Sector Rotation Spotting the Turns

Post on: 10 Май, 2015 No Comment

/media/images/tradestation/social-media/16px/facebook /% %img src=

Sector Rotation Spotting the Turns

By Frederic Palmliden, CMT

Senior Quantitative Analyst, TradeStation Labs

Summary

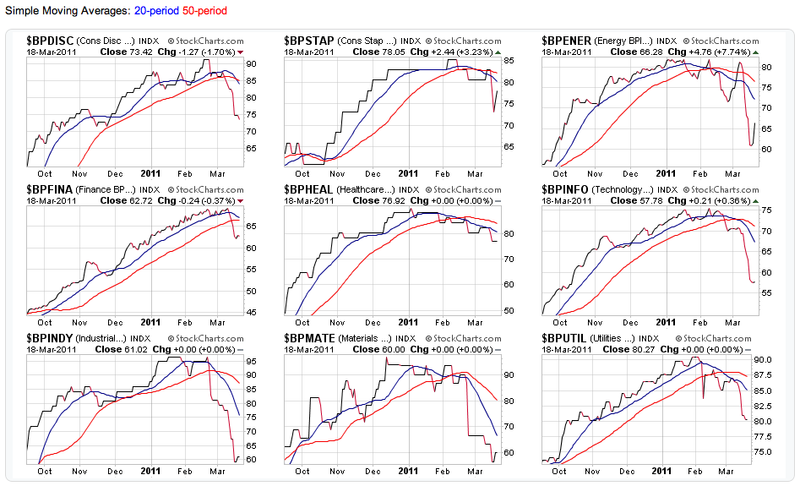

Sector rotation is based on the concept that different sectors of the equity markets perform differently during various phases of an economic cycle. Much technical and fundamental research has been conducted on intermarket analysis as the question nowadays is more where to invest than whether or not to be in the market. For instance, cyclicals may start to outperform consumer staples when the economy is experiencing an upswing reflecting improved consumer expectations and optimism about the direction of the business cycle.

While there are many approaches to monitoring sector underperformance and outperformance, this paper will focus on sector rotation using a proprietary relative strength methodology. Challenges associated with traditional relative strength analysis become apparent when several moving parts are involved, which is the case with sector rotation. This paper will discuss and address these challenges, while providing a preview of future TradeStation Labs products.

Figure 1 S&P Sector ETFs with the NRSS Indicator for Industrials (XLI)

%img src=

/media/Images/TradeStation/Education/Labs/Analysis /%

Background

Different market sectors perform better at different stages of the business cycle. Sector rotation refers to capital flowing from one stock market sector to another as investors pursue the next best-performing sector during a given business cycle. The intermarket relationships behind sector rotation are extensive and go beyond this paper. For example, energy stocks may take over market leadership near the end of an economic expansion due to rising energy prices and the resulting buildup of inflation pressures. The turn from the end of an economic expansion to the beginning of an economic contraction may be marked by leadership switching from energy stocks to more defensive sectors, such as consumer staples. It is important to note that market trends usually anticipate economic trends by six to nine months. Factors that affect sector rotation are wide-ranging and include industrial production, consumer expectations, interest rate movements, the shape of the yield curve and trends in the currency market. To learn more about some of these factors, readers may want to refer to Intermarket Analysis Profiting from Global Market Relationships by John J. Murphy (John Wiley & Sons, Inc. Hoboken, New Jersey, 2004). In his book, Murphy provides a visual look at sector rotation throughout the market cycle and economic cycle (represented in Table 1 below).

Table 1 Murphys Sector Rotation Throughout the Market Cycle (Gray) and Economic Cycle (Blue)

In this paper, the nine Select Sector SPDRs will be used. These are exchange traded funds (ETFs) representing the nine sectors of the S&P 500 index (see Table 2 below).

Table 2 Select Sector SPDRs