Secular V Markets Dightman Capital Global Market Monitor

Post on: 29 Апрель, 2015 No Comment

Published 22 September 09 04:33 PM | Brian Dightman

If you have been participating in my recent monthly online strategy updates (you can register for the next webinar here ), you have heard me talk about secular and cyclical markets. If you are wondering what this means, I offer the following insight.

There is much debate on the subject and no definitive definition that I am aware of on the subject of secular markets. To use an analogy, I would compare the seasons of a year as secular and the weather patterns within each of those seasons as cyclical. Starting with a hot summer season you progress to a cold winter before heading back to a hot summer (secular), but throughout this major transition you have many short term temperature variations (cyclical). Some summers are unseasonably cold and the opposite can be true for winters. With economies and stock markets, think of the secular time frame as years/decades and the cyclical timeframe as quarters/years.

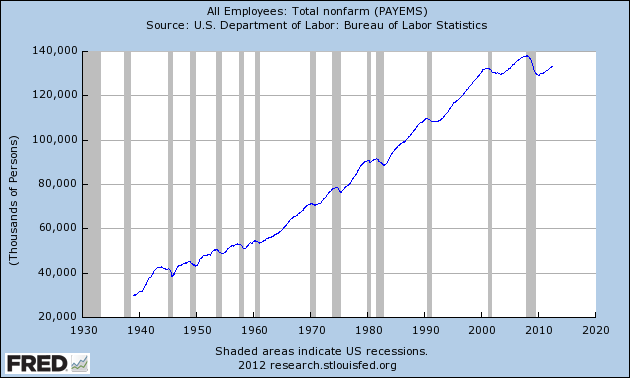

Secular markets are created from deeply rooted structural characteristics in an economy. I believe among other things, household debt, government fiscal condition (at all levels), and an aging population are a few examples of the structural characteristics of the current secular bear market in U.S. stocks.

Cyclical markets are predominantly influenced by the business cycle experiencing its own expansion and contraction within the secular environment. I believe the business cycle process is largely autonomous but can be influenced by government actions (interest rates, tax policy, stimulus, etc.). The business cycle is the natural ecosystem of capitalism at work where, as a simple example, businesses grow during periods of growth, over expand, start to struggle and are then forced to downsize, merge or go out of business.

The best example of a modern day secular bear market can be seen in Japan, the worlds second largest economy. On New Years Eve in 1989 the Nikkei 225 Index of Japanese stocks peaked at 38,915. Approximately 20 years later, it closed at 10,443, down over 70% from its peak as illustrated in the chart below.

Turning to the U.S. stocks have experienced big swings in value over the last ten years but have not been able to advance past the highs reached in 2000.

I try to approach the process of managing money from a risk management perspective that considers both the secular and cyclical environments. Right now I view the current environment as a secular bear, cyclical bull market. That means I am willing to position my strategies to make money in the near term, but ready to move defensively if I believe the rally has run its course and new trend down has started. Among other things, I believe household debt levels will need to be reduced, government finances will need to be improved, and lower U.S. consumptions levels (assuming higher saving rates materialize) will need to be replaced with higher consumption levels by foreigners before we can transition to a secular bull market.

Once we finally transition back to a secular bull market we should see long periods of stock market appreciation. From 1982 to 1999 the S&P 500 appreciated an eye popping 1,048% over 17 years. If we added in dividends it would be even higher!

I hope you found this information helpful. If you have any questions, feel free to let me know and I will do my best to answer them.