Share Class Types Mutual Funds

Post on: 11 Июль, 2015 No Comment

Expenses, Advantages and Disadvantages

Adam Gault/ OJO images/ Getty Images

Quick! How many mutual fund share classes exist in the investment universe? Also, which one is best for you? There are several different types of mutual fund share classes, each with its own advantages and disadvantages, most of which center upon expenses. For a direct comparison of share classes, you may want to look at the article, Which Mutual Fund Share Class Is Best? However, you came to the best place to begin learning about the basics of share class types.

Class A shares generally have front-end sales charges (also known as a load). The load, which is a charge to pay for the services of an investment advisor or other financial professional, is often 5.00 and can be higher. The load is charged when shares are purchased. For example, if you bought $10,000 of a mutual fund Class A shares, and the load is 5.00%, then you pay $500 as a commission and you will have a total of $9,500 invested in the fund.

A shares are best for investors who plan to invest larger dollar amounts and will buy shares infrequently. If the purchase amount is high enough, you may qualify for breakpoint discounts. Be sure to inquire about these discounts on the load if you plan to purchase additional shares of the fund (or mutual funds within the same fund family).

Unlike the A shares, mutual fund Class B shares are a share class of mutual funds that do not carry front-end sales charges, but instead charge a contingent deferred sales charge (CDSC) or back-end load. Class B shares also tend to have higher 12b-1 fees than other mutual fund share classes. For example, if an investor purchases mutual fund Class B shares, they will not be charged a front-end load but will instead pay a back-end load if the investor sells shares prior to a stated period, such as 7 years, and they may be charged up to 6% to redeem their shares.

Class B shares can eventually exchange into Class A shares after seven or eight years. Therefore they may be best for investors who do not have enough to invest to qualify for a break level on the A share, but intend to hold the B shares for several years or more.

Class C Share mutual funds charge a level load annually, which is usually 1.00%, and this expense never goes away, making C share mutual funds the most expensive for investors who are investing for long periods of time. There may also be 12b-1 fees. In the humble opinion of your mutual funds guide, C share funds are most beneficial for brokers and investment advisors, not the individual investor, because of the high relative ongoing expenses. If your advisor recommends C shares, ask them why they do not recommend A shares or B shares, both of which are better for investment time horizons of more than a few years.

In general use C shares for short-term (less than 3 years) and use A shares for long-term (more than 8 years), especially if you can get a break on the the front-load for making a large purchase. Class B shares can eventually exchange into Class A shares after seven or eight years.

Class D mutual funds are often similar to no-load funds in that they are a mutual fund share class that was created as an alternative to the traditional and more common A share. B share and C share funds that are either front-load, back-load or level-load, respectively.

One of the most widely held D share mutual funds is PIMCO Real Return D. Compared to PIMCO Real Return A, PIMCO Real Return B and PIMCO Real Return C, the D share class is the only one with no load and it has the lowest net expense ratio .

Adv share class mutual funds are only available through an investment advisor, hence the abbreviation Adv. These funds are typically no-load (or what is called load waived) but can have 12b-1 fees up to 0.50%. If you are working with an investment advisor or other financial professional, the Adv shares can be your best option because the expenses are often lower.

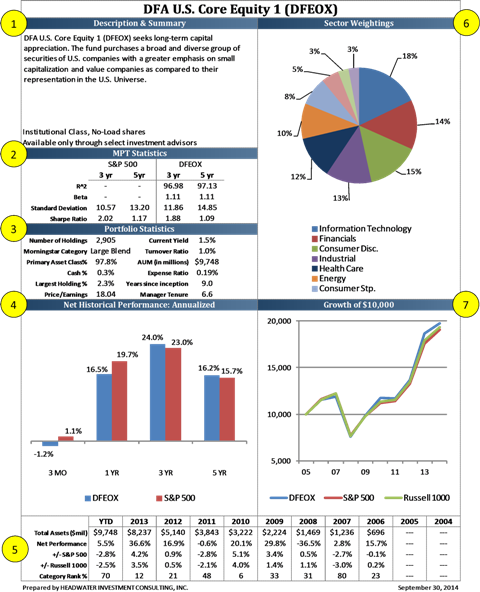

Inst funds (aka Class I, Class X, Class Y or Class Y) are generally only available to institutional investors with minimum investment amounts of $25,000 or more. In some cases where investors pool money together, such as 401(k) plans, breakpoints can be met to use the institutional share class funds, which typically have lower expense ratios than other share classes.

