Separating Alpha From Beta Portable Alpha

Post on: 18 Апрель, 2015 No Comment

The previous discussion focused on the choice between traditional long-only actively managed funds versus index funds Long-only refers to the constraint on these funds that they cannot sell short (i.e. have a negative weighting on) shares they expect to decline in price, nor buy put options on them.

Before moving on, we should explain what these terms mean. Consistently successful active management (that is, active management that delivers higher after-tax risk adjusted returns than a comparable index fund) ultimately comes down to consistently successful forecasting. Some active managers attempt to forecast the future performance of a company, and buy (i.e. go long) its stock if the current price is below their estimate of its value. Other active managers try to forecast the future behavior of other investors. They go long stocks whose price they expect will increase because of net buying pressure by other investors.

However, assume that both of these active managers also identify stocks that they expect will decline in price. At a long-only fund, the investment policy prevents the manager from using two techniques to try to profit from these downside forecasts. The first is short sales. Here is a simple example of how this works. Assume the Widget Company’s stock is trading at $100 today, but you forecast it will go down to $80 within a month. Since you don’t own any shares of Widget, you borrow them (which costs you a small fee — say, $1). You then sell these Widget shares to another investor (who expects them to rise in price) for $100 per share. If your forecast is accurate, and Widget declines in price. you purchase the shares you have to return to the original lender for $80, and make a profit of about $19 ($100 less $80 less $1).

As an alternative to the short sale, you could have purchased a put option on Widget. Put options give the owner the right, but not the obligation to sell the shares at a specified price (known as the strike price) up to a specified date in the future. The interesting thing about put options is that they are so-called leveraged instruments, because they cost only a fraction of the strike price. So, in our example, you could have paid $5 (known as the option premium) to purchase a three-month put option on Widget at the current price of $100. If the price of Widget’s stock drops to $80, you could then sell your put option at a price of $20 ($100 less $80). In our simplified example, your profit would be $15 ($20 less $5)

On balance, we concluded in the previous section that most investors would be better off using index products to implement their portfolio’s asset allocation strategy. However, a new development in the investing world — separation of alpha and beta — further complicates the choice between active and passive investing.

Let’s start with some basic terminology. When you invest in the stock of a single company, you are taking on two types of risk. The first is risk that is specific to the company itself. This risk has many different names, including idiosyncratic risk, specific risk, and unsystematic risk. The key point to keep in mind about this type of risk is that it declines as you invest in an increasing number of companies. This is the power of diversification. At some point (between 30 to 50 companies in different industries, depending on which study you are reading), company-specific risk is eliminated, and you are left with the core risk associated with investing in equities as an asset class. This is also known as systematic, or undiversifiable risk.

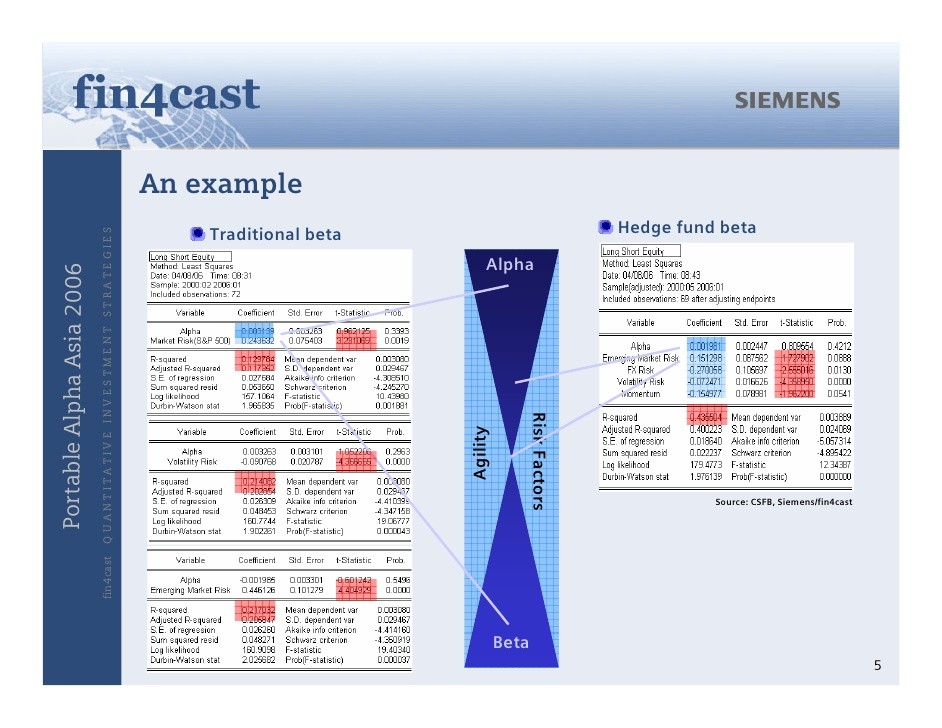

The total return from investing in a single company’s shares therefore has two parts, which correspond to the return from taking company-specific risk and the return from taking risk associated with equities as an asst class. The specific breakdown between these two types of return is identified through linear regression analysis, which compares the returns on the specific stock to the returns on the market as a whole over a given period of time. This produces an equation for the stock’s return, that is expressed in this form: Stock Return = alpha plus (beta times market return). Beta is a measure of a stock’s exposure to the overall risk of investing in the equity market. A stock with a beta of less than one is less risky than the overall market, while a stock with a beta greater than one is more risky. The equity market itself has a beta equal to one. Hence, another name for systematic risk is beta, which (confusingly) is also used to describe the return you earn for accepting exposure to it.

