Sector Rotation Trading Strategies For Dummies

Post on: 10 Май, 2015 No Comment

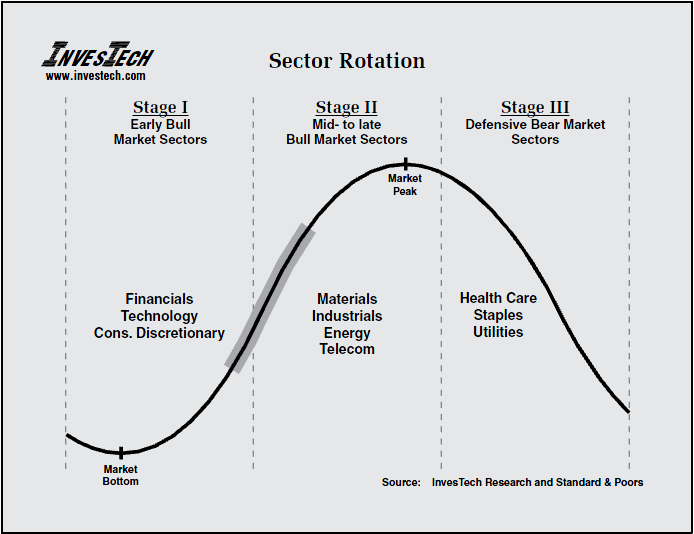

ETFs make implementing sector rotation trading strategies easier by minimizing the time you need to spend on individual stock research. You can use that time instead to follow sectors. After youve researched and selected the family of ETFs you want to use, you can spend most of your time researching what analysts are saying about where the economy is going. You then can rebalance your portfolio to follow economic trends.

When using a sector rotation strategy, youre looking for the sector that is at a low and next most likely to recover. You want to buy low and sell high.

Early recovery

When consumer expectations and industrial production begin to rise and interest rates are bottoming out, you know youre entering the early stages of recovery. There were early signs of recovery in late 2011 and 2012, as unemployment began to fall, but the economy still has a long way to go to dig its way out of the biggest recession since the Great Depression.

In the early stages of recovery, basic industry, such as XLB (Select Sector SPDR — Basic Industries), and energy sectors, such as XLE (Select Sector SPDR — Energy Select) or IXC (iShares S&P Global Energy Index Fund), tend to take the lead, so finding the right ETFs in these sectors is a good way to overweight your portfolio as the economy moves into recovery.

Full recovery

After the economy fully recovers, youll start to see signs that consumer expectations are falling. Productivity levels and interest rates flatten out. During this economic period, companies in the consumer staples and services sectors tend to take the lead. But be ready to move when the economy heads into its next recession.

You should always have some portion of your portfolio in the noncyclical industry ETFs that supply the staples of life even in times of recession. One possible option may be XLP (Select Sector SPDR — Consumer Staples).

Early recession

You can recognize the earliest part of a recession by certain signs: consumer expectations fall more sharply and productivity levels start to drop. Interest rates also begin to drop. The utilities, such as XLU (Select Sector SPDR Fund — Utilities), and finance, such as XLF (Select Sector SPDR Fund — Financial), sector ETFs are ones to hold because underlying stock prices usually rise in the early part of a recession.

Investors tend to seek stocks that provide some safety and pay higher dividends. Gold and other valuable mineral stocks also tend to look good when investors seek safety. Although the 2008 recession was an anomaly, generally you see banks, insurance companies, and investment firms perform well during the early parts of a recession.

Full recession

You may not think to look at consumer stocks when the economy is in a full recession, but during a full recession consumer expectations actually improve. Spending increases. Yet industrial productivity likely remains flat, and businesses dont increase their production levels until they believe consumers actually are ready to spend again. Interest rates drop or stay low because neither businesses nor consumers are spending, so credit becomes more available.

In the recent recession, credit remained tight as banks worked out their problems with mortgage and credit card debt losses. This is not always so severe. During a full recession, ETFs that focus on cyclical, such as XLY (Select SPDR Fund — Consumer Discretionary), and technology stocks, such as XLK (Select Sector SPDR — technology), or IXN (iShares S&P Global Technology Index Fund) usually lead the way to recovery.

- Add a Comment Print Share