Sales of Luxury Goods Are Recovering Strongly

Post on: 31 Март, 2015 No Comment

Nordstrom has a waiting list for a Chanel sequined tweed coat with a $9,010 price. Neiman Marcus has sold out in almost every size of Christian Louboutin “Bianca” platform pumps, at $775 a pair. Mercedes-Benz said it sold more cars last month in the United States than it had in any July in five years.

Even with the economy in a funk and many Americans pulling back on spending. the rich are again buying designer clothing, luxury cars and about anything that catches their fancy. Luxury goods stores, which fared much worse than other retailers in the recession. are more than recovering — they are zooming. Many high-end businesses are even able to mark up, rather than discount, items to attract customers who equate quality with price.

“If a designer shoe goes up from $800 to $860, who notices?” said Arnold Aronson, managing director of retail strategies at the consulting firm Kurt Salmon, and the former chairman and chief executive of Saks.

The rich do not spend quite as they did in the free-wheeling period before the recession, but they are closer to that level.

Photo

Lissette Gutierrez chose a pair of $1,495 Christian Louboutin shoes at Bergdorf Goodman in Manhattan. Credit Deidre Schoo for The New York Times

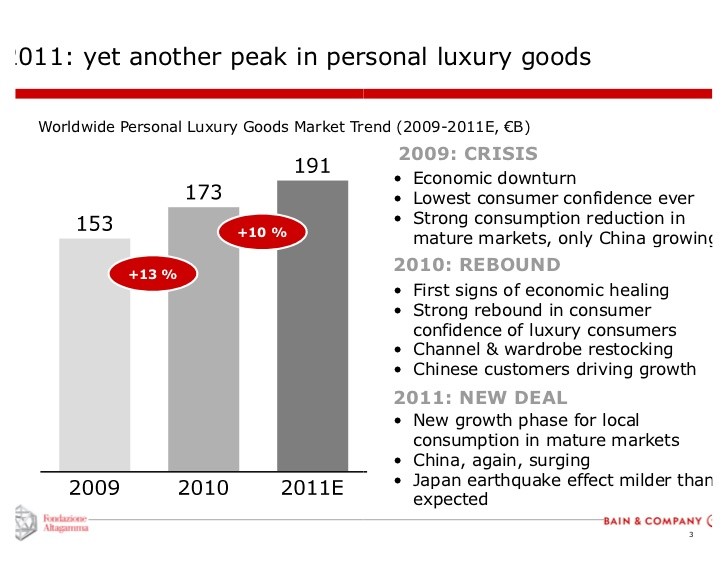

The luxury category has posted 10 consecutive months of sales increases compared with the year earlier, even as overall consumer spending on categories like furniture and electronics has been tepid, according to the research service MasterCard Advisors SpendingPulse. In July, the luxury segment had an 11.6 percent increase, the biggest monthly gain in more than a year.

What changed? Mostly, the stock market, retailers and analysts said, as well as a good bit of shopping psychology. Even with the sharp drop in stocks over the last week, the Dow Jones is up about 80 percent from its low in March 2009. And with the overall economy nowhere near its recession lows, buying nice, expensive things is back in vogue for people who can afford it.

“Our business is fairly closely tied to how the market performs,” said Karen W. Katz, the president and chief executive of Neiman Marcus Group. “Though there are bumps based on different economic data, it’s generally been trending in a positive direction.”

Caroline Limpert, 31, an entrepreneur in New York, says she is happy to spend on classic pieces, like the Yves Saint Laurent tote she has in both chocolate and black, but since the recession, she avoids conspicuous items.

“Over all, you want to wear less branded items,” she said. “If you have the wherewithal to spend, you never want to be showy about it.” Still, she said, she is quick to buy at the beginning of each season. “I buy things that could sell out.”

Photo

A Gucci coat for $11,950 at Bergdorf Goodman, where more customers have been willing to pay top dollar for luxury goods. Credit Deidre Schoo for The New York Times

The recent earnings reports of some luxury goods retailers and automobile companies show just how much the high-end shopper has been willing to spend again.

