Seeking Alpha Momentum Investing With ETFs

Post on: 16 Июнь, 2015 No Comment

By Timothy Strauts

Last week, my colleague Alex Bryan wrote an article titled Does Momentum Investing Work? Alex’s article offers an introduction to momentum drawing on a growing body of academic research on the topic to examine its potential sources, how it might be exploited, and the obstacles facing investors seeking to capitalize on this phenomenon. If you haven’t read his piece, I recommend doing so before reading any further as it will serve as the basis for this article.

Trying to actively harness momentum at the level of individual stocks will result in a portfolio with high volatility, high transaction costs, and a large number of positions that can border on unwieldy. However, by swapping stocks with exchange-traded funds, we can mitigate many of the issues that complicate implementing a momentum strategy with just stocks.

Market-timing is a dirty (compound) word. The efficient-markets hypothesis holds that market-timing is futile. Conventional wisdom says that not only is market-timing nearly impossible, but many investors (and retail investors in particular) seem to have forgotten to wind their watches and exhibit buy high, sell low behavior. Momentum, the tendency for prices to trend, is one of the most reliable ways to extract returns from naive investors who engage in reverse market-timing.

Momentum can take many forms. Two particular forms of momentum can be fairly easily mimicked with ETFs: time series momentum and asset class momentum. Next, we’ll discuss each flavor of momentum and walk through some hypothetical portfolios constructed with ETFs that seek to exploit them.

Time Series Momentum

The simple moving average, or SMA, is a common technical indicator. As its name indicates, it’s calculated by averaging the past prices for an asset over a specified time period. Typical technical trading strategies involve owning assets when they are trading at prices above their 200-day SMA and holding cash when they trade below their SMA.

Perhaps the best known proponent of SMA-based timing is Mebane Faber, whose 2007 paper, A Quantitative Approach to Tactical Asset Allocation, further popularized SMA-based market-timing among practitioners. Faber found that employing 200-day SMA-based timing reduced drawdown and volatility and improved absolute returns across an array of diverse asset class benchmarks such as the United States stock market, the MSCI EAFE Index, the Goldman Sachs Commodity Index, a REIT Index, and 10-year Treasuries.

In 2011, we performed our own study of moving-average-based timing indicators. We tested 83 different indexes that encompassed U.S. and foreign stocks, bonds, and commodities. Some of the indexes went back as far as 1926. The results were eerily consistent. In almost every asset class SMA-based timing strategies reduced drawdowns and volatility while maintaining or improving absolute returns. Consistent with the behavioral explanation for momentum, the SMA-based timing worked best in less-efficient, more-volatile asset classes. Look-back periods ranging from 10 to 12 months seem to provide the most consistent performance without excessive trading.

A startling example of how employing time series momentum can improve a portfolio is Greece. Since March 1992, the MSCI Greece Index has returned negative 2.0% annualized, with most of this poor performance explained by its 93% drawdown since 2007. Meanwhile, a 12-month SMA-based timing strategy would have produced an annualized return of 11.9%. It would have been difficult to imagine five years ago that Greece would be on the brink of default today, but the strategy would’ve gone to cash in February 2008 and avoided the ensuing bloodbath.

Asset Class Momentum

Asset class momentum differs from the type of momentum examined by academia in one key regard. Most academic research employs a 12-1 momentum strategy, which looks at returns over the trailing 12-month period, excluding the most recent month. Stocks tend to show a short-term reversal in the most recent month, so it is excluded. However, when examining momentum at the asset class level this short-term reversal disappears, so it’s not necessary to remove the most recent month’s returns.

Model Portfolios

As mentioned earlier, ETFs may be a more-efficient tool for those looking to implement a momentum strategy. What follows are two examples of momentum-driven model portfolios taken from the Morningstar ETFInvestor newsletter. Newsletter editor and ETF strategist Sam Lee tracks six different model portfolios that incorporate elements of both time series and asset class momentum. The portfolios use a 12-month SMA and 12-month total returns as their two momentum indicators. It is important to note that the portfolio performance shown below does not include the effects of taxes or transaction costs.