Load-waived funds are mutual fund share class alternatives to loaded funds, such as A share class funds. As the name suggests, the mutual fund load is waived (not charged). Typically these funds are offered in 401(k) plans where loaded funds are not an option. Load-waived mutual funds are identified by an LW at the end of the fund name and at the end of the ticker symbol .

For example, American Funds Growth Fund of America A (AGTHX), which is an A share fund, has a load-waived option, American Funds Growth Fund of America A LW (AGTHX.LW).

R share mutual funds do not have a load (i.e. front-end load, back-end load or level load) but they do have 12b-1 fees that typically range from 0.25% to 0.50%.

If your 401(k) only provides R share class funds, your expenses may be higher than if the investment choices included the no-load (or load-waived) version of the same fund.

A common R Share fund family seen in 401(k) plans is American Funds. For example you may have seen American Funds Growth Fund of America or American Funds Fundamental Investors or American Funds Small Cap World in either R1, R2, R3 or R4 share classes.

It is wise to take advantage of any matching contributions your employer may make when you contribute to your own 401(k). However, be sure to pay attention to the expense ratio. especially if there is no employer match. Therefore, you may choose to open your own account and find a no-load fund .

If you are not using an investment advisor, there is no need to invest in a particular share class. For example, no-load funds are not technically a share class.

Whether you do it yourself or choose an expert for financial advice, you are choosing an advisor. Start the decision process of hiring an advisor by asking a few reflective questions: If a friend needed an advisor, would you recommend you? Do you want to hire you as the advisor or do you need to hire someone else? What is the value of your time compared to the monetary cost of using an advisor? Do you enjoy the process of investment research and financial planning or do you dread doing it to the point of neglecting your finances?

Skill and knowledge matter less than good judgment. Some investment advisors and financial planners are just as susceptible to damaging emotions and poor judgment as the average do-it-yourselfer. However, a good adviser will look at your money logically and help lay out an objective road map to follow so you can reach your future financial goals while living your present life more fully. How much might this be worth to you? Perhaps even your own acquired skill and knowledge of financial matters is greater than that of many financial advisors but how much does quality of life factor in to your decision?

Again, whether you do it yourself or you use an expert, you are choosing an advisor. The question boils down to this: Do I want to hire myself or do I want to hire someone else? If hiring someone else, you want to find someone who works under a structure that promotes those great virtues (humility, honesty, simplicity, moderation and frugality) that we mentioned previously. This eliminates most advisors who are paid only by commissions and/or those who are incentivized by products they sell. In other words, you don’t need a salesman—you need an unbiased advisor that is paid by no one else but you.

Finding the best of anything is really a subjective exercise; what works for one person may not be ideal for another. However, when it comes to mutual funds, there are some fund companies that provide the best overall experience for the individual investor.

There is no one-size-fits-all mutual fund family or investment company. Therefore there is no one way to go about finding the best one-stop shop for investing. But you can certainly narrow down the choices by considering what matters most to the wise investor—a wide variety of choices, low expense ratios. sound investment philosophies and experienced management to name a few signs of good value.

Note: PIMCO has the best overall selection of actively-managed bond funds. Also, not all of the Fidelity’s funds are no-load. They also have advisor shares and loaded funds .

No matter which share class (or non-share class) you choose, it is wise to do your own research, rather than leave it up to anyone else, including a trusted advisor.

