Sensex Targets Raised on Modi Mania India Real Time

Post on: 22 Апрель, 2015 No Comment

sensex

A woman walks past a large screen showing television coverage of Narendra Modi, prime ministerial candidate of the Bharatiya Janata Party. Bloomberg News

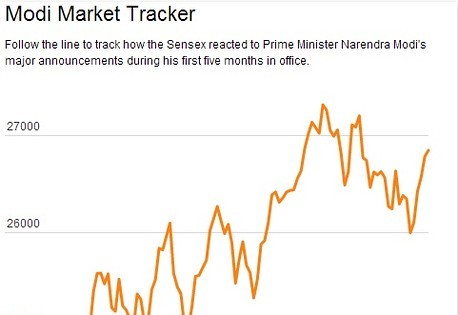

With Narendra Modi set to take over as India’s new prime minister this week, Wall Street firms are busy Modi-fying their expectations from Indian stocks.

Several foreign brokerages have raised their targets for where the benchmark index will be at the end of this year, because they believe Mr. Modi will usher in a flurry of much-needed reforms.

On Monday, the benchmark S&P BSE Sensex rose 1% to 24363.05 – a fresh closing record for the index.

Advertisement

The Bharatiya Janata Party’s absolute majority, having won 282 of the 545 seats in the lower house of Parliament, means Mr. Modi’s push toward investment-friendly policies and subsidy pruning won’t be encumbered by opposition, said BNP Paribas, which raised its Sensex target to 28000 from 24000 for the end of 2014.

Investors hope that a BJP-led government would be able to accelerate policy reforms and overhaul the countrys poor infrastructure.

“We believe that a strong government can solve a number of impediments plaguing the Indian economy through a mix of policy, execution and quick and decisive decision making,” Nomura Holdings Inc. said in a report.

That brokerage raised its target for the Sensex to 27200 points from 24700 by the end of the year.

India’s stock market has been on a bull run since September, when the BJP named Mr. Modi its prime ministerial candidate. The Sensex has jumped 28% since September.

Deutsche Bank AG, which set its year-end target at 28000, said the historic verdict justifies a revised rating of Indian equities, as a fragmented coalition with differing economic ideologies and agendas over the past decade has caused market malaise. “We are at the cusp of a structural bull market,” said Deustche Bank in a research note.

Analysts said investors were frustrated with the Congresss welfare-focused approach to policy-making, which relied on expansive government subsidies and hurt the economy.

Investors hope that BJP’s Mr. Modi, who has been the chief minister of the western state of Gujarat since 2001, will replicate some of the state’s economic success over the past decade. Gujarats economy expanded by 10.1% a year, on average and adjusting for inflation, from 2001 and 2012, compared with 7.7% for Indias economy as a whole.

Despite the jubilance, some brokerages are more cautious. Bank of America Merrill Lynch, which raised its Sensex target to 27000 from 25500, said that BJP still must rely on the opposition parties in the upper house of parliamentwhere it does not have a majorityto pass legislation. Citigroup Inc. also has a moderate Sensex target of 26300 by the end of December.

“We see steady, long and strong run ahead…but the big sprint is probably done,” Citi said in a report. The real economy’s challenges persist and the revival will be more gradual than sharp, it added.

Analysts say banks, oil-and-gas and infrastructure-sector stocks are perched to gain from a spending boost that will lift revenues.

Follow India Real Time on Twitter @WSJIndia .