SEC 13F How to Get Use 13F Filings

Post on: 16 Март, 2015 No Comment

How to Make George Soros Tell You about His Latest Investments

There is a place on the internet where you can get a detailed portfolio snapshot from the worlds greatest traders and investors including George Soros. Bruce Kovner. Warren Buffett. Philip Falcone. or John Paulson. Regularly and for free. The place is US SEC (Securities and Exchange Commission).

SEC 13F Holdings Report and US Securities Exchange Act

According to Section 13(f) of the US Securities Exchange Act of 1934, all big institutional investment managers who exercise investment discretion over $100 million are obliged to file a quarterly form in which they disclose all their portfolio holdings to the SEC. I will not waste your and my time here on the legal details, which you can find in the 13F FAQ on the SEC website .

How the 13F Holdings Report Looks

The good thing for us is that the 13F holdings reports are publicly available in full detail on the SEC website. For every fund or company, the report contains list of securities and for each security there is fair market value and number of shares held. You can take advantage of these reports if you want a hint regarding what the big guys have been doing in the markets.

So How Do You Get the Latest 13F Filing of George Soros?

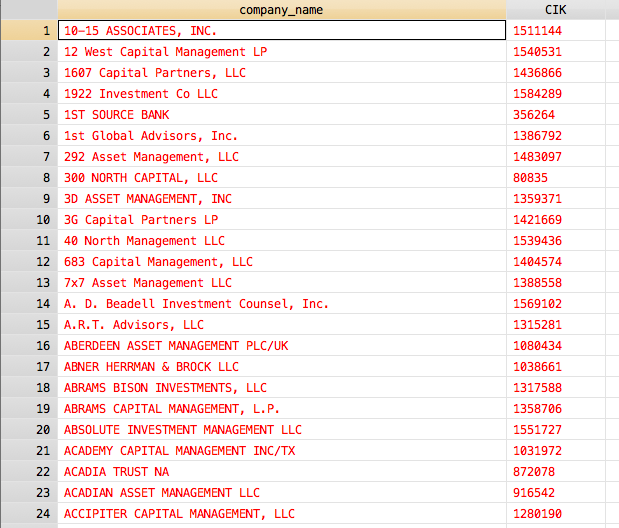

Go to SEC EDGAR System company search website and type the company or fund name in the form. It helps if you know the fund or management company by exact name. For example, by typing “George Soros” you get no results – you need to ask for “Soros Fund Management”. Another example: if you search for “Berkshire Hathaway” you get four different companies and three of the names contain “Berkshire Hathaway” (the right one is Berkshire Hathaway Inc). However, for the best known managers the fund and company names are widely known and you can easily google them or find them on Wikipedia.

After submitting the search query you get a list of all forms that asset manager has filed (most of them are not really interesting). Look for form 13F-HR – Quarterly report filed by institutional managers, Holdings .

Getting the Top Hedge Funds Holdings from Media

When the big names report their 13F-HR, it always gets attention of the media, so you can alternatively see at least the largest holdings on CNBC, Bloomberg, and on various websites and blogs. You often get them with commentary and analysis of the changes. It is up to you if you want the information already processed, or prefer raw detailed data from the SEC and analyze it yourself.

Dont Just Copy Soros or Buffett. They Might Have Already Sold Anyway.

Even when you are happy with the idea of following someone elses trading strategy, the usefulness of the 13F form for your own trading and decision making is limited by the significant lag between the fund manager making a trade and the trade being reflected in the report.

Form 13F shows holdings at the end of each quarter. but it is published at the SEC website several weeks later – around the middle of the following quarter. Therefore, when for example George Soros doubles his position in GLD in October, you have a chance to know that only by mid February – and by this time Soros might have already sold the position. There is a big lag and you should not hope that merely buying the stocks the big smart guys file in their 13F will make you money.

How to Best Use the 13F Filings

Instead, it is better to use the 13F form reports as a learning tool. It is something like reading Warren Buffetts Berkshire Hathaway annual report, which many people say is the best education source in stock picking.

If you follow the 13F filing of your favourite managers regularly (every quarter), you will see how their holdings change from quarter to quarter and how their strategy has changed during the past quarter. For example when you see the positions in oil stocks held by a fund tripled in the past quarter, you can conclude that the manager got quite bullish on oil.

13F Holdings Report vs. Quotes in Media

For the few most famous fund managers, you can complement the 13F form with reading or watching their opinions and interviews that some of them have published from time to time. One advantage of the 13F form against the quotes in media is that the 13F is certainly unbiased. detailed. and its meaning cant be distorted by a journalist who takes one sentence from the context and totally changes its meaning. The 13F holdings report is a useful piece in the mosaic of learning how the successful investors think.