The term alpha in this equation refers to the return you earn for accepting exposure to company-specific risk. This is also known as idiosyncratic risk, and is theoretically uncorrelated with (i.e. independent of) the overall risk of the market (i.e. with beta). As we have already noted, in the equity market as a whole, company-specific risk is diversified away. That also means that the return associated with accepting it must be zero for the equity market as a whole (leaving just the beta return on the overall market). This is what people are referring to when they say alpha (that is, active investing) is ultimately a zero sum game.

Now let’s move on to how the term alpha is used by professional investors. As in the example above, it refers to a return in excess of what one would have earned simply by maintaining a constant exposure to one or more asset classes. To generate alpha, an active investment manager basically has two choices. She can select securities that will perform better than the asset class average, and/or she can time her investments in different asset classes based on her forecasts for their future returns.

People who pay active investment managers’ high fees naturally have a great interest in whether or not the managers are generating alpha. However, measuring an active manager’s alpha is not as straightforward as it seems. Probably the most difficult issue is determining the market return or returns that will represent compensation for systematic (beta) risk. Now why is this a problem? Here is a simple example. Let’s say you hire an active manager to outperform the S&P 500 Index. To do this, the manager consistently tilts his portfolio toward stocks with low market to book ratios, which are also known as value stocks. Let’s also say that the past year has been one in which value stocks outperformed the S&P 500. On paper, it looks like the manager generated significant alpha for you, and deserved the high active management fees you paid him. But was this really the case? If year in and year out, the manager’s investment strategy consists of nothing more than systematically tilting towards value stocks, could not an investor have done this for herself by buying a fund that tracks the S&P 500 Value Index? Put another way, shouldn’t the manager’s performance be compared to this index benchmark, rather than to the S&P 500? In this case, the answer is probably yes, and the active manager’s S&P 500-based alpha is therefore overstated, if it exists at all.

On the other hand, if the investment manager’s tilt toward value shares was actually a tactical decision (e.g. the year before his tilt was toward growth stocks), then the S&P 500 was indeed probably the right benchmark to use when evaluating his performance. The point is this: the concept of alpha is not at all straightforward.

And now we come to the interesting part: the trend (known as portable alpha) to separate beta from alpha investing. Let’s start with the mechanics, and look at one way this separation might be accomplished. In this example, an investor uses index futures contracts to obtain exposure to the beta risk and return of a given asset class (e.g. by buying futures contracts that track the performance of the Goldman Sachs Commodities Index). However, futures contracts are leveraged instruments, in the sense that you can purchase them for less than their face value (e.g. you spend $20 to obtain $100 of exposure to the GSCI). The remaining $80 is then invested with an active manager that focuses on providing so-called pure alpha. This means that the manager tries to eliminate his or her exposure to beta risk (and beta return), leaving just alpha risk and return. The manager might accomplish this by selling short the relevant index futures contract, or by holding offsetting long and short positions in different stocks.

Now let’s move on to the more important part of the story: what makes this approach potentially attractive? The key here is the fact that pure alpha is theoretically uncorrelated with beta. And that makes it a potentially very valuable addition to an investor’s portfolio. Moreover, the separation of beta and alpha make it much easier for an investor to define and control his or her exposure to risk. For example, assume that your target asset allocation leads to a portfolio with an expected annual standard deviation of returns (volatility) of 15%, based on beta risk alone. You could then say, I’m willing to take on a further 1% in risk in pursuit of additional alpha returns. This type of calculation is close to impossible to make in a world of long-only actively managed funds that combine alpha and beta exposure. It is only when beta and alpha investing are separated that it becomes theoretically possible.

At this point, we know what you’re thinking: Sounds great. Where do I sign up? Before you rush out and look for pure alpha funds, you should also keep two potential shortcomings in mind. First, multiple analyses have shown that, however attractive they are in theory, in practice, pure uncorrelated alpha funds don’t seem to exist. Even equity market neutral hedge funds have been found to have strong correlations, if not with the equity market, then with the beta returns on other asset classes, such as bonds.

Second, going from a traditional long-only actively managed fund to a pure alpha fund does not make the inherent challenges of active investment management disappear. The fund manager must still possess either superior information and/or a superior model to make consistently superior forecasting and positive alpha possible. Moreover, you the investor must have either superior information or a superior model to enable you to identify the few truly skilled active managers that exist. Finally, you must also believe that the active managers you identify will earn returns that are higher than the fees they will charge you and the taxes you will pay on the returns they generate (an important point, since they tend to be quite active traders).

Now let’s move on to another important issue for investors who want to use index products to implement their asset allocation strategy: the choice between exchange traded funds (ETFs), and index mutual funds (also known as trackers, unit trusts or OEICs).

Download Free Section PDF