RSI Indicator Helps Traders Get on the Right Side of Major Market Moves

Post on: 8 Июль, 2015 No Comment

The Relative Strength Index (RSI) is among the most popular technical indicators. It is a price oscillator that is used to spot oversold and overbought markets.

Despite being called the Relative Strength Index, RSI does not provide any information on relative performance or relative strength. The formula uses data only from the stock, mutual fund, ETF or other investment being analyzed, while relative strength compares the investment being studied to other available investments.

To calculate the RSI indicator, the following formula is used:

RSI = 100 [100 / (1 + RS*)]

*Where RS = Average gain / Average loss

The default time frame used to calculate the averages is 14 days, but any time value can be used.

How Traders Use It

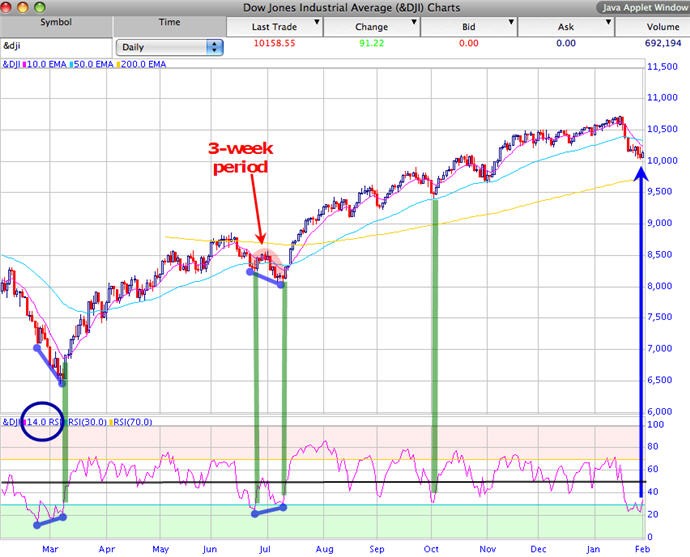

Traders use the Relative Strength Index to spot oversold market conditions when RSI falls below 30 and overbought market extremes when RSI is above 70.

Since markets can remain oversold or overbought for extended periods of time, it is usually best to wait for the indicator to reverse before entering a position. An example of this technique is shown below.

While many analysts look at the 14-day RSI, the 2-day RSI is often used by short-term traders. With this time frame, the overbought level could be as high as 95 and oversold markets will have an RSI reading below 5.

Short-term traders will buy or sell when the 2-day RSI hits those extremes rather than waiting for a reversal, for example, and exit the trade based on a predefined holding period of 5 days. This is a very aggressive strategy but can be successfully implemented by short-term traders.

RSI can also be used to spot divergences. If price reaches a new high while this technical indicator is moving lower, that is a sign of a possible price reversal. A small bearish divergence like that marked the top in silver in April 2011 (shown below). A bullish divergence occurs when RSI moves higher as prices reach new lows.

Why It Matters To Traders

When a technical indicator is popular, it can become market moving in the short term. If a large number of traders spot a divergence or an overbought/oversold signal in the RSI, a quick price move could follow.

RSI is a highly reliable technical indicator that usually delivers tradable results in backtesting with daily, weekly and monthly data on stocks, ETFs, and stock market indexes. By monitoring RSI, traders increase their odds of being on the right side of major market moves.