Mutual fund research can be made easier with a good online research tool. Whether you are a beginner or a pro and if you are looking to buy the best no-load mutual funds, review an existing fund, compare and screen different funds or you are just trying to learn something new, mutual fund research sites, such as Morningstar. can be helpful and easy to use. Search screens on their online tools allow for an investor to narrow their search for no-load and load-waived funds. Most of the online mutual fund research sites require you to register for free or premium access.

By now, you fully understand that keeping expenses and fees low is a core element of finding quality mutual funds. Before doing your research, you need to have a good idea of what to expect with mutual fund expenses. There are plenty of good mutual funds with below-average expense ratios to choose from in the universe. Therefore don’t settle for expensive when you can have inexpensive AND high quality! Here is a breakdown and comparison of average expense ratios for basic fund types :

Large-Cap Stock Funds: 1.25%

Mid-Cap Stock Funds: 1.35%

Small-Cap Stock Funds: 1.40%

Foreign Stock Funds: 1.50%

S&P 500 Index Funds: 0.15%

Bond Funds: 0.90%

When investing yourself (directly with a mutual fund company or discount broker) never buy a mutual fund with expense ratios higher than these! Notice that the average expenses change by fund category. The fundamental reason for this is that research costs for portfolio management are higher for certain niche areas, such as small-cap stocks and foreign stocks, where information is not as readily available compared to large domestic companies. Also index funds are passively managed. Therefore costs can be kept extremely low.

Note: These averages are what I would call close approximations and were taken directly from my Morningstar mutual funds software. You can also find similar numbers on most mutual fund research sites .

Why do index funds outperform actively-managed funds. Over long periods of time, index funds have higher returns than their actively-managed counterparts for several simple reasons.

Index funds, such as the best S&P 500 Index Funds. are intended to match the holdings (company stocks) and performance of a stock market benchmark, such as the S&P 500. Therefore there is no need for the intense research and analysis required to actively seek stocks that may do better than others during a given time frame This passive nature allows for less risk and lower expenses.

Also active fund managers are human, which means they are susceptible to human emotion, such as greed, complacency and hubris. By nature, their job is to beat the market, which means they must often take additional market risk to obtain the returns necessary to get those returns. Therefore, indexing removes a kind of risk we may call manager risk. There is no real risk of human error with an index fund manager, at least in terms of stock selection. Even the active fund manager that is able to avoid the trappings of their own human emotion can’t escape the irrational and often unpredictable nature of the herd.

Best of all the cost, expressed as an Expense Ratio. of managing an index fund is extremely low compared to those funds that are actively engaged in outperforming the averages. In other words, because index fund managers aren’t trying to beat the market they can save you (the investor) more money by keeping management costs low and by keeping those cost savings invested in the fund.

Many index funds have expense ratios below 0.20%, whereas the average actively-managed mutual fund will can have expenses of around 1.50% or higher. This means, that on average, an index fund investor can begin each year with a 1.30% head start on actively-managed funds. This may not seem like a large advantage but even a 1.00% lead on an annual basis makes it increasingly difficult for active fund managers to beat index funds over long periods of time. Even the best fund managers in the world cannot consistently beat the S&P 500 for more than 5 years and a 10-year run of winning versus the major market indexes is almost unheard of in the investing world.

As a final note from your humble Mutual Funds Guide. there are several other share class types, such as K Shares, J Shares, M Shares, S Shares and T Shares not mentioned here. Investing should be simple and non-obstructive of the priorities in life such as health, family and the pursuit of happiness. Therefore use a trustworthy advisor or invest in a simple portfolio of low-cost, no-load index funds.

You may benefit by the lazy portfolio, which is a collection of investments that requires very little maintenance. It is considered a passive investing strategy. which makes lazy portfolios best suited for long-term investors with time horizons of more than 10 years. Lazy portfolios can be considered an aspect of a buy and hold investing strategy. which works well for most investors because it reduces the chances of making poor decisions based upon self-defeating emotions, such as fear, greed and complacency, in response to unexpected, short-term market fluctuations. The best lazy portfolios can achieve above-average returns while taking below-average risk because of some key features of this simple, set it and forget it strategy.

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.