Sensex PE Ratio is stock market overvalued or undervalued

Post on: 1 Май, 2015 No Comment

Sensex PE Ratio is one of the most basic & fundamental thing that is seen by investors while investing in equities. Sensex PE Ratio can tell you the valuation of the market (overvalued, undervalued or rightly valued). In this article we will share why P/E(Price/Earning) Ratio is important for every investor, how PE for single stock is calculated, how SENSEX PE is calculated, what was the average Sensex PE in past (long term charts) & where you did mistakes and you can also find the current SENSEX PE.

Understanding Value of Equity Markets

One of the greatest Investor Warren Buffet says The stock market is filled with people who know the price of everything but value of nothing What does he wants to convey when he says PRICE and VALUE and is there any difference between these two.

Let me give you an example to explain this: would you buy a simple new pen of REYNOLDS for Rs. 1000. I am sure you would not. But if I ask you to buy the same for Rs. 1, would you be interested in it. Probably YES. Now here is the difference between PRICE and VALUE. Both Rs.1000 and Re. 1 are price of that pen quoted by the seller but your decision to buy that pen or not to buy the pen is not based on the price but what VALUE you derive from that. At 1000, the pen looks costly but at Re. 1 it looks cheap. Value is the utility that you derive by paying a price to a particular thing. This is why we say at times, Ye CHEEZ AAP MEHENGI LE AAYE ya fir YE CHEEZ AAP SASTI LE AAYE. But in case of investments, how do you ascertain its VALUE.

Value of Investment

Utility in investment is calculated by the return it would generate in one years time and this is known as PE or Price to Earnings. PE is nothing but the price that an investor is ready to pay to earn Re.1 every year. To make it simple, if you have invested Rs. 100 in a FD which is giving you an interest of 8%, at the end of the year you would get Rs. 8. In other words, to earn Rs. 8, you need to invest Rs. 100 or to earn Re. 1, you need to invest Rs. 12.5 (100/8). And hence the PE of bank FD is 12.5. Now if the interest rate had been 12%, the PE would have been 8.33. Now if PE is low, you expect higher return and if PE is high, you expect lower return.

Is stock market something different? It is a place where share are bought and sold. Seller demands a price that is quoted on Screen but do you know the VALUE. For example, let say Reliance is quoted at Rs. 1000 per share. Now this is the price but what is the VALUE. Not many would have the answer. So we all understand the price in stock market as it is quoted before us, but we seldom understand its VALUE.

Calculated PE of any stock

To understand the value of share market, we need to understand PE of SENSEX. But lets first try to understand how P/E is calculated for single stock.

PE=Price (MPS-Market Price Per Share )/Earning (EPS-Earning Per Share)

To understand PE, we need to first understand Price and the earning per share (EPS) of stock for this we take example of Infosys. Current Market Price of Infosys is Rs. 3000. Now what about earning per share? If we divide the Total Net profit (past 12 months) of Infosys by the numbers of shares it has, we will get what is known as Earning per share so EPS of infosys comes out to be 111. Now we can divide Price by EPS, we will get infosys current PE that is 27(3000/111). In simple words PE is nothing but the price that an investors ready to pay to earn Re. 1 every year. So in case of infosys people are ready to pay Rs27 to earn Rs. 1 every year.

BSE SENSEX PE Ratio

To understand Sensex PE, we need the price and the earnings of Sensex. Sensex is nothing but price movement of 30 big companies in India like RIL, Infosys, TCS, Maruti etc. Price of Sensex is nothing but what is quoted before us Sensex at 20000 or Sensex at 21000. Now what about earnings? Now these companies are working for profits which are meant for owners of the company. In case of companies, owners are shareholders. Now if we divide the Total Net profit of the company by the number of shares it has, we will get is known as Earning Per Share (EPS). Now if we add the EPS (according to weightage for eg. weightage of reliance in Sensex is 11% its current EPS is 53 so 5.83 will be used similarly for other companies) of all 30 companies, we get the EPS of Sensex. The combined EPS of Sensex is the earning which we were looking at. Now PE of Sensex is nothing but Level of Sensex/EPS.

