S The Trader s Tribune Members Area Shorting Stocks

Post on: 16 Март, 2015 No Comment

Layman’s Guide to Shorting Stocks

One characteristic of a bear market is an inevitable renewal of interest in short selling. Short selling is the practice of borrowing stock from your broker and selling that stock with the hope that you can buy the same stock back (and return it to your broker) at a lower price. If you’re successful in your trade, you’ll keep the difference in price in the stock. In some ways, shorting is simply like buying a stock long, in reverse. There are, however, key differences between short sales and buying stock on the long side. I’ll attempt to cover most of those differences in this article.

The process of selling stock that you not own is called short selling or shorting. The process of buying that stock back (hopefully at a lower price) is called buying to cover or simply covering. The idea is to short high and cover low. In order to sell short, you must have a margin account with your broker. The reason for this is that a margin account enables you to borrow from your broker. Most people think of a margin account in terms of borrowing money from your broker, in order to buy more stock on the long side, but margin also permits you to borrow stock you do not own, in order to sell it and cover at a lower price. I do not know of any brokers who will allow you to short sell on a cash account.

The biggest difference between buying a stock long and selling it short is that shorting entails assuming (at least in theory) unlimited risk. When one buys a stock long, you already know the maximum amount of money that you can lose: 100% of your investment. When selling short, however, there is no limit on how much you can lose. The reason for this is because a stock’s price can (in theory) rise forever, whereas it can only fall so far. The unlimited risk aspect of shorting is overblown in my opinion. The reason I say this is that although in theory a stock can rise straight up forever, have you ever seen one that actually did? While it is important to understand the unlimited risk involved in shorting, from a practical point of view, its not as big a deal as it might seem.

The actual execution of a short sale is subject to a few special rules; developed to limit the effects of short sales in a panic sell off. Specifically, stocks shorted on the New York Stock Exchange are subject to the uptick rule. In layman’s terms, the uptick rule states that a short sale can only occur when the sale occurs at the same price as the previous sale in that stock, or on an uptick (i.e. a higher price). This prevents large professional short operators from simply overwhelming buyers and driving the stock lower in a panic. The NASDAQ has a similar rule that requires the short sale to occur at a price higher than the inside bid or simply the bid price.

The practical effect of these two rules is that it becomes difficult to short a stock which is declining rapidly. For this reason, one should never attempt to short sale a falling stock using a market order. Because of the uptick rule, the stock could drop a long way before your short order executes. By the time your short does execute, it’s likely that buyers are stepping in and in effect, you’d be shorting the bottom. The best way to avoid this scenario is to use a limit order, when shorting. Indeed, you may miss out on a move in a stock, but the limit order will save you from getting burned by the uptick rule. (Limit orders, for those who don’t know, will only execute the trade at the price which you designate. If the stock doesn’t reach that price, the trade doesn’t execute.)

Except in rare circumstances, shorting should only be done as a short term trade. The first reason for this, is that when you short a stock, you are betting against all the efforts and strategies of the CEO and management of the company you are shorting. It is their job to make the share price increase in value and you can bet they will do everything in their power to help that occur. If they don’t, they’ll lose their job and someone else will! The second reason for limiting short sales to short term only is that a short sale (unlike a long buy) delivers diminishing returns, the longer you hold it. To understand what I’m saying, let look at an example:

Let’s say I short 100 shares of XYZ at $50. If the stock falls 10% to $45, I’ve made 10% on my transaction. If I continue holding, the stock will need to fall another 11.1% (to $40) for me to make another 10% on my money. At this point, the stock will need to fall to $35 (or 12.5%) for me to make another 10% on my original investment. The further a stock falls, the less return the short sale generates relative to the daily percentage change in the share price.

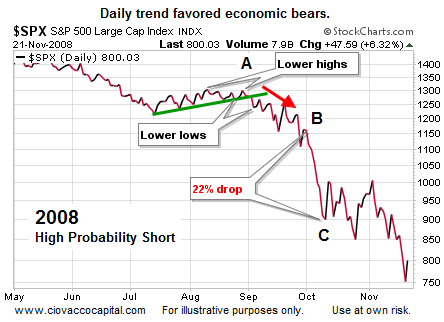

In a bearish market, selling short can be profitable and exciting. Stocks tend to drop faster than they rise, so a good short in a poor market climate can return a lot of money in a hurry. On the other hand, its very difficult to make money on the short side, if the overall market is bullish. Use short sales to take advantage of overbought securities and to hedge against downturns in the overall market. My rule on short selling is to get in, set your target and get out.