Sector Rotation

Post on: 16 Март, 2015 No Comment

How to Practice Sector Rotation in Your Portfolio

Everything you need to know about sector rotation investing and how to implement it within your own investment portfolio can be learned in a few short minutes. If you want to implement a successful sector rotation strategy you really only need to know two key pieces of information:

1) what stage of the economic business cycle we are in,

2) what stock sectors perform best in each economic stage of the business cycle.

Sounds simple? It theory it is, but in practice it requires a little more work. In the rest of this article we will explore some of the key concepts and issues you will need to know to practice a successful sector rotation strategy.

Sector Rotation Illustrated

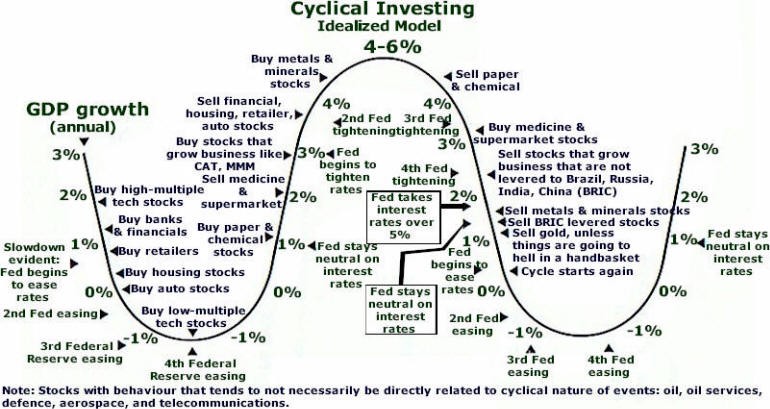

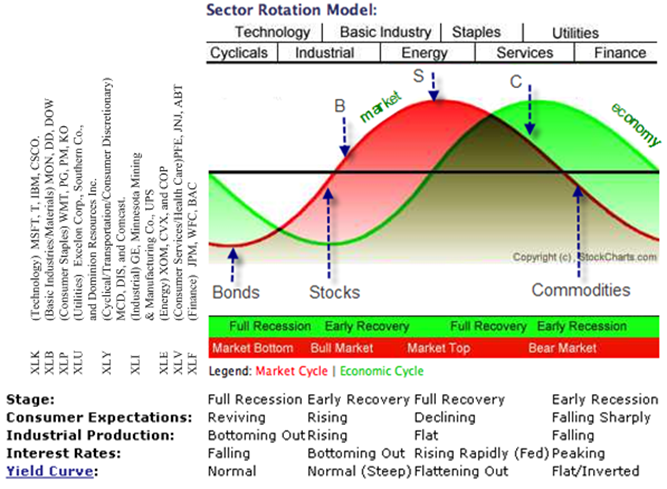

Perhaps the easiest way to understand sector rotation is to see an illustrated chart walking us through each stage of the economic business cycle, illustrating what the stock market is doing at that stage of the cycle and showing which stock sectors are expected to perform the best. In each stage of the economic business cycle we can see exactly which stock sectors should perform best, which sector investment vehicles one can use, level of industrial production, consumer expectations, and what the interest rate yield curve looks like. We need to observe these datapoints when approaching sector rotation with a fundamental analysis viewpoint to help us identify exactly what stage of the economic cycle we are facing. Sometimes the answer is not so clear and may not fit neatly into the box of what is expected. Life can be a little messy sometimes and fundamental analysis is no different. The important takeaway point is to utilize the model to assess what should be happening, and to look at the other datapoints as signs or clues that the economic cycle may be changing. Click to see the full sector rotation chart and each step in the cycle.

The Basic Sector Rotation Model

There are four basic stages to a regular economic business cycle, and within each stage of the cycle we have different levels and changes in industrial production, consumer confidence, interest rates, and Gross Domestic Production. To capitalize and profit on these expected changes that happen through a business cycle and investor can position their portfolio weightings more into the sectors that should benefit the most as the cycle shifts into the next economic phase. Learning how to identify the stages of the economic cycle, and to sense when they are shifting is key for this strategy to work effectively. What makes this theoretical model a little more difficult to implement in real life is that these economic indicators in the model are lagging indicators, while to stock market is a leading indicator, meaning it anticipates these changes well in advance of them actually happening. So what is an investor to do? Learn the 4 economic cycle stages of the sector rotation model .

