Roth IRA Contribution v Fund Savings

Post on: 2 Июль, 2015 No Comment

Earlier this week I explored how the performance of money invested in a 401(k) should compare to a regular brokerage account. This brought to mind a different debate:

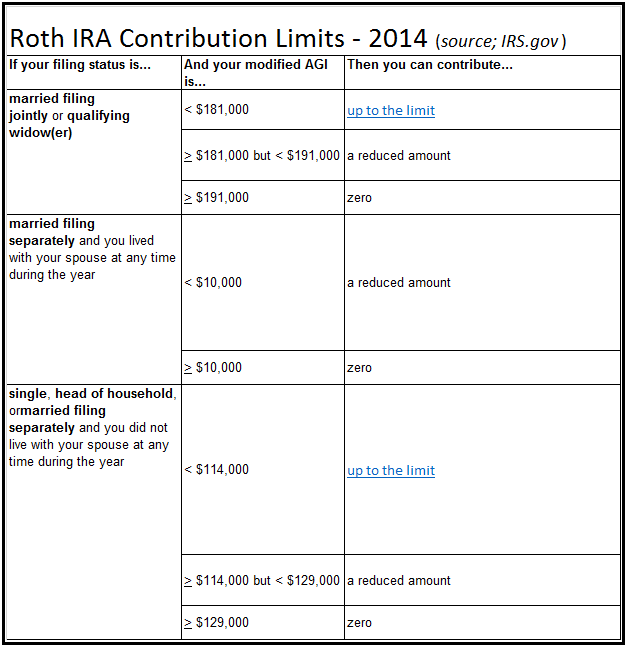

If you had to choose between contributing $4,000 to a Roth IRA or keeping/putting it towards your Emergency Fund, which would should you choose? Were assuming you dont have the funds to do both. Many people put Emergency Fund near the top of their priority lists. just below taking advantage of any free money 401(k) match, but above all other retirement accounts. This is because you dont want to have to dip into retirement accounts and face stiff penalties, or otherwise be faced with other forms of high interest debt like credit cards or personal loans if you need money urgently.

However, the annual $4,000 Roth IRA contribution limit is a use it or lose it proposition. You cant put nothing in this year, and then $8,000 the next. Once April 15th rolls around, youve missed out on potential tax advantages that may extend several decades (even to your heirs). This may be mitigated somewhat if you also have a Roth 401(k) or other similar account available.

I used to be in the Emergency Fund First camp, but now I think Ive changed my mind, mainly thanks to commenter Jbo. Heres my reasoning. Lets say you go ahead an contribute $4,000 to a Roth IRA but leave it invested in something safe like a money market fund. Many banks also allow you to open IRA accounts holding certificates of deposit. Now, there are basically two possible resulting scenarios after you do this:

You end up needing the money

No problem, you can always withdraw your Roth IRA contributions without any penalty. Just take out what you need (up to $4,000), and leave the rest in the account. Since its in a safe investment it wont have decreased in value due to stock market volatility. Youll still lose the tax advantages on any withdrawals, but youd have missed out anyways.

You dont need the money

More likely than not, you wont need all the money, and hopefully within a year or so your emergency fund will be replenished from other sources. Now, you can start really taking advantage of the Roth IRAs tax benefits and move to riskier investments.

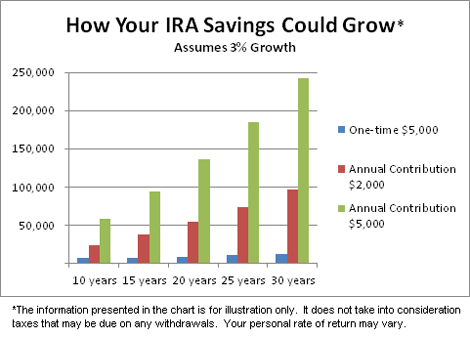

Using the same assumptions as before. a $4,000 post-tax Roth IRA contribution would theoretically end up being worth $40,251 after 30 years. If the $4,000 was placed in a taxable account, youd only end up with $32,834. Even if you assume inflation will run 3% a year, thats still $3,000 more in todays dollars that you made on your initial contribution of only $4,000 by putting it in a Roth.

Am I missing anything? It would seem like putting money in the Roth IRA is a pretty safe bet. The downside is very small, and the upside is very high. One key thing to remember is to keep the Roth IRA money in a safe investment while you are treating it as a emergency fund, as stocks have been known to drop as much as 40% in one year. You dont want to be having to sell your stocks to get cash after that happens!

- Make sure your current IRA is charging you as little in fees as possible. Visit Mint.com and their IRA wizard for a quick look into the best discount brokers offering IRAs.

Last updated: January 23, 2014