Scared of Commodities Use Commodity ETFs

Post on: 18 Июнь, 2015 No Comment

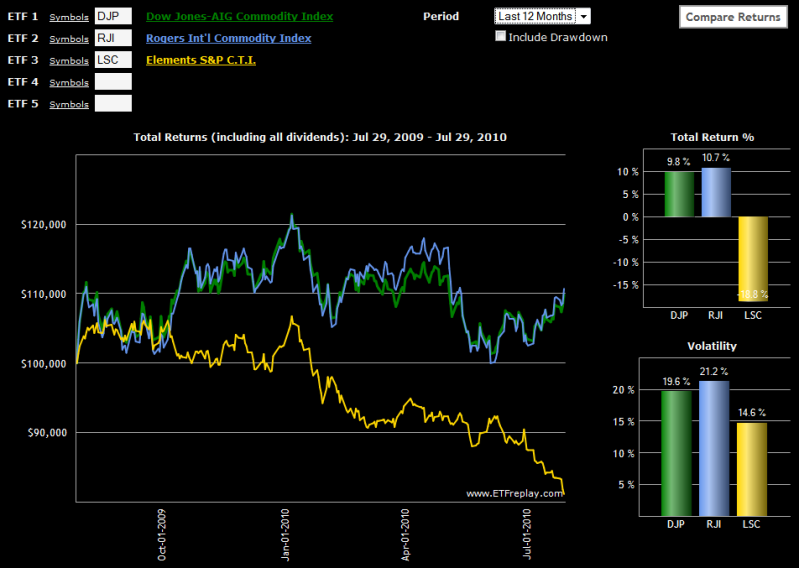

Figure 1

ETFs can offer an investor the opportunity to participate in the Commodities markets with no leverage if they choose. Of course, if the investor wants to trade on margin in their Equity account, then they have the option of using leverage. One of the drawbacks to this style of investing instead of using Futures is that the brokerage commission tends to be higher and you dont get the same dollar move in the ETFs as you would the Futures. Your profit potential can be reduced because you are not using leverage and incurring larger commissions.

Since the bull market in Commodities began back in 2002, we have seen Commodities become their own asset class. Investors are looking for hard assets to place in their portfolios to protect against inflation and diversification from just paper investments. With this diversification comes a negative correlation between Commodities and Stocks. A recent study shows that the correlation between the UBS Commodity Index and the Stock market was only .33 over the last 10 years.

Before showing you some of the ETFs that are related to Commodity investing, lets discuss that contango problem again and how it can be dealt with in your choices of ETFs. ETFs can lose as much as 5-10% per year of their return value in some Futures markets because of this contango situation. This becomes more of a problem if you select an ETF that is Commodity specific, for example, GLD – Gold, USO – Oil, UNG – Natural Gas, etc. because any of these markets could be in contango and each time the ETF has to rollover their contracts, the fund will take a profit hit.

Lets look at a way that might help you get around this problem of contango. Remember that word diversification? Well, it applies in ETFs also. By investing in ETFs that track the broad Commodity indexes as opposed to Commodity specific indexes such as Gold, Oil, Natural Gas, etc. you will have a portfolio of a basket of Commodities and not all of them will be in contango at the same time. Some may actually be inverted markets and this offers great pricing at rollovers for the ETFs. See Figure 1 and note how inverted markets offer lower prices with each succeeding contract. One note of caution about Commodity ETFs: Always read the prospectus and make sure that the ETF is tracking the physical Commodities and that the ETF is not tracking companies related to producing or processing these Commodities.

Here is a list and exchange symbols of some of the popular ETFs that have baskets of Commodities in each:

- RJI Rogers International Commodity

- GSG – S&P GSCI Commodity Index

- GCC – Green Haven Continuous Commodity Index

- DJP – Dow Jones Commodity Index

- DBC – Powershares DB Commodity Index

Figure 2 demonstrates the Commodities in the Powershares DB Commodity Index ETF. Notice how they are non-correlated so a Commodity may be trending up and the other trending down. Also, the different Commodities might not all be in contango thereby helping the index to profit without rollover losses.

Figure 2

When selecting ETFs that have baskets of Commodities, always review the prospectus and review the weightings of each ETF. Some ETFs are heavily weighted in energy products, while others might be more agricultural. Try to find a more balanced ETF where each sector is relatively equal to another.

If you decide not to invest in a broad sector Commodity Index, there are ETFs that specialize in a specific Commodity. I would recommend that if you invest in these, that you still diversify by putting non-correlated ETFs together to offer better risk protection from over-investing in a single Commodity. This usually happens when a particular Commodity is in the news and novice investors put all their money in this one ETF. When Commodities do create bubbles, they come down faster than anyone can imagine. Just look back at Crude Oil when it rallied to $147 almost in a parabolic fashion and then when the bubble burst, prices came back down in the lower $30 range very quickly. This was just one incident of a bubble, but there have been plenty in the past.

Here is a list of popular ETFs that specialize in specific Commodities with their exchange symbol:

- DBA – Powershares DB Agriculture Fund

- USO – United States Oil Fund

- SLV – Ishares Silver Trust

- IAU – COMEX Gold Trust

- GLD – SPDR Gold Shares

When looking at buying these ETFs, remember to first look at the trend of a Commodity Index such as the CRB Index or the Goldman Sachs Commodity Index. If you notice these are not in uptrends, the odds of your ETF purchase working may not be very good. Even though most Commodities are non-correlated to Stocks and to a degree one another, they still are driven by supply and demand. Most Commodities have been supply driven until the last couple of years and we have started to see where demand is driving Commodity prices on a regular basis. This bull market we are in started around 2002 and the market continues to run.

As I write this we see the CRB Index is still in a nice uptrend with demand levels holding on pullbacks (Fig 3). Here are three letters to keep in mind with Commodities in my opinion: BTD. On the trading floors, traders call this Buy the Dips! Can the Commodity markets turn and go down? Of course they can, but as we watch this market, how can you argue with this trend unless you are a market top picker? Of course, I like these types of traders because when they sell this Commodity market, they eventually become buyers to cover their shorts.

Figure 3

As you broaden your asset class knowledge, please do not let the leverage and volatility keep you from participating in these markets. By using ETFs, you can participate as a long-term investor in assets that people really want to own today. I highly recommend that you do your homework with any investment you make. This means researching the performance of the ETF, expense fees associated with owning it and its correlation to the actual Commodity or Sector and Liquidity. I mention liquidity because if a bubble does occur, liquidity will help you liquidate your position in a timely and profitable manner.

It takes the hammer of persistence to drive the nail of success. John Mason