Sector Rotation Analysis and Stages of the Stock Market

There are also four basic phases to the cycle of a stock market that we are interested in when trying to time the rotation of sectors. Within each stage of the stock market phase we have different economic activities and different market index directions, velocity of change, and momentum. Each phase of the stock market in this model is anticipating what will happen in the underlying economic cycle, and this is why we consider the stock market to be a leading indicator. The general consensus is that the stock market anticipates economic events that are about 6 — 12 months into the future, and will start to respond to what it anticipates will happen 6 — 12 months before it actually occurs. In the context of sector rotation this means that one must be good at predicting or anticipating where the economic business cycle will be in 12 months time, or be a patient investor and position portfolios well in advance of the actual changes. See 4 more stages of the stock market cycle using sector rotation analysis .

The Stock Market Sectors

Perhaps There are 11 basic sectors used to categorize all stocks in the general stock market index, and nine of them are considered cyclical sector groupings, which means they are sensitive to the economic cycle and rise up and down at different points in the economic cycle. The two other common sectors are classified as defensive sectors and are not as sensitive to the economic environment, and generally provide a safer haven for investors when the economy is contracting. Discover when the 11 stock sectors are expected to outperform .

Sector Rotation Funds

If sector rotation is so great why not just invest in the any of the available sector rotation funds? With over 10,000 mutual funds available to investors, many of these funds have created sector rotation style funds to allow investors exposure to this style of rotation investing. But how have sector rotation funds performed relative to the general market? How much are the fees and costs involved in owning a sector rotation fund? Are there minimum holding requirements and investment levels? There are many issues you need to consider before jumping into any of the sector rotation funds offered in the market place. In addition, several fund managers have created sector funds which will limit their active management within the specific sector or industry the fund specializes. These mutual fund sectors are more similar to ETFs yet still have some of the downsides of typical mutual funds. Read more about investing in a sector rotation fund .

Sector Rotation ETFs

How have sector rotation ETFs performed? One would think that with the structural cost advantages over mutual funds along with the flexibility of trading intraday like a stock these vehicles would have performed well? We would expect investment professionals at the helm of a sector rotation ETF to perform well, and to generally outperform the market indexes and similar sector rotation mutual funds due to their cost structure advantage. Another very popular option for investors practicing sector rotation is to focus on sector ETFs. Exchange Traded Funds have exploded in popularity due to their many advantages over mutual funds, and many practitioners of rotation investing also apply this model to more narrow industry funds. See how sector rotation ETFs are performing .

Implementing a DIY Sector Rotation Strategy

Here we put all the pieces of a sector rotation strategy together in an easy to follow step-by-step guide so any DIY investor can read the economic and fundamental clues occurring in the business cycle and position their own investment portfolio to benefit from sector rotation. Regardless of your investment knowledge or experience, after a little reading and research you should be able to follow and implement this basic strategy. All you need to do is be able to read the clues of what the economy is doing and where it is expected to go. Following these simple datapoints can be found in the daily business section of any newspaper. Here are the steps to implement your own sector rotation strategy .

Supercharged Sector Rotation Investing

One of the most common pitfalls of following a sector rotation investment style based on fundamental analysis of economic conditions is that getting the timing right is very difficult. Professional economists argue constantly over what stage of the cycle and economy is experiencing, and have many different and conflicting predictions on where an economy is headed. If professional economists cannot even agree on interpreting these basic business cycles what hope does a DIY investor have? Luckily we have discovered a simply way to time the rotation underlying the economic cycle using leading indicators that anticipate the cycle rotation before it actually occurs. Read more on how to take sector rotation investing to the next level .

The Best Sector to Invest in Now?

Now that we have reviewed all the key pieces of the sector rotational strategy, how do we know what sector to invest in today for the best investment return? If mutual fund managers struggle to do it, and Rotation ETF funds fare no better, how is a DIY investor supposed to figure out which sectors to invest within? Here we breakdown what an investor should look for, what important steps to follow, and what resources you will need. We also discuss a revolutionary method that is simple to implement and takes less than 10 minutes of your time per month. Discover the best sector to invest in now!