Short Selling Make money when prices go down

Post on: 30 Август, 2015 No Comment

October 3, 2011 Print

What is Short Selling?

Contrary to what the name suggests, short selling is not exclusively for the height challenged. Anyone can do it provided you put in the time to learn/grasp/perfect the process/fundamentals.

Short Selling is a risky way to make profitable trades from declining stock prices. It also goes by the names “shorting” and “selling to open”.

Brace yourself this is a potentially profitable. albeit dicey/speculative process.

How does Short Selling work?

If you believe stocks are going to increase you buy them, right?

Well, the idea behind short selling is the opposite; you expect the stock price to go down in the future. You have anticipated this and positioned yourself to profit - through shorting the declining stock.

By short selling, you would sell the stock now at the current market price, and when the stock price declines in the future, you would buy back (also known as cover ), the shares at the lower price. And make a bundle, right? Well, hopefully.

“How do I sell something that I don’t have?” you may ask. The answer to that question is you (or more likely, your broker) would borrow the shares from someone who currently has the shares, and then sell it.

The understanding is that you would replace those shares that you borrowed at a later date by covering your position. Luckily you do not have to roam the streets trying to find someone who owns the shares and would lend it to you. There are stock brokers for that.

So essentially, short selling reverses the order of a typical stock purchase: stocks are sold first and bought later

Short Selling on Margin

In order for brokers to let you sell something that you do not own, they need to issue you a Margin (link to margin here) approval. This makes sure there are no dine and dash scenarios, and is a necessary part of the process.

A Word of Caution

While short selling a stock is an effective way to make money from declining prices, you have to realize that there is no cap on the losses you can incur should the stock price go the other way.

The most a stock price can drop to is $0, but the most it can rise to is limitless. So in theory, your loss could be limitless as well. You may want to read that last sentence again.

ALWAYS have an exit point beyond which you should cover your position no matter what.

Want to see it in action?

Mary thinks of herself as a wise investor and is eager to take profits when possible. She looks at Google, and thinks it’s overpriced, overrated and is probably due for a drop (We now know that when someone wants to profit from a potential price drop they can!).

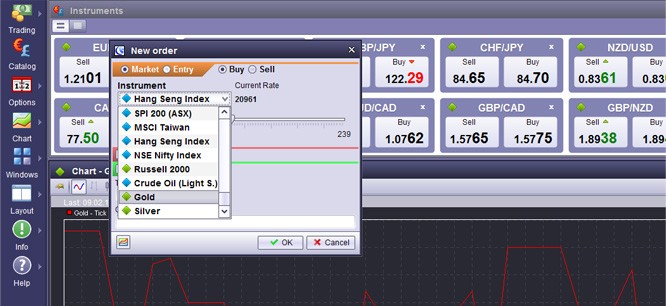

Google is currently trading at $600 and Mary places short order of 10 shares. (You can do the same by clicking here).

Fast-forward 3 months Mary is right and Google’s price drops to $500. Awesome! Mary is happy with her $1,000 profit ($10010 shares). She closes her position by places a cover order for all 10 shares.

Still curious? Here’s how it works behind the scenes.

When Mary places a short order, she’s actually borrowing the stock and selling it on the market. To cover it, she buys the stock back and returns it to the person she borrowed it from.

Confused? Let’s break it down.

When Mary places a short order for 10 shares of Google, her broker (real or electronic) will try to find the shares to borrow. The broker will look in his client’s portfolios, his inventory, or will ask other brokers. Let’s say he finds the 10 shares in Bob’s portfolio and borrows them (He’s very quiet and Bob will never find out!). Don’t feel too bad for Bob, the broker will return them soon.

The broker then sells the shares on the market for $600. Mary is now short 10 shares of Google for $600 a share (total of $6,000).

Fast-forward 3 monthsGoogle’s price drops to $500, Mary is happy and places an order to cover. The broker will do this by buying 10 shares of Google back from the market for a total of $5,000. The broker now returns the 10 shares to Bob’s portfolio (see I told you he’d never find out). Since the broker sold the shares for $6,000 and bought them for $5,000, Mary made a profit of $1,000.

Short With Care

While short selling is an effective tool to make profits from declining stock prices, it is extremely risky if you do not have an exit strategy in place when you go into the trade.

You are essentially selling someone else’s stock via a broker. While the margin ensures that you do not lose too much money, the small print does not always protect your interests. Hence, you need to make sure of two things:

- You carefully read (and understand ) the rules in place regarding your margin with the broker

- You KNOW when to get out by covering your position.