Sell The Rumor and Buy The News (NYSE SPY NYSE SDS NYSE SH NYSE SSO NYSE TNA NYSE TZA)

Post on: 18 Апрель, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

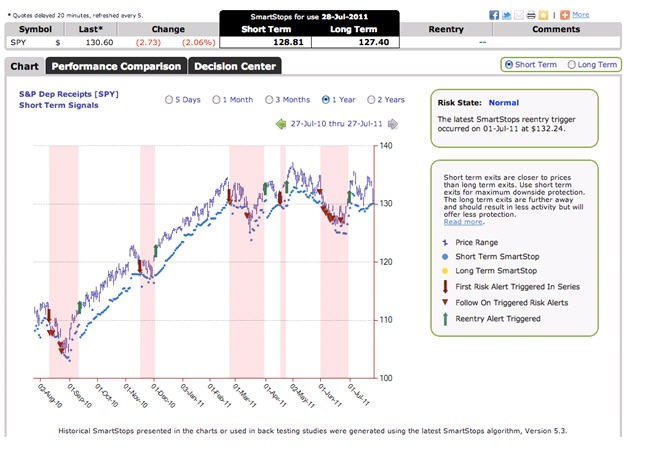

So I currently recommend closing all shorts near the 1265 to 1270 sp500 range or the DJIA 12000 range . I believe this support will hold and the market will bounce from there. Of course that is not guaranteed. Will have to see how the market reactions on neckline support and then take cues from there. But I suspect we will see a mini capitulation near these levels. We may dip under these levels briefly but I suspect it would only be for a very short time frame.

Assuming the S&P 500 (NYSE:SPY) and DJIA gets to that range within the next couple of trading days I would then expect a multi day or possibly 2 to 3 week extended upside bounce that would create an ideal NEW shorting opportunity that positions the market to move down again for a break of the yellow dotted neckline.

That break of the neckline should be accompanied by a wide price spread and a relatively big move.

August would be the perfect month for the upside bounce in that it would be typically a low volume upside bounce when everyone is on vacation.

The new shorting opportunities could arrive either at the 1295 range or the 1315 to 1320 range.

The only scenario where I can see us slicing through the neckline like a hot knife through butter is if we do a repeat of the May 2010 scenario. I just do not see how something like that can be predicted. I suppose the first sign that will occur again will be the speed with which we do or do not take out the yellow dotted neckline support.

So for now I am sticking to the theoretical yellow drawn in line for the upcoming price action. The BOT short signal of a few days ago is still intact and is likely to remain so for quite some time.

Related ETFs: SPDR S&P 500 ETF (NYSE:SPY), ProShares UltraShort S&P500 ETF (NYSE:SDS), ProShares Short S&P500 ETF (NYSE:SH), ProShares Ultra S&P500 ETF (NYSE:SSO), Direxion Daily Small Cap Bull 3X Shares (NYSE:TNA), Direxion Daily Small Cap Bear 3X Shares (NYSE:TZA).

I started Best Online Trades because I really enjoy trading and I also enjoy writing about trading. Writing about trading or trading strategies helps transfer thoughts that would otherwise stay in ‘theory’ and helps move them to more concrete form for me. And hopefully along the way you will pick up something useful as well. BestOnlineTrades covers many different aspects of trading, from commodities to stocks, from indices to ETF’s.