S&P Equity Research Showing Not All S&P 500 ETFs Alike Favors SPY

Post on: 21 Июль, 2015 No Comment

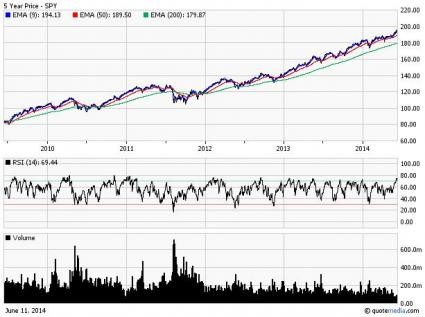

Overweight-rated SPY rose 32.9% in 12 months versus Marketweight-rated RSP’s rise of 38.1%

An analysis of S&P 500 exchange traded funds (ETFs) by Standard & Poors Equity Research shows that not all such funds are alike and that investors must look under the hood at each funds stock weightings before choosing an ETF for their portfolios.

In a comparison of the SPDR S&P 500 ETF (SPY) versus the Rydex S&P Equal Weight ETF (RSP), S&P Equity Analyst Todd Rosenbluth found that SPY had a relatively strong 12-month period as of June, rising 32.9%, but the ETF lagged RSP, which climbed 38.1%.

However, because RSP is constructed differently from SPY, giving equal weighting to all stock holdings in the S&P 500 versus SPYs more heavily weighted holdings in the biggest companies, S&P Equity Research favors SPY with an Overweight rating compared to RSPs lower Marketweight rating.

People tend to choose an ETF based on the cost and how well it matches the benchmark, Rosenbluth said in a phone interview on Tuesday. But we think people need to look under the hood and understand that the stocks that are actually in their ETFs are different from each other because the largest positions are not the same. If you think that the larger positions are undervalued and less risky, as we do, then SPY is a better option even though the Rydex ETF offers more diversification.

But Craig Callahan, president of ICON Advisers. a mutual fund company based in Greenwood Village, Colo. warns that market cap weighted indexes such as SPY are not for every investor.

Whenever you put together a portfolio or index thats market cap weighted, youve taken on a momentum strategy without knowing it, Callahan said.

With a momentum strategy, an investor is buying the stocks that are performing well and thus weighted moreand thats fine, but when you reach a peak, you go the other way and get clobbered, he said. Youre invested in what has been leading, so youre accumulating more and more of what was hot and less and less of what is leading.

Rosenbluths report, What Does Your S&P 500 Index ETF Really Own?, uses a quantitative modeling tool on S&Ps MarketScope Advisor to compare the performance of the two ETFs. SPY has the highest market capitalization of any ETF, at more than $90 billion. In comparison, the smaller RSP has a market capitalization of $3.4 billion.

Rosenbluth said S&P Equity Research does not endorse any particular S&P 500 ETF, and the group does not receive revenues from any ETFs tied to S&P 500 benchmark, although the broader S&P and parent company McGraw-Hill do.

Our quantitative model using MarketScope tells us one ETF is higher ranked than the other, he said. This is not my pick on what the best ETF is, this is the objective research performed by the model.

As of May, SPYs top-10 holdings, at 18.5% of assets, consisted of the most widely held companies, including GE, IBM and Exxon Mobil. These three stocks and six others within the top 10 are rated as Buy or Strong Buy by S&P Equity Research.

This ETF receives an overall Overweight ranking from S&P Equity Research, standing out compared to other ETFs we cover for its risk considerations and cost factors, wrote Rosenbluth of SPY.

Drilling down to individual names in the ETF, the MarketScope tool found that none of the 10 largest positions in SPY show up within the top 10 for RSP, and some of these are not exactly household names despite generating more than $1 billion or more in revenues, Rosenbluth wrote, pointing to Citrix Systems, Dean Foods and National Semiconductor.

While some of the stocks within the RSP top 10 have performed well in 2011, he noted, S&P Equity Research considers six of the holdings either fairly valued or overvalued.

Reprints Discuss this story