U.S. Sector Momentum Strategy

The above table lists the eligible holdings for the U.S. Sector Momentum strategy. On a monthly basis, each ETF’s current price is compared with its 12-month SMA. If it’s trading below its 12-month SMA, it is excluded from further consideration. The remaining ETFs are sorted by their trailing 12-month total returns. The top three ETFs from this second sort are equally weighted in the portfolio. If there are fewer than three ETFs trading above their 12-month SMA, the portfolio will hold cash in combination with the one to two ETFs meeting this first criteria. If no ETF qualifies, the portfolio will be entirely in cash.

The sector momentum strategy has very high turnover. State Street Select Sector SPDRs are some of the most-liquid funds in the market, so trading with market orders should not be a problem. The strategy will likely generate substantial short-term capital gains as it will make between 15 and 20 trades per year.

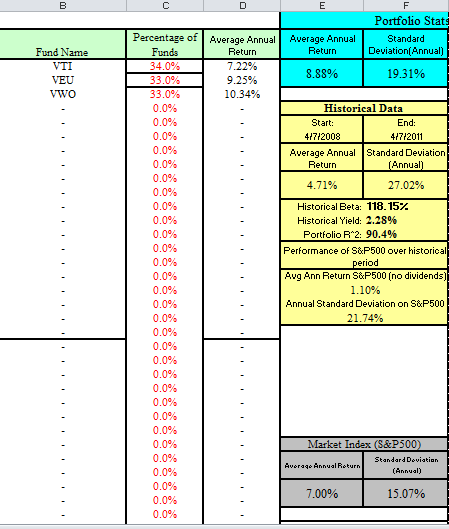

Global Momentum Strategy

The eligible portfolio holdings for the global momentum strategy are listed in the table above. On a monthly basis, each ETF’s current price is compared with its 12-month SMA. If it is trading below its 12-month SMA, it is excluded from further consideration. The remaining ETFs are sorted by 12-month total returns. The portfolio picks the top two ETFs resulting from this second sort. If only one ETF is eligible, the portfolio will hold that ETF and cash in equal amounts. If no ETF qualifies, the portfolio will be entirely cash. The custom benchmark we have created for this strategy is an equal-weighted portfolio of the eligible holdings.

The global momentum strategy is best suited as a satellite investment strategy within the confines of a tax-sheltered account. Most investors will be uncomfortable holding such a concentrated portfolio that only owns one or two ETFs at a time. In trendless markets, the strategy will make many trades without much success. One implementation method could be to invest 80% of assets in a diversified core portfolio and allocate 20% to the global momentum strategy. This strategy typically makes between five and 10 trades per year.

The two model portfolios described above use ETFs in an attempt to exploit momentum. Over the period examined, both have generated high relative returns with below-average risk. In the case of the global momentum strategy, the blending of time series momentum and asset class momentum appears to offer a particularly compelling combination. However, there are periods when these strategies underperform. In those periods of underperformance it may be difficult to adhere to this discipline. As is the case with many funds or strategies that may be temporarily out of favor, many investors tend to throw in the towel at exactly the wrong time—the exact sort of behavior that might explain why momentum exists! It’s also important to note that the frequent trading inherent in implementing these strategies will increase trading costs and reduce tax efficiency. Investors considering implementing such strategies should do so within the confines of a tax-deferred account, ideally one offering low-cost (or even free) trades.

Disclosure: Morningstar, Inc. licenses its indexes to institutions for a variety of reasons, including the creation of investment products and the benchmarking of existing products. When licensing indexes for the creation or benchmarking of investment products, Morningstar receives fees that are mainly based on fund assets under management. As of Sept. 30, 2012, AlphaPro Management, BlackRock Asset Management, First Asset, First Trust, Invesco, Merrill Lynch, Northern Trust, Nuveen, and Van Eck license one or more Morningstar indexes for this purpose. These investment products are not sponsored, issued, marketed, or sold by Morningstar. Morningstar does not make any representation regarding the advisability of investing in any investment product based on or benchmarked against a Morningstar index.