Sector Rotation What It Is and How to Use It

Post on: 10 Май, 2015 No Comment

Sector Rotation:

What It Is and How to Use It

How Using this Simple Strategy Could Increase Your Return AND Decrease The Risk To Your Portfolio

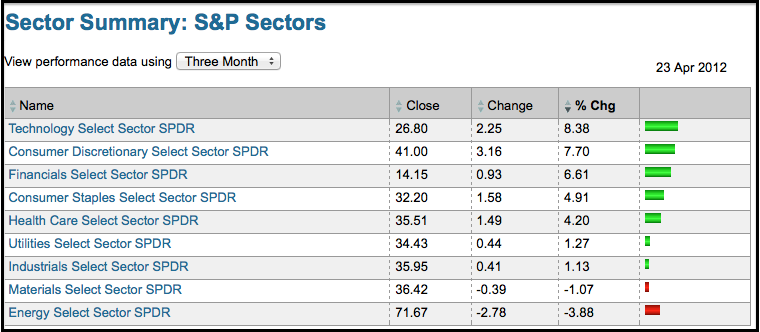

Sector rotation is an investment strategy that alters the portfolio weighting of the various market sectors and industries over the course of a multi-year economic and/or market cycle. Many index providers (S&P, Dow Jones, Morningstar) segment the U.S. market into sectors. Although their approaches to defining each sector differ slightly, they generally agree that there are approximately 10 major sectors.

A broad market index, such as the S&P 500, is a capitalization-weighted roll-up of all of the sectors. An investment manager pursuing an index strategy does not attempt to alter the weighting of each sector in the portfolio. However, over the course of a full market cycle, the sector weightings will automatically change as sectors come into and fall out of favor. For example, the energy sector represented about 7% of the S&P 500 at the end of 2004.

By November 2007, energy represented about 11% even though no portfolio changes were made. The index, and any portfolio tracking the index, had its sector weightings automatically adjusted throughout the years as the result of energy company stocks significantly increasing in value while other sectors saw little change or perhaps a loss in their market value. However, the S&P 500 is not considered a sector rotation strategy. It simply experiences small changes in its sector weightings because of sectors coming into and falling out of favor.

In a sector rotation strategy, the manager typically takes action to overweight those sectors believed to be favorable and underweight those sectors believed to be unfavorable. Along with the manager’s success in identifying the favorable sectors, the degree to which the overweighting and underweighting are performed will have a large impact in the resulting return, risk, and correlation characteristics of the sector rotation strategy.

Adding Sector Rotation Could Increase Your Return

Sector rotation is a unique investment strategy that could greatly increase the returns for your portfolio. In addition, it has the potential for reducing your overall risk of your portfolio. Check out the most compelling reason to consider sector rotation as illustrated in the chart below.

Chart represents a combination of Capital Cities Asset Management’s (CCAM) Fidelity Single Sector (labeled Sector Rotation) and the S&P 500 (labeled Index), quarterly data with annual rebalance; for the time period 12/31/94 thru 09/30/06. CCAM Fidelity Single Sector performance is based on composite of all accounts under management in the portfolio for the entire quarter. Reinvestment of all dividends and distributions is included. Reduction due to management fees is reflected. Does not reflect the payment of a discontinued one-time sales load to Fidelity, typically 3%. Management fees may vary based on assets under CCAM management. Fee schedule is available upon request. Past performance is not a guarantee of future results. CCAM Fidelity Single Sector is the composite of Fidelity Single Sector I and Fidelity Single Sector II. This investment involves risk. There is always the possibility of incurring a loss. Individual account performance may vary from composite presented.