Separately Managed Accounts

Post on: 22 Июль, 2015 No Comment

What are managed accounts or wrap accounts?

Wrap or managed accounts are terms given to a money management service in which clients receive investment recommendations and guidance from an investment specialist and pay an annual fee based on your total assets under management.

When do you need a managed account?

If you want to benefit from the expertise of an investment professional to provide you with objective guidance and help you implement a diversified wealth management strategy, you may want to consider a managed account.

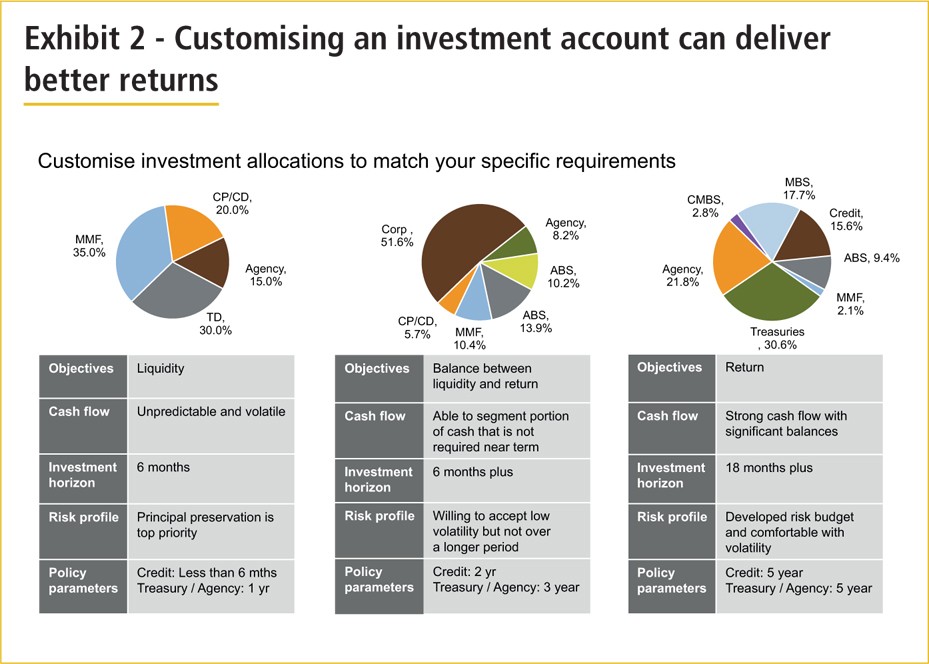

By asking a number of questions, an advisor would work with you to complete a profiling questionnaire in order to identify your investment needs, goals, time horizon and risk tolerance. The final result of this process is a customized portfolio designed specifically for your needs.

What are typical investments within a managed account portfolio?

A managed account or wrap account can include stocks, bonds and mutual funds as well as institutional money managers.

Managed Account Services

The fee based managed account program offers objective advice because there are no sales charges, proprietary mutual funds or other products to which we are bound. Services would include risk-based portfolio management, asset allocation, diversification and portfolio monitoring with quarterly reviews. All for an inclusive fee.

The money management process

The cornerstone of a managed account is a disciplined 4 step money management process to develop a customized portfolio specifically designed to meet your needs.

- Define Investor Needs

When you open a managed account you will be asked by your BCM financial advisor to complete a questionnaire that will profile who you are as a investor. Among other things, the questionnaire will help identify your needs for long-term growth and/or income, investment goals, time horizon and risk tolerance.

Your risk profile determines how your portfolio will be structured. Different investment types called asset classes will be blended into your portfolio in a specific formula according to your risk profile. The blending of asset classes is a strategy called asset allocation. The goal of asset allocation is to diversify your portfolio by owning complementary asset classes that balance each other. When done properly asset allocation reduces a portfolio’s risk and volatility. Asset allocation is considered by many experts to be crucial to successful long-term investing.

A portfolio is only as good as the managers in charge of managing it. Leading mutual funds and/or institutional money managers manage your portfolio. All mutual funds and institutional money managers are carefully screened and selected based upon your needs. These managers are some of the most experienced and respected specialists in their investment fields responsible for managing portfolios for universities, charities, pension funds and other large institutional investors.

Detailed reports of your portfolio are reviewed with you by your BCM advisor. Clients are given the opportunity to have portfolio reviews as frequently as quarterly. Changes to your portfolio can be made to take advantage of market opportunities and economic conditions or to reflect changes in your individual situation. Portfolio monitoring and reviews help keep track of your current asset allocation, your portfolio’s current value and portfolio performance.

What are the typical investments within a managed account?

A managed account greater than $100,000 can include stocks, bonds and mutual funds (over 10,000 choices). A managed account greater than $500,000 can include stocks, bonds, mutual funds (over 10,000) and also institutional money managers.

What is the minimum to qualify for a managed account?

There is a minimum of $100,000 to open a managed account .

How Can BCM Help You?

Beacon Capital Management Advisors (BCM) advises individual investors with many facets of financial planning and wealth management and we welcome the opportunity for you to speak to a BCM Advisor to learn more about the wealth management services we provide to our clients. BCM is registered in 50 States and is an Accredited Business of the Better Business Bureau since 2004. Complete the form below and a BCM Advisor will promptly respond to your inquiry.

Disclosures:

*Information contained in these sections merely highlight some benefits. There are risks involved with all investments that could include tax penalties and risk/loss of principal.