chapter on stockholders’ equity.

If the company classified the investments in the example above as available for sale securities, the financial statements would appear as follows:

On the Balance Sheet :

Investments in Available for Sale Securities

($130,000 market value; $100,000 cost) = $130,000

Accumulated Other Comprehensive Income

Unrealized Holding Gain: Available for Sale Securities =$30,000

On the Income Statement :

Other Income and Expense

Dividends and Interest Earned = $ 10,000

Loss on Sale of Investments = $(2,000)

Held to Maturity Securities

A bond investor (bondholder) is directly or indirectly making a loan to the corporation in return for a stated amount of interest that typically is paid semiannually and a stated amount that will be paid back on a specified future date.

As is discussed in more detail in the section on long-term liabilities in this chapter, the bondholder is guaranteed to receive a stated amount of interest, but if the stated interest is too low, an investor pays less for the bond; likewise, if the stated interest rate is higher than current conditions indicate, the bond must be purchased at a higher price.

Bond prices fluctuate over time, influenced by current market conditions, the state of the economy, and the perceived risk of a particular corporation. However, at the time of the initial investment, the price paid by the bondholder locks in a long-term rate of return if the bond is held to maturity. The investor can either hold the bond until it matures to earn that rate or sell the bond to another investor at its current market price, again based on the market conditions existing at the time.

When bond investments are classified as trading or available for sale securities, the stated interest payments the investor receives will be reported as income in the income statement for the year, the bond investment on the balance sheet will be based on its current market value, and the change in the value of the bond investment will be reported either in the income statement or in stockholders’ equity, as was discussed above.

However, if the investor intends to hold the bond investment until it matures, it generally will be classified as a long-term investment, specifically as a held to maturity security. Unlike trading and available for sale securities, a held to maturity investment is not adjusted to market value at year end because the company does not expect to sell the investment in the near term; the current market price of the bond is less relevant than it is for other investments the company can or intends to sell in the near term.