Selling Short Stocks Risk of Selling Short Stocks

Post on: 20 Июль, 2015 No Comment

Please refer to our privacy policy for contact information.

Selling short stocks is an advanced trading technique that runs counter to the goal of most investors – to find the best stock to buy.

Short sellers, as the market knows them, look for the best stock to sell.

Short sellers sell stock they don’t own with the belief it will fall in price in the near future. When the price drops, they can buy the stock at the lower price, pocket the profit and return the shares to the original owner.

Is this a great country or what?

Here’s how short selling works. Say you believe that the market has way overpriced Amalgamated Kumquats and it is due for a big fall.

Selling Short

You call your broker and say you want to “short” 300 shares of Amalgamated Kumquats. Your broker will require you to have a margin account meaning you must meet their credit and deposit requirements.

Your broker will then sell 300 shares of Amalgamated Kumquats out of their inventory or “borrow” the shares from another customer or another broker.

Your broker can only make the “short” sale on an “up tick,” meaning the stock must be going up. This is to prevent a bunch of short sellers from jumping on a declining stock and driving down the price even further.

Your broker escrows the money from the sale in your account for the protection of the original owner of the shares. You normally won’t earn interest on this money and if the stock pays a dividend during this time, you’ll owe it to the owner.

How it Works

If the stock falls the way you predicted, you can buy 300 shares at the lower price and replace the borrowed shares. The difference between what you sold the stock for and what you bought it for is your profit. For example:

You short 300 shares at $45 per share. Your broker deposits $13,500 in your account. Two weeks later, the price has fallen to $35 per share. You instruct your broker to “cover” your short or buy 300 shares to replace those you sold.

Your broker buys 300 shares at $35 per share and deducts $10,500 from your account to pay for the shares. The broker replaces the borrowed shares and you have a profit of $3,000 ($13,500 — $10,500 = $3,000). I have ignored commissions and so on to keep the math simple.

For being right, you pocket a $3,000 profit in a very short time. However, what happens if you are wrong? This is the dark side of short selling.

Same shorting scenario: You short 300 shares at $35 for $13,500. However, instead of falling like all reason and logic suggests, the stock rises and rises fast.

Before you know it, the stock is at $55 per share. You get a call from your broker, who is getting nervous. Your account for short selling is a margin account and if the stock goes too high, you will have to deposit more money or cover the short by buying the stock.

You decide to cut your loses and cover the short by buying the stock at $55 per share for $16,500. Since you only have $13,500 in your account, you have to come up with another $3,000 out of your pocket to make things right. You suffer a $3,000 loss.

What are the Risks?

As you can see, short selling can offer quick profits, but also high risks. The advantage of using someone else’s stock to earn money carries the opportunity for extraordinary profits and the possibility of financial disaster. Here are some of the risks:

- Obviously, if the price rises, you can lose money. If a large number of short sellers try to cover their positions in a stock, it can drive up the price even faster. This is a short squeeze.

- You are betting against the market’s history, which has trended up. That’s certainly not true of individual stocks; however, an active bull market may raise even marginal stocks.

- There is no way to accurately predict when a stock will fall (or rise for that matter). The value the market places on a stock does not always match its metrics.

Add to that mix, the question of timing and it becomes problematic to predict when a stock will fall. Long-term investors can wait for a stock to rise. A short seller doesn’t usually have that luxury.

How to Pick Shorts

How do you pick stocks to short? Some use the same techniques as you would to pick winners, just look at the bottom of the list instead of the top.

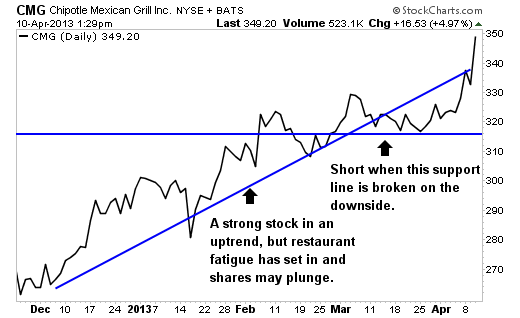

The key is finding stocks that appear vulnerable to impending news or have weak fundamentals. Other candidates might be companies that are the “latest thing,” since consumers tend to forget these things tomorrow.

Conclusion

Short selling is not for new investors. In fact, many would suggest it is not investing at all, but speculating. Don’t get drawn to the possibility of easy money, because it’s not there. The potential for loss is greater than the potential for success.