Sectors To Watch Should You Invest In Healthcare

Post on: 19 Июнь, 2015 No Comment

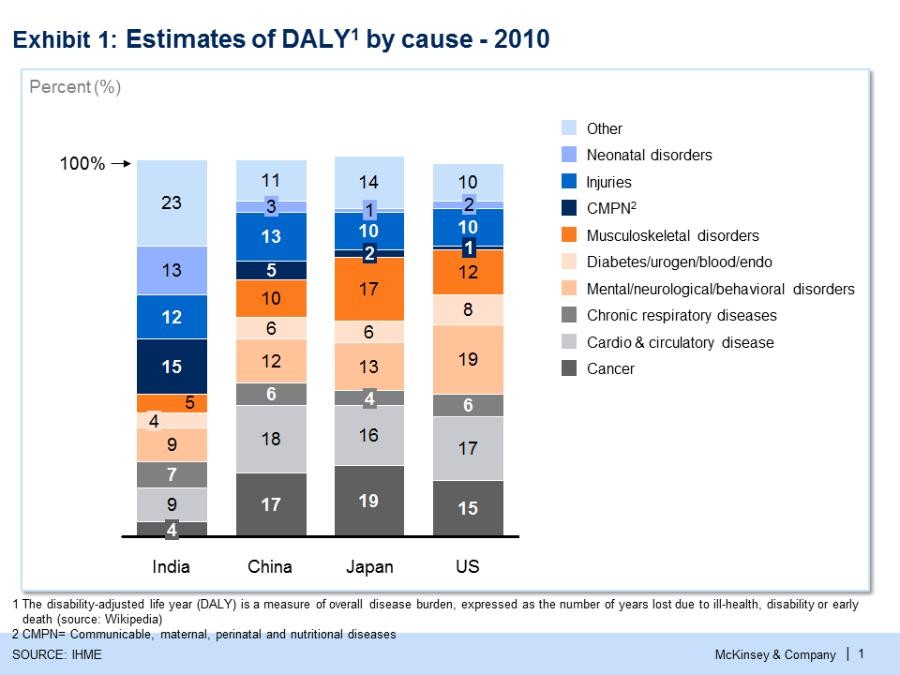

Healthcare in the US is undergoing major changes.

One thing’s for sure, since health care reform was signed into law in 2010, the industry has dealt with a lot of uncertainty. After surviving a challenge in the Supreme Court and President Obama’s reelection, it’s safe to say the reforms are here to stay.

At this point, 2013 is shaping up to be a relatively uneventful year for healthcare. But it will surely be back in the spotlight in 2014 when 29 million currently uninsured Americans join the health insurance system.

In short, the health care reforms seek to increase access to affordable healthcare.

That’s clearly good news for consumers. But one question remains… will healthcare businesses be able to make money in the new system?

Right now, health care companies are in the process of adjusting to the new reality of providing health care in America. They’ll have to treat more people but make less money on each patient.

In my opinion, 2013 is the calm before the storm.

Healthcare companies will be dealing with the expense of adjusting to the new reforms but they won’t get the benefit of the influx of 29 million new patients that will increase the number of people with health insurance. That means 2013 will likely be a difficult year for earnings growth. But earnings growth should accelerate in 2014.

Here’s the thing…

You can wait around to invest in healthcare until 2014. Investors are already bidding up healthcare stocks in anticipation of earnings growth accelerating in 2014.

The Health Care Select Sector SPDR (XLV) is up 20% over the last year.

That’s an impressive return for an ETF. And even more so considering it was dealing with uncertainty from the Presidential election. With the removal of uncertainty, I’m expecting an even stronger 2013.

A simple option strategy to profit from more upside in health care in 2013 is to buy some “LEAPS” or long-term call options on XLV. The goal is to generate returns similar to owning the ETF but with less money out of pocket and limited risk.

Right now you can buy XLV January 2014 $40 call options for about $2.50 apiece.

These at the money call options have more than a year until expiration. And the breakeven is $42.50.

If healthcare stocks simply have another year like it did in 2012, XLV should be trading for at least $47. That would send these options soaring to $7.00 apiece. That’s a return of 180%.