Short Selling Stocks

Post on: 16 Март, 2015 No Comment

Short selling: un-American or pro-market?

The ability to sell something you don’t own is one of the unique aspects of Wall Street. This article aims to demystify the concept of short selling, why traders do it, how short sales work, and the many risks involved. Besides the risks, traders must be diligent in following margin requirements, short selling rules, and even deal with margin calls or hard-to-borrow issues when necessary. Recognizing the important aspects of short selling allows traders to better manage potentially unlimited losses due to market risk, as well as other perils like dividends and corporate actions.

Oftentimes short sellers are the black sheep of the investor community and many wish short sellers simply did not exist. In actuality, however, short sellers aid in creating a healthy and efficient market in many ways. Several benefits include improving the price discovery mechanism, allowing for the expression of a contrarian view, and bringing additional liquidity and activity to sometimes illiquid and inactive markers. Bullish traders and investors may actually learn about new investment opportunities from short-selling analytics, like short interest and days-to-cover. Understanding these short-selling topics coupled with the concepts covered in Stock Basics: An Investor’s Guide will give you a more well-rounded view of the markets.

What’s short selling, and why do traders do it?

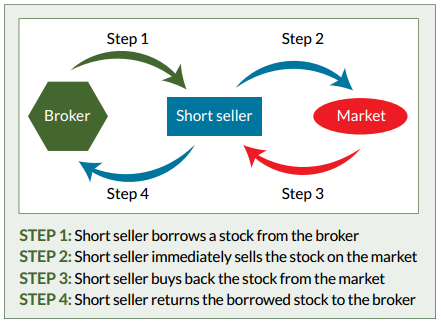

Short selling flips the old adage: “buy low, sell high”. Anticipating that a stock’s price will drop, a short seller performs this action in reverse: first they sell high, then they buy low. The tricky part is that the short seller doesn’t actually own the shares they want to sell.

To accomplish this, you’d actually borrow shares of stock via TradeKing and then sell them in the open market, without ever owning the shares. Then you must buy identical shares back at a later date to return to the owner, again via TradeKing. Your goal as a short seller is to purchase the shares back for less cost in the future and net a profit. If the market value of the shares increases during the period when you’re borrowing them, however, you can suffer serious – even unlimited — losses.

Because short sellers are betting a stock’s price will drop, they’re often looked upon as wet blankets. However, short sellers are just trying to make an honest buck like other investors. They’re attempting to profit by shorting stocks which they believe are overvalued, just as traditional long investors try to profit by owning undervalued stocks.

Because a short position is the opposite of a long position, many features are the reverse of what you might expect. In particular, when short selling, the potential profit (rather than the loss) is limited to the value of the stock, but the potential loss of short selling is unlimited.

How does short selling work?

Unlike buying common stock. in which it is possible to initiate a position and hold indefinitely, selling short requires you to keep an eagle-eye on the market, since losses on any short position are theoretically unlimited.

- Borrow Shares — To profit from a decrease in the price of a stock, a short seller borrows the shares and sells them, expecting they will be cheaper to buy back in the future. The owner is not notified the shares are loaned to the short seller, but this action does not impede the owner from selling at any time.

The risks of selling short

When you’re short common stock. you face several different kinds of risk. First, you have market risk, which simply means the stock price may increase and work to your detriment. You are also at risk of the company taking a corporate action while you are short the stock. This could be something simple like declaring a dividend will be paid, or more complex, like spinning off a company or issuing warrants. Either way, this is something that could cause your account significant pain if ignored.

- Market risk — Because there is no limit on how high a stock can go, the market risk you face as a short seller is potentially unlimited. The higher the stock price goes, the more pain you feel.

Here’s the kicker for short sellers: if you are short the stock at the market close the day before the ex-date, you will owe the dividend — meaning, it will be deducted from your trading account and paid to the owner of the shares. When shorting 100 shares with a dividend of only a few cents per share, this may not seem worth mentioning. But if you short thousands of shares with even small dividends, this can rack up some big losses for you in a hurry.

Rules specific to short selling

Unlike going long, a number of rules restrict which stocks may be shorted and the necessary conditions for shorting. This means you won’t always be able to short any stock you want, whenever you want.

- Margin Requirements — You must hold in your account 100% of the security’s current market value. This is the cash you received from the initial short sale plus any increase which may have occurred to date. Because there is a liability attached to the receipt of the cash, you are not entitled to spend it. On top of that, there are standard margin requirements for short-stock transactions. However, TradeKing has the right to require higher amounts. Here’s a breakdown.

You already know you must hold the security’s entire market value. On top of that you must also hold 50% of the initial value of the short stock in cash and / or marginable securities if the strategy doesn’t go your way. That means you’ll typically need to have the equivalent of 150% of the stock’s value on hand at any time to help cover your risk. You are also subject to maintenance requirements throughout the life of the trade (usually at least 40% of the current value).

Furthermore, if your holdings are not diversified and your account is too concentrated in a short position, TradeKing may decide to impose higher amounts or additional restrictions. We will contact you by email and phone if necessary, so make sure your account information is up-to-date. If you can’t come up with the extra collateral, it’s game over – TradeKing will require the position be closed and take action if necessary to do so. Feel free to contact us with any questions about margin requirements.

Oftentimes this happens when the stock price is increasing and the original share owner wants to take some profits. This may also happen when there are fears of bankruptcy or in the event of takeovers. Just be aware it’s entirely possible that you’ll get forced into an ill-timed exit against your will.

The mechanics of transacting a short sale

Entering your short position

Establishing a short stock position involves selling shares that you do not own in the open market. When you short the shares, you receive cash into your account, and you are obligated to buy the shares at a later date in order to close your short position. You might be asking yourself, “How can I sell something that I don’t own?” The answer is quite simple: you borrow the shares via TradeKing and promise to return the shares later when the position is closed.

This transaction is initiated when you enter a sell short order on shares of a stock for which you are bearish. After TradeKing confirms the shares are available for shorting and you have sufficient assets in your margin account as collateral, the order is released to the market and the proceeds of the sale are credited to your account.

TradeKing must be able to make delivery of the shorted shares, in what is known as a “stock locate.” Brokers have several ways to borrow shares in order to facilitate locates and make good on the delivery of the shorted shares. If they cannot locate them from their own customers, they may be able to arrange loans from custody banks and fund management companies; however, this service may come at a cost to the short seller. If this happens, the shares are likely “hard-to-borrow”. Some factors that can influence the availability of stock are high demand, small float and increased volatility of the particular security.

Clearing firms (which handle back-office operations for brokerage firms) provide a limited number of shares for short selling. For the average TradeKing client looking to short a stock, this is an ample supply. Occasionally, the number of shares held short rises to a point where the clearing firm may activate policies to make the stock harder to borrow in order to maintain their own supply, namely by implementing hard-to-borrow fees. If you open and close a short position intraday (not held overnight), you will not be subject to a fee. However, if you hold the position longer, a hard-to-borrow fee will be passed on to you.

The hard-to-borrow rate for a security can range from a fraction of a percent to above 100% of the principal value of the trade, depending on market demand. Market conditions are in constant flux. The amount of these fees is constantly changing, even intraday, and may not be known in advance. If the stock you decide to short carries a hard-to-borrow rate above 3%, you will receive a warning message when previewing a live order. Should the fee rise above 3% while holding a short position, TradeKing will attempt to advise you of this change and may close your position without prior notice, if necessary. You will be responsible for any hard-to-borrow fees and rate increases if they occur.

Exiting your short position

You can close the short position at any time when buying back the shares. This is called “buying to cover.” If the price has dropped during the borrowing period, you make a profit. If the price has increased, you’ll incur a loss.

Why sell short?

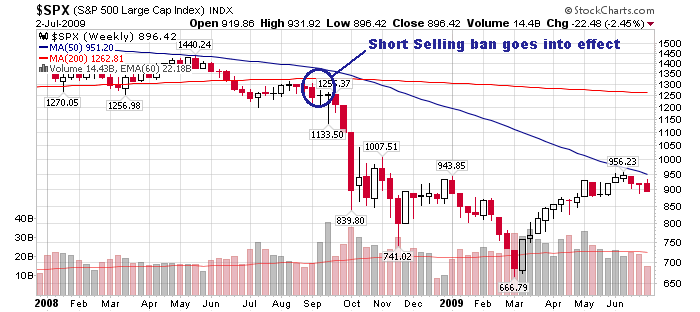

Short sellers play a valuable role in expressing their contrarian opinion. They act as a counterbalance to exuberance in the marketplace. While short sellers typically become newsworthy or subjects of regulatory scrutiny during sharp market contractions, they are not directly responsible for these rapid market moves downward. On the contrary, short sellers keep the market healthy by providing liquidity at times when the market badly needs it. Short sellers express a contrary opinion that is necessary for a smooth, functioning market and an efficient price discovery mechanism.

What benefits do short sellers bring to the market?

