Separately Managed Accounts Overview

Post on: 16 Март, 2015 No Comment

Overview

Nuveen Investments continues to be a leader in the separately managed accounts market with $38 billion in assets under management*. Within this market, Nuveen is known for managing high-quality, customized portfolios that seek to provide consistent, risk-adjusted returns over time.

Separately Managed Accounts Features

Investors may appreciate increased portfolio transparency, tax management capabilities and flexible portfolio tailoring.

- A separately managed account is a private portfolio of actively managed, individual securities. By not commingling assets with other investors, clients may closely monitor the portfolio’s progress and evaluate their individual securities and asset allocations.

- As a result of individual security ownership, separately managed accounts offer tax flexibility through tax gain/loss harvesting potentially reducing the tax impact of the portfolio. Furthermore, for financial planning purposes, individual portfolio positions may be gifted from a separately managed account. Nuveen Investments is not a tax advisor. Clients should consult their professional advisors before making any tax or investment decisions. This information should not replace a client’s consultation with a professional advisor regarding their tax situation.

- Customization of the portfolio can be provided by choosing to avoid investing in certain securities or economic sectors (i.e. socially responsible investing), tailoring the portfolio to the investor’s distinct requirements and requests.

- Separately Managed Accounts provide individual investors access to specialized money managers for one asset-based fee. That fee may include investment counseling, portfolio management, brokerage fees and ongoing account administration.

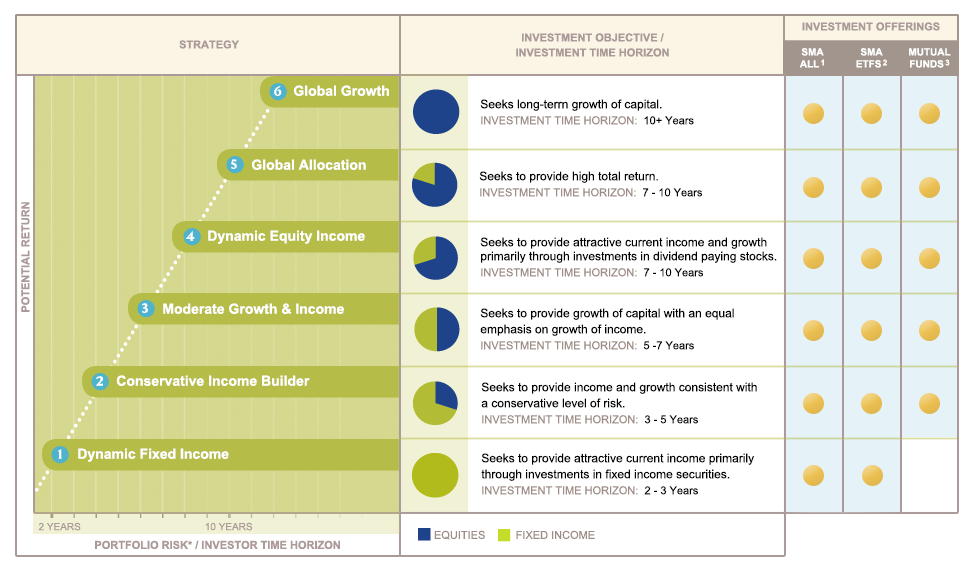

Nuveen Investments Separately Managed Account Offerings

As a separately managed account client of Nuveen Investments, investors have access to a full range of domestic and global equities, taxable and tax-exempt fixed income investment choices offered through our boutique affiliates. The availability of these strategies varies across investment firms; prospective clients should consult their financial advisor about investment strategies that are appropriate for their investment objectives, risk tolerance, tax status and liquidity needs.

*Assets under management as of December 31, 2014