S&P 500 is a good benchmark

Post on: 18 Апрель, 2015 No Comment

S&P 500 is a good benchmark

Q: What should I compare the returns of my portfolio to so I can know if I’m doing well or not?

A: So your portfolio was up 10% last year, so what? The interesting thing about investing is that returns by themselves are meaningless. What’s important is how you’re performing versus the rest of the stock market.

The concept of relative performance doesn’t just pertain to investing. It’s something we’re all introduced to at a young age. On the playground, you may have been able to run a 9-minute mile. That’s fine, unless you were the slowest kid in the class and everyone else was running an 8-minute mile. Suddenly, your performance seems mediocre.

That’s precisely why investors need to put their market returns in perspective. Let’s say you meet someone at a cocktail party who brags about her investing prowess. This investor may say they’ve picked some risky stocks and earned 30% returns over the two past years. Yes, getting a 30% return is great, except for one problem. Investors who simply bought a small-cap value index fund at the beginning of 2003 and held on would have seen a 46% return in 2003 and a 22.3% return in 2004, according to Callan Associates. So, suddenly, the braggart’s returns don’t look so impressive.

And that’s why it’s important for investors to compare their stock market returns to an index to make sure they’re on track. But with hundreds of indexes to choose from, how do you decide which one to compare your returns with?

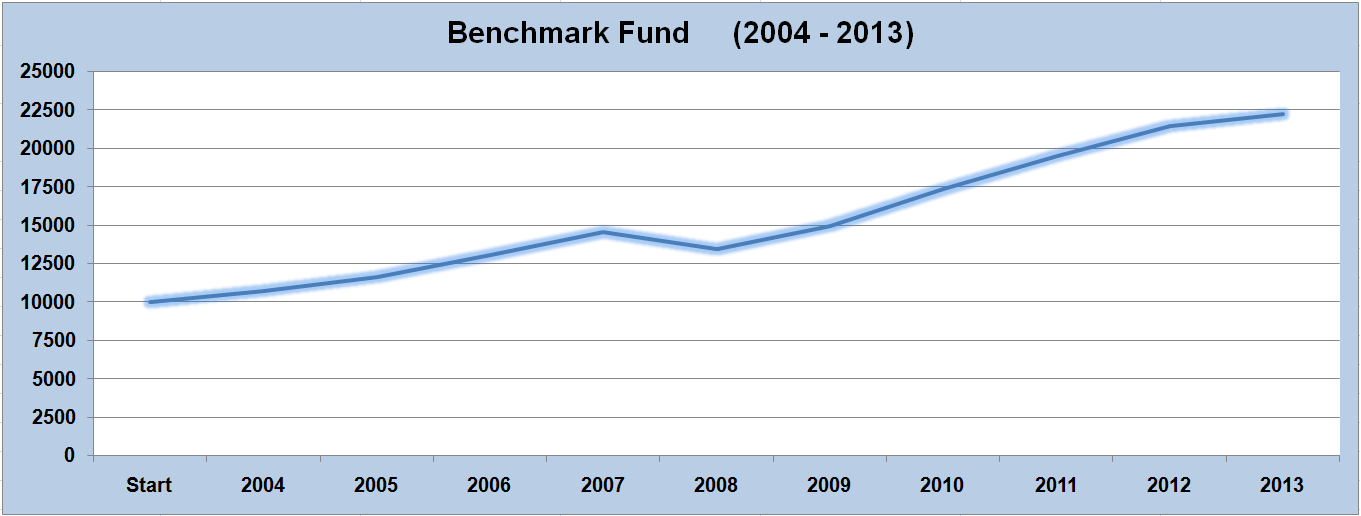

For the vast majority of investors, the best thing to do is to compare your portfolio against the Standard & Poor’s 500 index. Since most investors are invested in a diversified portfolio of large, small, value and growth stocks in many industries, the S&P 500 is a good benchmark. In addition, S&P does a good job making all sorts of data about the index available at sites such as www.spglobal.com. You can use the portfolio feature at USATODAY.com to help you measure your portfolio’s performance.

But, with that said, the S&P is not appropriate for all investors. If you have a large concentration of your portfolio in small stocks, you might want to compare your portfolio or a portion of it with the Russell 2000 index, which tracks small-cap stocks.

To help you decide what index is appropriate, you can find an actively managed mutual fund that is similar to your investment style. You can then look in that fund’s prospectus to see what it is using for a benchmark. But above all, make sure you’re comparing yourself to a close benchmark. Then, if you’re not keeping up with the benchmark, you’re falling behind, no matter what your absolute returns are.

Matt Krantz is a financial markets reporter at USA TODAY. He answers a different reader question every weekday in his Ask Matt column at money.usatoday.com. To submit a question, e-mail Matt at mkrantz@usatoday.com .