Screens The Disciplined Investor

Post on: 28 Май, 2015 No Comment

February 14, 2008

Just listening to investors or analysts talk these days and it is hard to miss the ongoing chatter about an apparent and impending recession. Some analysts say we are already in one, others point to its arrival in the near future. Regardless of what the experts have predicted, no one can deny our country’s economic downturn. Looking at the pathetic housing market, the recent lackluster results in the financial markets, and the absolute horrific price of gas, it is fairly easy to assume we are well into an economic downturn, moving toward a full-blown recession.

So what do you do when it comes to investing in this turbulent time? Do you panic and pull out all your investments, toss the cash in a garbage bag and hide it under the mattress until this is all over? Some might advise such a ridiculous strategy, but the truth is that there is a benefit in being an smart investor during this time.

Investing, like any other business, is all about making good use of whatever advantage you have, and when the masses pullout, it is often a good time to think about going in.

Recession/bear market investing is absolutely different than traditional investment strategies for many reasons. To begin with, the average investor should probably not enter into risky investments like futures trading, option buying, or strategies that utilize leverage at a time like this. When an investment is considered a risky move in a good economy, then in a bad economy it should be considered off limits, unless of course you have a powerful grasp on the art of the advanced trading style that gives you a leg up. For most investors though, it is a good idea to stay away from such a risky endeavors, and focusing on the 5 pillars of investing during economic downturns.

The Five Pillars of Investing During Economic Downturns:

1. Understand The Business Cycle

2. Perform an Internal Audit Before Buying Anything

3. Invest in Evergreen Industries

4. Invest in Long-Term, Proven Winners

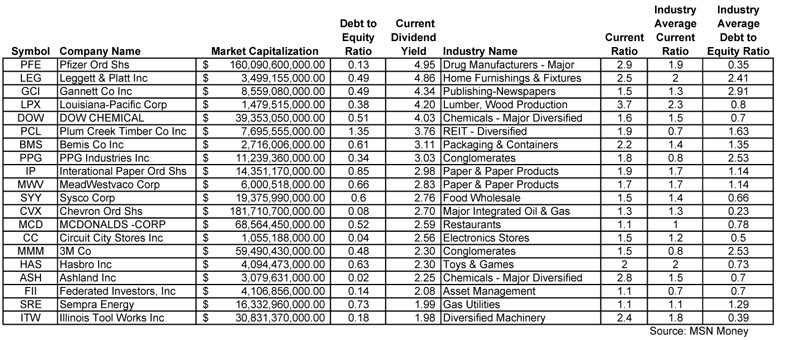

5. Look for Deep Value Stocks

The first and most important move any investor can make during an economic downturn is to educate themselves about the business cycle. All businesses, and as a whole our economy, go through a cycle. They have growth periods, followed by stagnant periods, followed by downward periods. This is something that happens to Read more