Roth IRA vs 401k

Post on: 7 Август, 2015 No Comment

Lately some of my readers have been emailing me questions about what the best path is to take when it comes to your retirement savings. Even though it would be nice to invest in as many different types of retirement funds as possible, sometimes our ability to save money is limited, and we have to make a choice about which one to use first. So while the homepage of IRA vs 401k Central lists all the pros and cons of each type of investment, some people just want to know – between a Roth IRA vs 401k, which one should I start off with in order to get the best return?

Fortunately there is a strategy to investing in BOTH that can get you the most bang for your buck.

A Roth IRA vs 401k Strategy – Start by Getting the Maximum Employer Contribution:

Employer contributions to your 401k plan are by far the biggest advantage when it comes to weighing a Roth IRA vs 401k plan. When your workplace is offering you free money as a way to encourage you to participate in their 401k plan, you take it! For example, my employer gives me 25% on top of whatever I contribute to my retirement fund. That’s like basically getting a 25% raise for doing absolutely nothing except saving my money.

My suggestion: Contribute to your 401k plan to get at least the maximum amount your employer is willing to pay out. For example: My employer matches a quarter for every dollar I invest up to 8% of my salary. Therefore, the minimum target I should try to hit is 8% so that I get every dollar of free money that I’m entitled to.

Because a Roth IRA (or even a traditional one) is something you setup yourself, it is extremely rare that any employer helps or makes contributions to this account. Basically whatever you invest is what you get.

Now granted we could get into the finer details and perhaps discover that the 401k plan they offer may have excessive fees or underperforming funds. However, I do believe that as things become more transparent with these plans we will see less and less of this kind of nonsense. For myself personally, the funds offered by my 401k are simply okay. Not too expensive but not really too cheap either. I keep things really simple and just go with mostly low-cost index funds that track the S&P 500. Not only is this the least expensive option, but it also gives me great confidence that I will at least be at average with the market status quo. If you look, I’m sure your 401k plan offers a similar type of fund.

Beyond the minimum amount needed to get your full employer 401k contribution, your next move should be to invest in a Roth IRA. Although it’s a lot smaller amount you can invest, there are a lot of reasons you should consider it:

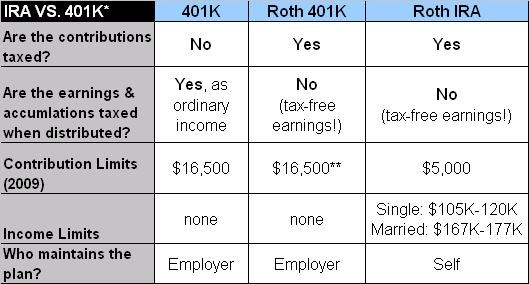

- Since you are taxed up front, you won’t have to pay taxes later on in life during retirement.

- You can select what kinds of investments you want to get into. They don’t necessarily have to be mutual funds. You could pick dividend stocks if you want.

- You can choose which financial institution to use and trust (Vanguard, Fidelity, Betterment, etc)

- You won’t have to take out Required Minimum Distributions during retirement like you will with a 401k at age 70-1/2. The money can stay in your account for as long as want. Not only is this great for your golden years, but this is also particularly nice if you’re thinking a really long time in advance and plan to will your fortune to your heirs .

There are only really two important caveats here:

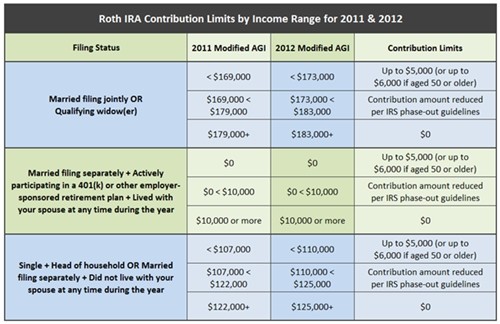

- You’ll need to figure out whether or not your taxable income exceeds the IRS limits . However, even that has a loop-hole. You always have the option to invest in a Traditional IRA and then convert it into a Roth IRA after a small waiting period.

- You should also think about your tax situation. If you plan to be richer during retirement than you are now, then paying taxes now would make sense. However, if you’re like the average American, then chances are that you’ll probably be making a lot less during retirement than you are now.

After you max out the Roth IRA, then you should be able to go back and make additional contributions to your 401k all the way up to the IRS limit of $17,500 for 2013.

Again, this will be a good thing for your money because you’ll be stashing it in a place where it will be allowed to grow tax-free until you decide to finally withdraw it. Most people don’t realize how quickly or how much a difference reaching the full 401k contribution can make.

Other Retirement Income Alternatives:

Although they may not carry as strong of tax advantages as a Roth IRA or 401k, there are plenty of other kinds of investments you can explore that will help you achieve your retirement goals in different ways. For example:

- A regular stock brokerage account could help you retire early because you would have access to the money without restriction.

- Real estate could help diversify your portfolio by serving as both an asset and something that generates income monthly.

- Annuities could help provide stable income to avoid the turbulence of the stock market.

Each method will have various pros and cons. Even if you don’t plan to use any of these exclusively, it would still be wise to know what other kinds of options are at your disposal.