Tiffany’s first-quarter sales were up 20 percent to $761 million. Last week LVMH, which owns expensive brands like Louis Vuitton and Givenchy, reported sales growth in the first half of 2011 of 13 percent to 10.3 billion euros, or $14.9 billion. Also last week, PPR, home to Gucci, Yves Saint Laurent and other brands, said its luxury segment’s sales gained 23 percent in the first half. Profits are also up by double digits for many of these companies.

BMW this week said it more than doubled its quarterly profit from a year ago as sales rose 16.5 percent; Porsche said its first-half profit rose 59 percent; and Mercedes-Benz said July sales of its high-end S-Class sedans — some of which cost more than $200,000 — jumped nearly 14 percent in the United States.

The success luxury retailers are having in selling $250 Ermenegildo Zegna ties and $2,800 David Yurman pavé rings — the kind encircled with small precious stones — stands in stark contrast to the retailers who cater to more average Americans.

Apparel stores are holding near fire sales to get people to spend. Wal-Mart is selling smaller packages because some shoppers do not have enough cash on hand to afford multipacks of toilet paper. Retailers from Victoria’s Secret to the Children’s Place are nudging prices up by just pennies, worried they will lose customers if they do anything more.

Photo

While the free spending of the affluent may not be of much comfort to people who are out of jobs or out of cash, the rich may contribute disproportionately to the overall economic recovery.

“This group is key because the top 5 percent of income earners accounts for about one-third of spending, and the top 20 percent accounts for close to 60 percent of spending,” said Mark Zandi, chief economist of Moody’s Analytics. “That was key to why we suffered such a bad recession — their spending fell very sharply.”

Just a few years ago, luxury retailers were suffering. Too many items were chasing too few buyers, and high-end stores began cutting prices. As a result, consumers awaited 70 percent discounts rather than buying right away. Sales of luxury goods fell 17.9 percent in October 2008 from a year earlier, SpendingPulse said, and double-digit declines continued through May 2009.

Now, many stores are stocking up on luxury items, as shoppers flock to racks of expensive goods.

“They’re buying the special pieces, whether it’s the exotic leathers, the more fashion-forward pieces,” said Stephen I. Sadove, the chairman and chief executive of Saks Fifth Avenue. “There’s a dramatic decline in the amount of promotions in the luxury sector — we’re seeing higher levels of full-priced selling than we saw prerecession.”

Play Video | 2:21

For High-End Goods, a Recovery

Apparel stores are struggling to get customers to spend, even with sales and coupons. But luxury retailers are beginning to raise prices to pre-recession levels.

Video by Mac William Bishop on Publish Date August 3, 2011.

In 2008, for example, the most expensive Louboutin item that Saks sold was a $1,575 pair of suede boots. Now, it is a $2,495 pair of suede boots that are thigh-high. Crème de la Mer, the facial cream, cost $1,350 for 16 ounces at Bergdorf Goodman in 2008; it now costs $1,650.

“I think that she’s willing to pay whatever price the manufacturer and the retailer deem appropriate, if she sees that there’s intrinsic value in it,” Ms. Katz said.

Part of the demand is also driven by the snob factor: at luxury stores, higher prices are often considered a mark of quality.

“You just can’t buy a pair of shoes for less than $1,000 in some of the luxury brands, and some of the price points have gone to $2,000,” said Jyothi Rao, general manager for the women’s business at Gilt Groupe, a Web site that sells designer brands at a discount. “There’s absolutely a customer for it.”

Jennifer Margolin, a personal shopper in San Francisco, said she had noticed changes in clients’ attitudes. They “pay full price if they absolutely love it,” she said. “Before it was almost completely shying away, where now it’s like, ‘O.K. I’m comfortable getting a Goyard bag,’ but they get it for the quality.”

Goyard bags, in addition to having a distinctive pattern, will usually run a few thousand dollars. And, yes, they are selling out quickly.

Correction: August 5, 2011

A picture caption on Thursday with an article about a recent increase in the sale of luxury goods misidentified the brand of shoes that a shopper, Lissette Gutierrez, planned to try on at Bergdorf Goodman in Manhattan. The $1,495 shoes are Christian Louboutin, not Louis Vuitton. Also, because of an editing error, the article referred incorrectly at one point to the president and chief executive of Neiman Marcus Group, who commented on the trend in luxury goods. The executive, Karen W. Katz, is a woman.