Secular Bear Market Cyclical Bear Market

Post on: 13 Май, 2015 No Comment

Summary: Understanding the nature and scale of a bear market is often very difficult to do at the time. Instead, it might only be after the event that the full scale of devastation becomes clear. One reason for this is that there is more than one type of bear market. Therefore, this page will hopefully explain some of the differences between a secular bear market and a cyclical bear market.

Offering a cast iron definition of something can be a very tricky thing to do. This is especially the case in the world of finance and investment. Many investment related terms have no sense of meaning to those that exist outside the financial or economic spheres. It is for this reason that we turn to another source here.

In the world of investment strategy, Barton Biggs has been a very major player on the global scene for some years. For a number of years, he was considered the number one global strategist, and spent many years within the upper echelons of Morgan Stanley. In his excellent book about the hedge fund world, Hedgehogging. he describes bear markets thus:

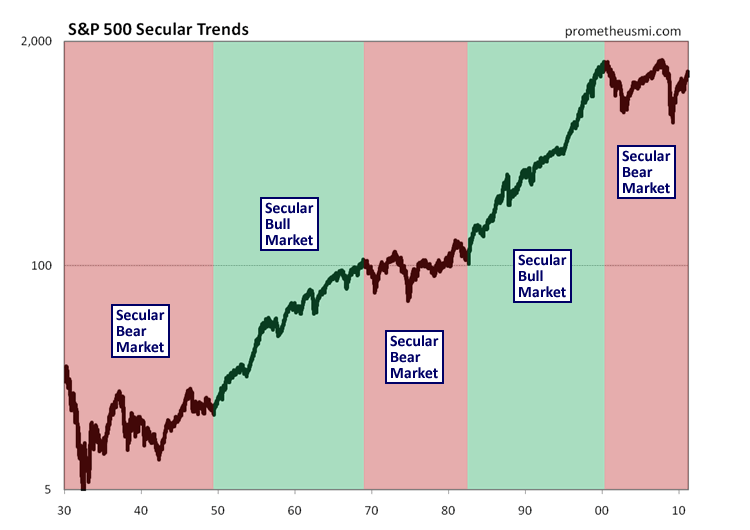

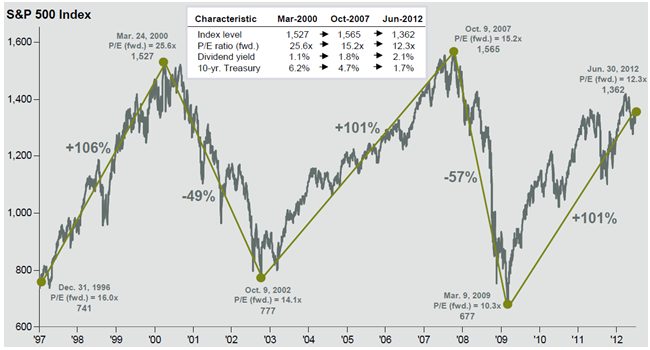

To me, a secular bear market is a decline in the major stock averages of at least 40% — and considerably more in secondary stocks — where the decline lasts at least three to five years. The fall is then followed by a long hangover that drags on for a number of years as the excesses are purged. There can be cyclical bull markets during this period, but it will be a long time before a new secular bull market begins in which the popular averages exceed the old highs and climb towards new peaks.

By contrast, a cyclical bear market is a fall of at least 15% but less than 40% that rarely lasts more than a year. A panic is a very short, sharp break. Length is an important part of the secular bear market definition, because time and sustained pain are what alter behavior patterns and change society. By these definitions, I count two secular bear markets in the United States in the past century (1929 to 1938 and 1969 to 1974), at least three panics (1916, 1929 and 1987), and 25 garden-variety cyclical bear markets.

Whilst we could all argue over the exact definitions, the above two paragraphs offer a very concise description from an incredibly talented investment mind that has literally decades of experience watching the NYSE, London Stock Exchange and many others.

Clearly, it is worth being able to distinguish a secular trend from a cyclical trend as this will help your investment thinking substantially in the moment. Simply being able to make some educated guesses about when a secular bear market will end could be very useful.

When these descriptions are combined with the thoughts of veteran bear market expert Harry Schultz. it becomes quite clear that bear markets — be they big or small — are very painful experiences for both a professional and an individual investor. There are of course many reasons for this, however human nature is almost certainly the overriding factor.

Why human nature?

Avoidance is not the answer

We suggest that it is simply because the majority of humanity is optimistic and lives in hope, especially so when it comes to money invested in an equity market. Thus, we find it difficult to face the idea that things will turn out badly and prefer to look away.

I can remember once reading in an online newsletter the following anecdote: the author explained that one of his stock trading clients had admitted that he simply had not switched his home computer on for several weeks to avoid seeing the devastation that the downward market trends of the time had caused to his portfolio.

It is easy to imagine that in times of market volatility many people stop checking the latest numbers from the Dow Jones and NASDAQ and temporarily stop opening the Wall Street Journal each morning.

This also leads us to avoid educating ourselves about bear markets, recessions, panics, depressions and stock market crashes. Such ignorance makes us blind to the potential reality.

To quote Harry Schultz on this, Failing to make an investment decision is still an investment decision .

To read more about different types of stock market conditions and their impact, please visit the following pages: