Scalping (trading) Wikipedia the free encyclopedia

Post on: 16 Март, 2015 No Comment

§ How scalping works [ edit ]

Scalpers attempt to act like traditional market makers or specialists. To make the spread means to buy at the Bid price and sell at the Ask price, in order to gain the bid/ask difference. This procedure allows for profit even when the bid and ask don’t move at all, as long as there are traders who are willing to take market prices. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds.

The role of a scalper is actually the role of market makers or specialists who are to maintain the liquidity and order flow of a product of a market.

§ Principles [ edit ]

- Spreads are bonuses as well as costs — Most worldwide markets operate on a bid and ask based system. The numerical difference between the bid and ask prices is referred to as the spread between them. The ask prices are immediate execution (market) prices for quick buyers (ask takers); bid prices for quick sellers (bid takers). If a trade is executed at market prices, closing that trade immediately without queuing would not get you back the amount paid because of the bid/ask difference. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads (costs). On the other hand, traders who wish to queue and wait for execution receive the spreads (bonuses). Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades.

- Lower exposure, lower risks — Scalpers are only exposed in a relatively short period, as they do not hold positions overnight. As the period one holds decreases, the chances of running into extreme adverse movements, causing huge losses, decreases.

- Smaller moves, easier to obtain — A change in price results from imbalance of buying and selling powers. Most of the time within a day, prices stay stable, moving within a small range. This means neither buying nor selling power control the situation. There are only a few times which price moves towards one direction, i.e. either buying or selling power controls the situation. It requires bigger imbalances for bigger price changes. It is what scalpers look for — capturing smaller moves which happen most of the time, as opposed to larger ones.

- Large volume, adding profits up — Since the profit obtained per share or contract is very small due to its target of spread, they need to trade large in order to add up the profits. Scalping is not suitable for large-capital traders seeking to move large volumes at once, but for small-capital traders seeking to move smaller volumes more often.

§ Different parties and spreads [ edit ]

Whenever the spread is made one (or more) party must pay it (paying the cost to receive some value on completing the transaction quickly) and some party (or parties) will receive that money as profit.

§ Who pays the spreads (costs) [ edit ]

The following traders pay the spreads:

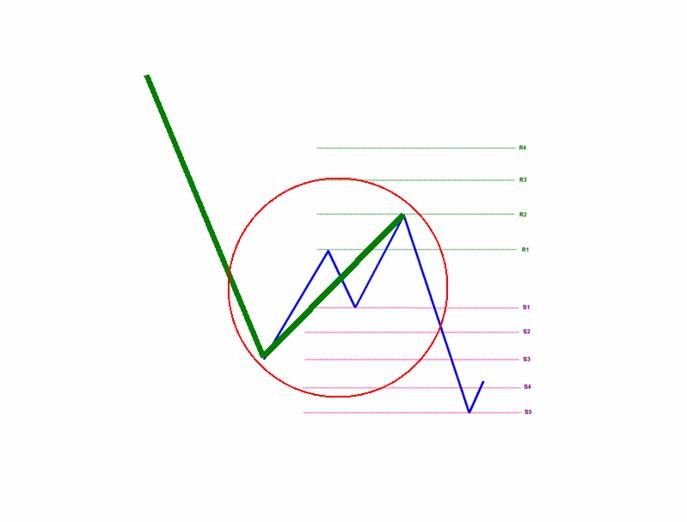

- Momentum traders on technicals — These traders look for fast movements hinted from quotes. prices and volumes, charts. When a real breakout occurs, price becomes volatile. A sudden rise or fall may occur within any second. They need to get in quick before the price moves out of the base.

- Momentum traders on news — When news breaks out, the price becomes very volatile as many people watching the news will react at more or less the same time. A trader needs to take the market prices immediately as the opportunity may vanish after a second or so.

- Cut losses on market prices — The spread becomes a cost if the price moves against the expected direction and the trader wishes to cut losses immediately on market price.

The following traders receive the spreads:

- Individual scalpers — obviously they trade for spreads and can benefit from larger spreads.

- Market makers and specialists — people who provide liquidity place their orders on their market books. Over the course of a single day, a market maker may fill orders for hundreds of thousands or millions of shares.

- Spot foreign exchange (exchanges of foreign currencies) brokers — they do not charge any commissions because they make profits from the bid/ask spread quotes. On July 10, 2006, the exchange rate between Euro and United States dollar is 1.2733 at 15:45. The internal (inter-bank dealers) bid/ask price is 1.2732-5/1.2733-5. However the foreign exchange brokers or middlemen will not offer the same competitive prices to their clients. Instead they provide their own version of bid and ask quotes, say 1.2731/1.2734, of which their commissions are already hidden in it. More competitive brokers do not charge more than 2 pips spread on a currency where the interbank market has a 1 pip spread, and some offer better than this by quoting prices in fractional pips.