Far from being market downers as they’re sometimes portrayed, short sellers play an important role in the efficient matching of buyers and sellers. Short sellers simply express their opinion that the market is about to trend downward. Just like a political debate at a cocktail party, dissenting opinions help everyone better understand all sides of an issue than if everyone in the crowd agrees unilaterally. In a similar way, short sellers help all investors understand the full range of opinions and views about a particular stock, a process known as “price discovery”.

Short sellers run counter to the market’s natural bias towards going long, providing dissenting opinions that challenge the conventional wisdom. Overbought markets can be very unhealthy; short sellers thus serve a valuable, if unpopular, purpose in expressing their opinion that the market is overpriced. As a result, they help to keep the market in balance with their contrarian opinions.

During periods of market exuberance, market participants are clamoring to buy shares of specific stocks. However, at the end of the day, there are a finite number of shares out there. If investors just want to buy, the prices will skyrocket. Somebody has to step in and sell, and if none of the longs want to, a short seller is able to supply the shares. This provides additional liquidity to the market.

Market liquidity

Access to market liquidity is crucial for any investor. When people say a market is “liquid”, they mean stocks can be traded rapidly at any time with other market participants. Without short sellers stepping in to provide additional liquidity during periods of market duress, trading activity would slow to a crawl in certain stocks — and slowing activity breeds even less activity later.

At the same time, if there are fewer ready and willing buyers and sellers in a specific stock, the difference between the bid and ask prices will widen. These wider spreads reflect the higher market risk that a stock will not be able to be traded quickly at nearly the same price.

When the market lacks both depth and breadth, the buying and selling process becomes strained. Stocks may become illiquid if they are not readily saleable due to uncertainty about their value, or the lack of a market in which they are regularly traded. Just like turbulence on an airplane, choppiness in markets makes for a rough ride.

Short sellers must buy to cover eventually

While it may sound counterintuitive to sell something you don’t own, short sellers have in fact initiated a real financial obligation when shorting, and later they must make good on it. They will need to buy back the shares, or “cover,” at some point.

Because of their financial obligation, short sellers must act fast if the market moves against them. If as a short seller you’re wrong and prices climb, you face the prospect of huge losses. Since short selling involves selling first and buying later, when a whole bunch of short traders decide it’s time to cover at once, the result can be a dramatic bullish move, or “short squeeze.” Since covering their positions involves buying shares, the short squeeze causes an even further rise in the stock’s price, which in turn may trigger additional covering. Because of this risk, many short sellers restrict their activities to heavily traded stocks where liquidity is usually readily available.

The need to minimize those potentially unlimited losses causes short sellers to buy if the stock is moving higher against them. As buyers overwhelm the sellers in the market, it becomes increasingly difficult to manage losses on short sales.

Another motivation driving short sellers towards buying-to-cover is their margin requirements. If short sellers do not have enough capital to maintain a higher margin requirement for their short positions, they may be forced to close them.

What you can learn from short-selling analytics

Traders use several key indicators to gauge whether a market is overpriced. On one hand, these indicators can be used to analyze a potential short sale or existing short position. On the other hand, they can be used by bullish traders as a type of contrarian indicator.

- Short interest – This is the total number of shares held short in a given stock. It is often expressed as a percentage by dividing it by the total number of shares outstanding. These numbers are reported regularly.

In general, the higher the short interest, the more the sentiment is considered bearish. However, at a certain point, too much short interest becomes a contra-indicator, which is actually bullish. (Remember: all those shorts will eventually need to buy-to-cover.) Since short sellers are bearish and not bullish, they may monitor this number for potential exit points, or it may influence them to pass and move on to another potential trade.

Not every source of financial data calculates short interest statistics in the same way. To tally short interest, TradeKing uses the number of shares outstanding and the number of shares held short. Others may use the float instead of number of shares outstanding. (Keep in mind: a sizeable portion of a stock’s float is usually held in reserve by the company itself and not outstanding in the market.) Or they may use a method that provides a historical measure of short interest.

The basics of short selling stocks

Short selling is very different from owning stocks. It’s more complex, carries more risk and requires a higher degree of responsibility on the part of the trader engaging in this practice. Before jumping in and going short, it’s important to understand short selling, how it works, why traders do it, margin requirements, short selling rules, margin calls, hard-to-borrow issues and the degree of risk involved. The potential of unlimited losses is a trade characteristic which requires undivided attention.

When you get down to the details, short sellers play a vital role in our markets. They fully participate in price discovery by expressing an opposing view, while providing additional (sometimes badly needed) liquidity. Although short analytics focus on the bearish positions held by investors, the information they provide can alert all traders of potential forces which can greatly impact stock prices. Knowing how short selling works and the dynamics involved can assist traders of different market opinions to make more informed trading decisions.