SENSEX PE Chart

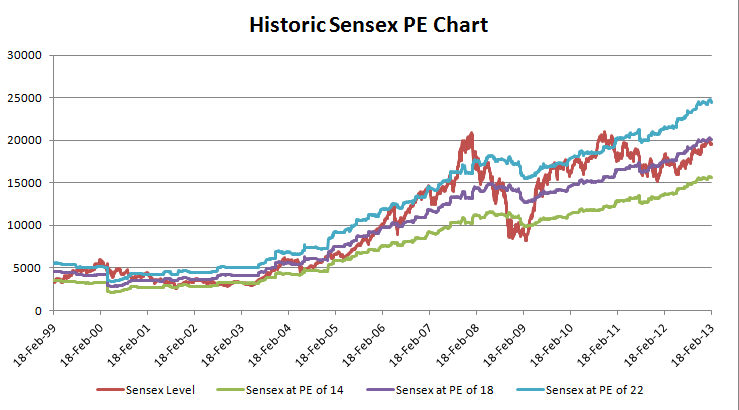

In above chart Blue Bars are showing Sensex PE (right hand axis) from 1999 till date March 2000 it reached to 30 & then came back to 13 in Jan 2002. In 2007 it was again closed to 29 & in starting of 2009 it went close to 10 (a time that was missed by maximum investors & even so called experts). Average Sensex PE from 1990 to 2010 remained close to 18. Current Sensex PE is close to 24.15(when market touched 21000). Blue Dotted Line shows the real movement on Sensex (left hand axis). As we have seen that average PE in India was close to 18 so green ribbon(line) shows if market would have remained close to that PE. Red ribbon shows undervaluation (14 PE) & Purple ribbon overvaluation or stretched valuation. Currently its above purple ribbon (stretched valuation) but that doesnt mean it should have to fall now we have already seen that in 2000 & 2007 it was close to 30 & in 1994 it even touched 50 before it came down. Nobody can time market this article is there is to share the concept.

Dont do this mistake (Click on the Cartoon to enlarge)

Earnings (EPS) of Sensex

You shall be surprised to know that the combined earnings of Sensex companies in 1992 was 80, in 2000 was 240 & now 860. This EPS growth directly convert into growth of Sensex from 1992 (Sensex was close to 2000) till today EPS has grown 10 times & our Sensex has grown same 10 times. Now Indian businesses are growing and so as the profitability of the companies. In this case, EPS is bound to go up and so as Sensex. I dont want to comment on where sensex could be in next 1 month of 6 months as in short term anything could happen but with reasonable confidence, I can surely say that in 5 years down the line, Sensex will be much higher than where we are today. Dont listen to analysts just follow basic rule of earning growth.

You can check latest Sensex PE Ratio here .

Few more PE Concepts

The concept we have read above in technical language called trailing (past) PE. There are few other type of PEs- Forward PE, Rolling PE & Diluted PE. Other than trailing PE (normal PE) only Forward PE is heard by you on daily basis (Thanks to our so called analysts & investment gurus Read Stop Fooling Investor ).

Forward Sensex PE

There is not a major difference in method of calculation in normal PE past 12 months EPS is taken & in Forward PE future expected PE will be taken. For example if current PE is 23 & some analyst believes that EPS of Sensex companies should increase by 20% he will say next year EPS (current EPS 862) will be 1035 so 1 year forward PE is 19.6. There is nothing wrong in doing it but in bull market when expectation of growth is very high this can give some deceiving figures. Even analyst Some time quotes 2 years forward PE.

Historic 1 year Forward PE Chart ( from 1990)

PE is very relative term it will be different for different markets, sectors, stocks it actually shows investor expectations. PE also reflects strength & future prospectus of the company. It should definitely be considered before making lumpsum equity investment but it should not be the only criteria. We request all readers to participate in equities through Mutual Fund route rather than going directly.

Please let me know do you liked this article & would you like to learn some more basic & important concepts like this. Feel free to ask any question other than which stock should you invest in.