Roth IRA Contribution Limits for 2013

Post on: 16 Март, 2015 No Comment

Find out the maximum amount you can put in your Roth IRA in 2013

You can opt-out at any time.

Please refer to our privacy policy for contact information.

Ready to put more money into your Roth IRA? Better yet, are you ready to start putting money into a Roth IRA for the first time? You need to know your limits. And the maximum contribution limits for Roth IRAs increase in 2013. (If you are filing taxes in 2013, check out Roth IRA contribution limits for 2012.

Roth IRA Contribution Limits 2013

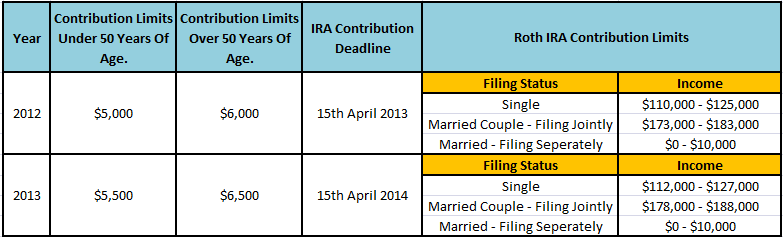

The maximum contribution limit is just that—the ceiling for annual Roth IRA contributions. The amount adjusts either each year or every other year with inflation. The Roth IRA contribution limit for 2013 is $5,500, a 10 percent increase from the 2012 limit of $5,000.

Roth IRA Catch-Up Contribution Limits 2013

If you are age 50 or older, you can put even more into your Roth IRA. How much more? In 2013, you can add $1,000 to your contribution amount. This catch-up contribution amount remains unchanged since 2012. What is a catch-up contribution? It’s the extra amount that the 50-plus set gets to put aside to catch up in the years before retirement. But you can use it even if you’ve saved throughout your career.

How a Roth IRA Works

If you don’t have a Roth IRA yet, you should know why it’s a great option for retirement savers and investors. Like a traditional IRA. contributions to a Roth IRA can be invested in a wide range of options, including stocks. bonds, mutual funds and even real estate. But traditional IRA contributions are rules for how Roth IRA withdrawals work .)

If you expect your tax rate to increase over time, a Roth IRA is a smart idea. You pay taxes on the money at today’s rate, and will not be taxed in the future when your income tax rate is likely to be higher.

Roth IRA Eligibility 2013

Not everyone is eligible for a Roth IRA. There are income limits. The amount you can contribute to a Roth IRA begins to phase-out for single or head of household taxpayers with adjusted gross incomes (AGI) between of $112,000 and $127,000 in 2013, up from $110,000 to $125,000 in 2012. That means you can contribute the full amount to a Roth IRA if your AGI is less than $112,000, and if your AGI is more than $127,000, you are ineligible. If you are a married couple filing jointly, the eligibility phases out for AGIs between $178,000 and $188,000 in 2013, up from $173,000 to $183,000 in 2012. So if you are a married couple filing jointly, you can make a full Roth IRA contribution if your AGI is less than $178,000. If your AGI is more than $188,000 you are ineligible to contribute to a Roth IRA in 2013.

2013 Contribution Limits for Other Types of IRAs

The contribution limits for traditional IRAs are the same as Roth IRAs: $5,500 in 2013, with a $1,000 catch-up contribution. Contribution limits for self-employed IRAs are slightly different. SIMPLE IRA contribution limits have risen to $12,000 in 2013, with catch-up contributions of $2,500. If you have a SEP IRA. your contributions work slightly differently. SEP IRA investors can put in up to 25% of gross income up to a maximum of $51,000 in 2013.

Why Make the Maximum Contribution to a Roth IRA in 2013?

For those who are able, contributing the maximum amount to your Roth IRA each year makes a lot of sense. Even if you already have a workplace 401(k) or a self-employed IRA, adding a Roth is a great way to boost your savings and help meet retirement goals. Particularly,as you near retirement. the goal is to save as much as you can, wherever you can. An added benefit of Roth IRAs is you may be able to withdraw contributions (but not investment growth ) from a Roth without penalty before retirement at 59 1/2.

So funnel some additional dollars into your Roth IRA in 2013. You’ll thank yourself later.

Disclosure: The content on this site is provided for information and discussion purposes only, and should not be the basis for your investment decisions. Under no circumstances does this information represent a recommendation to buy or sell securities.