Selling Put Options Buying Stocks at a Discount Investment U

Post on: 9 Июнь, 2015 No Comment

by Investment U Research

An Investment U White Paper Report

Imagine walking into your favorite store in the mall and seeing a sign that reads:

Sale: 30% Off Specially Marked Items

Not only that, there’s a part underneath that reads:

And We’ll Pay You For It, Too

You get paid money for buying goods at a discount? Sounds too good to be true, right?

While that’s probably not going to happen at your local stores, it’s perfectly possible in the stock market. And it comes courtesy of a little-known professional investment strategy called put option selling.

Many investors hear the words put and selling in the same sentence and head for the exit. Too complex. Too confusing. And downright scary. Or so the myth goes.

Let’s bust that myth right away. Put option selling isn’t difficult to execute. In fact, it’s actually easier than most investment methods. Not only that, it’s one of the most effective and profitable strategies that you can use in any market, even in those we see today.

Most regular investors don’t have a clue about it — but the pros do. Here’s a brief overview of how it works, so you can profit and those ordinary guys can’t.

No Mumbo-Jumbo. No Complications. Just Cash

When you execute a put-sell trade, you don’t have to buy a stock. You don’t have to sell a stock. It has nothing to do with bonds or currencies. And there are no complex parameters to the trade like with some options strategies.

Here’s the scoop: You’re either going to make money, or you’ll end up investing in a company at a ridiculously low, discounted price.

What you try to do is buy stocks for the price you want. And just for trying, you get paid for it.

I don’t know about you, but that’s pretty compelling in any market climate. And put-selling works in rising markets. falling markets. and flat markets. It’s a regular stock-buying strategy with a profitable twist upfront.

How To Execute A Put-Sell Trade

Ever wanted to buy a stock, but passed because the price was too high for your liking?

Most ordinary investors would simply sit on the sidelines and wait for the price to fall to a better level. But smarter investors know they can still get in the game by selling a put option on it instead. All you need to do is.

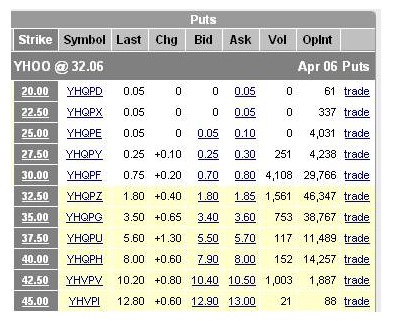

When you enter a trade like this, you’re obligated to buy those shares at your stated strike price by expiration. Keep that in mind when selling the contracts, so you don’t over-extend yourself. For example, if you sell two $15 put option contracts, you’ll need to have $3,000 on hand by expiration day to cover the cost of the shares ($15 x 200 = $3,000).

Note: You don’t need to have all that money on hand while the trade is open. Your broker will only ask you to keep a fraction of that amount available — known as a margin requirement. Consider the trade as a buy now, pay later type of deal. You’re putting off paying for the stock until a certain scenario occurs (see below).

In exchange, the option buyer will pay you for each contract you sell while you wait. This is known as a premium and is deposited into your trading account (the farther out the expiration date, the more money you’ll receive when selling the option). Meanwhile, ordinary investors are just waiting for the price to drop without collecting any money.

This Strategy Pays You For Trying To Get A Bargain

On options expiration day, you’ll have two scenarios:

So regardless of what happens, you keep the money from selling the put options upfront. Now let’s bust another myth.

But Isn’t This Risky?

As we mentioned at the top, some investors are put off from some options-based trades because they perceive them as being overly risky — and even downright scary!

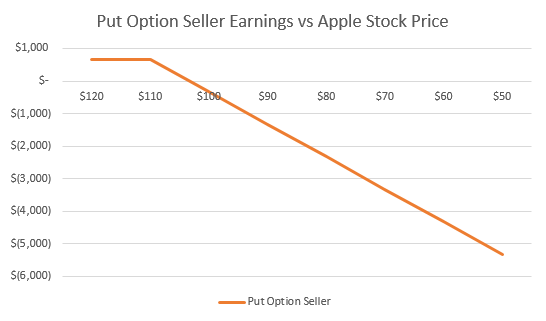

But selling put options is no riskier than buying shares outright. When you buy shares, the risk is that you lose your entire investment. When you sell a put option, you’re obligating yourself to buy shares, too. but at a much lower level than the current share price. And if you do end up buying the shares, your risk will be the same as a regular shareholder.

The difference is that nobody pays you cash to buy stocks outright — but they do when you sell put options. Selling puts is just another way to invest using the options market.

While some brokers see selling put options as riskier than stocks (and require that you keep more capital reserves on hand), your risk only kicks in if you’re obligated to buy the shares. And even then, you’d simply be long on the stock, with the same risks as with any stock.

Of course, the worst-case scenario is that the stock could fall to zero. But brokers never seem too restrictive when investors buy shares outright, rather than options.

An Important Note On Selling Put Options

Many regular investors don’t know about strategies like put-selling. But no matter whether the investment climate is rosy or wretched, it’s a perfect example of one that works.

But selling puts isn’t for everyone. You’ll need to check with your broker to make sure you’re approved to trade options and, specifically, sell put options.

Economic turmoil and a stock market’s decline creates great opportunities to buy quality stocks at outstanding bargain prices — and you can take advantage by using the options market to buy your desired shares at even lower prices.

Good Investing,

Investment U Research