Selecting ETFs During a Downturn SPY Investing Daily

Post on: 23 Июль, 2015 No Comment

By Benjamin Shepherd on September 7, 2011

Scanning exchange-traded fund (ETF) performance year-to-date is a pretty depressing exercise. Few ETFs have produced positive returns aside from Treasuries and precious metals, although some dividend-focused ETFs have held their own. Utilities, consumer staples and other defensive sectors are flat for the year, while anything that even hints of risk continues to fall.

Its understandable that investors have fled to safety given the recent weak US economic data and the ongoing sovereign debt crisis in Europe. But the prevailing risk off mentality is astounding. The Chicago Board Options Exchange Volatility Index, better known as the VIX or fear index, is a gauge of investors expectations about the markets near-term volatility. As such, the VIX often spikes during market downturns. Indeed, as investors fled the market en masse. the VIX jumped sharply, peaking at 48 on Aug. 8, before eventually falling to the low 30s. For the sake of context, prior to Augusts market turmoil, the VIX traded in the relatively complacent high teens.

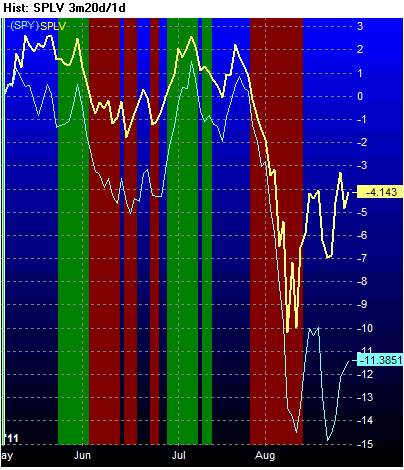

Source: Bloomberg

While it might seem counterintuitive, spikes in the VIX are often considered buy signals. In fact, research has shown that when the VIX spikes beyond 30, the S&P 500 typically returns 10 percent or more during the subsequent year. The only notable exception to that rule is when that spike occurs during a recession, such as when the VIX crossed that threshold in September 2008.

As Ive written on several occasions over the past few weeks, I dont believe were facing another recession in the US. Nevertheless, economic growth over the next several quarters will likely be slower than what weve grown accustomed to in years past. However, there are simply too many positive data points for me to buy into all of the negativity. Corporate earnings forecasts remain positive, though some of these forecasts have been cut. In addition, recent data from the Institute of Supply Management shows that the US service industry is expanding faster than expected. And although job growth is slow, it is trending positively.

Im not going to pound the Buy, Buy, Buy button on Jim Cramers soundboard. But I believe that the huge slump in equity prices this year is a buying opportunity. Consequently, this is a good time to revisit the process of ETF selection.

Selecting the Right ETF

As is the case when selecting any investment, the first step is to decide what sector, style-category or asset class youd like to use to fill out your portfolio. With a rapidly expanding universe of ETFs, theres a fund for almost any niche. In fact, more often than not, youll find at least a few. The key is figuring out which fund is the best fit.

The next step is to examine how the funds are constructed. Some, such as the HOLDRs funds, feature highly concentrated portfolios. Others, such as most of the iShares funds, contain hundreds of positions in their portfolios. Some ETFs use capitalization-weighted indexes, in which the largest companies feature most prominently in the portfolio and tend to drive overall performance. Others, such as many Rydex funds, construct their portfolios around an equal-weight index, in which the funds investable assets are divided equally among the underlying holdings.

I generally recommend diversified ETFs because thats one of the greatest benefits of the ETF structure. I also usually opt for a fund with an equally weighted portfolio when possible, as capitalization-weighted funds often overweight names that are fully valued, limiting their upside potential.

Whether an ETF fits your needs is a moot point if there isnt sufficient liquidity to easily trade into or out of a position. As with low-volume stocks, its quite easy to buy a thinly traded ETF; selling these shares at a decent price can be a chore, especially on short notice. To avoid these pains, stick with ETFs that have at least 100,000 shares traded on an average day.

Liquidity is also the key determinant of bid-ask spreads, which can become a substantial trading expense for unwary investors. Shares of an ETF can only change hands when a buyer and a seller agree on a price. The bid-ask spread will show you the highest price a buyer is willing to pay for shares, the lowest price at which a seller is willing to sell and the difference between the two. The wider the spread, the higher the transaction cost youll pay if you want to purchase or sell shares immediately.

ETFs with high trading volumes generally offer tighter bid-ask spreads. SPDR S&P 500 (NYSE: SPY). one of the oldest and most popular ETFs on the market, is the quintessential example of a heavily traded fund. On an average day, the ETF features a bid-ask spread as low as five basis points, so theres little price slippage for investors who trade the shares with market orders. On the other hand, extremely illiquid ETFs that trade only a few thousand shares a day can have bid-ask spreads in excess of 1 percent. This increases the likelihood of overpaying for an investment.

Another factor that affects bid-ask spreads is the type of asset an ETF tracks. Funds that track liquid US stocks often offer tighter spreads than those that track foreign stocks. Equity funds generally boast lower spreads than bond funds.

Management expenses are perhaps the most important consideration when selecting an ETF. Although ETF expense ratios are often significantly lower than the ones charged by similar mutual funds, some ETFs are less expensive than others.

US-focused and bond ETFs are usually cheaper than those that focus on foreign markets. Funds that track highly liquid securities also tend to be less expensive than those that focus on more esoteric fare. In general, investors should avoid funds with an annual expense ratio that exceeds 1 percent.

If youve run through all of the other screening criteria and are left with more than one fund in the pool of candidates, always go with the least expensive of the bunchparticularly if you plan on holding the fund for the long term.

Other experts may discuss premiums, discounts and tracking error when analyzing ETF investmentsall important considerations for investors. But first and foremost, investors should pair a sound investment thesis with careful consideration of the funds structure, liquidity and costs to generate a decent return.

Whats New

No new exchange-traded products were launched in the past week. Until recently, exchange-traded products had been launched at a rapid pace211 products have been launched year to date. However, ETF sponsors make money by accumulating assets under management; something thats tough to do amid the recent market volatility. Dont be surprised if new launches are slow until the market calms down.

Have Benjamin Shepherd help build your ETF portfolio with a free trial to Global ETF Profits