Search Best Retirement Planners with

Post on: 4 Июнь, 2015 No Comment

Directory of Professional Retirement Planners

Retirement planning is a term that refers to the allocation of financial resources towards retirement. In most cases this simply means setting aside money or other similar assets for the purposes of collecting a living income once you’re past working age. Financial independence is the goal of retirement planning. Most people hope to be able to survive without working at all, so that they can just travel or spend time with family. Getting to this point, of course, takes some time and a lot of attention to detail through the years. Getting ready to retire is a process that ideally starts as early as possible in one’s working career. Allowing our investments more time to earn for us is the best way to build our portfolios.

Readiness to Retire

The process of putting together plans to retire involves two basic parts. The first part is assessing your readiness to retire given the lifestyle goals you have and the age at which you hope to retire. The second is to come up with possible actions and decisions to improve your readiness and to get closer to your goals. Every action we take as investors through the years are in relation to this recursive process. Ideally, we are always evaluating how ready we are for retirement and how well our plans are proceeding. And making adjustments to these plans and changing the course of our strategies are normal parts of the planning process.

Retirement planning is not something that can be done in a day, a week, or even a month. It is not an event but rather a recursive and cyclical process. The best plans are the ones that provide enough flexibility to allow us to make changes as the need for doing so becomes evident.

To achieve this kind of flexibility and to come out with the best series of investments to help you achieve your goals, it is good to work with a retirement planner to make the process simpler and to help expose you to ideas and investments you might not be aware of. Retirement planning can be a difficult and sometimes mysterious process, but professional planning can make the process a whole lot simpler.

Investors who wish to reach their retirement goals need to start investing as early as they possibly can. Getting into the market early gives your investments more time to perform and to earn income for you. Establishing a consistent pattern early on also helps build up the portfolio so that it can better withstand downturns in the market. A long term investment pattern characterized by consistency means the investor does not have to rely on luck quite as much in order to reach their financial goals.

Setting Realistic Goals for Retirement

Investors who want to live comfortably when they are through working need to set reachable goals that are based on the lifestyle they hope to have, not on someone else’s formula or benchmark. After all, it is your life and no one else’s. Be honest about the way you hope to live and determine how much the lifestyle you want will cost you. Work backwards from there to calculate how much you’ll need to save in order to supplement Social Security and any other income you’ve got coming to you.

One key aspect of retirement planning is choosing the investment vehicles you will use to help you reach your financial goals. There are many different kinds of investments available and different opportunities will appeal to different people. But 401k accounts are a great way to put money away for retirement. A 401k is an option that should appeal to just about anyone. Making contributions to these funds results in immediate and long term tax benefits. The contributions themselves are deducted from your taxable income, and the growth on the account is tax deferred until withdrawal. Plus many of these accounts feature matching company contributions.

Individual retirement accounts also offer great tax advantages for folks planning to retire down the road. A traditional IRA features tax deferred growth, meaning that investors pay income taxes on their gains upon withdrawal. A Roth IRA is different in that it does not allow for deductible contributions, but once contributions are in the account they are no longer taxed even at withdrawal. Good retirement planning involves choosing the best retirement vehicles for the goals you have and your capability to invest. One rule of thumb: even if it is not your primary investment, take advantage of company matched IRAs and 401k accounts by contributing at least the minimum needed to capture that company match. This is free money, and free money is pretty hard to turn down when we’re planning for a retirement that will probably cost more money than we’d like to admit.

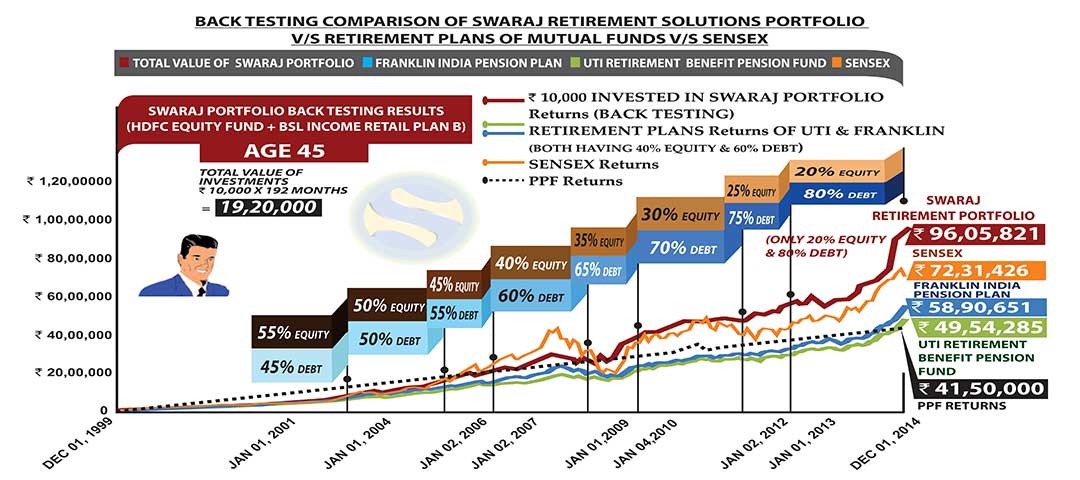

Focus on Asset Allocation

Healthy retirement planning depends on asset allocation rather than on the performance of one single investment. For this reason, it is good to spread your investment capital around. Of course, investors should not get into financial investments just for the sake of diversification unless they understand the income and growth objectives of the investments and are confident in their prospects for future performance. This part of retirement planning often requires the help of a professional. Most of us are not exactly experts in retirement planning. But even if you do get some help from an expert, it does not mean that you have to surrender control over your portfolio. Individuals can work out their own agreements with financial planners as far as portfolio control is concerned. But it does pay to get help with planning.

Professional retirement planning services can help investors get into the right stocks. Out of all investment types, stocks have the best chance historically of delivering a good return on investment over long periods of time. Stocks tend to grow ahead of the rate of inflation, meaning your gains more than offset the declining value of the dollar over time. Getting help with retirement planning can give investors an inside edge on great stock picks and systematic investment in the market.

Smart Financial Planning

Smart planning will yield a comprehensive strategy for systematic and disciplined contribution to funds designed for income, growth, and limited risk exposure. Professional services can help consumers design the right portfolio given their particular goals. Retirement planning is no walk in the park, but with some work this planning can be done effectively and with success.

An example of financial planning after an investor has retired is the strategy to withdraw from taxable accounts first in order to let tax sheltered funds grow unimpeded for as long as they possibly can. Retirement planning in its essence is an effort to get more mileage out of the money we have to invest, both on the way in and at withdrawal when we retire.

Retirement planning is a whole life strategy that involves lifestyle choices in the present to help finance the future. As we get older the need for discipline in this area becomes more and more apparent. The wise ones among us are those who take retirement planning seriously while they are still young, giving them a head start.