Robo AdvisorsThe Pros and Cons

Post on: 16 Май, 2015 No Comment

T he first so called Robo Advisor I recall is Betterment. Several years ago I met its founder, Jon Stein, and recently interviewed him for the podcast. Since then Ive used or evaluated Motif Investing, Acorns, Wealth Front. Future Advisors, and JemStep. Ive also used extensively the free Financial Dashboard offered by Personal Capital.

It was with this background that I read the following emails from readers asking about two of these robo advisors, Betterment and Future Advisors:

I am still thoroughly enjoying your podcasts. I have a new question. I am currently using Betterment for my wifes and my Roth IRA. I have been maxing our Roths for years, but just started with the TSP this year. After looking into it, the TSPs expense ratios are incredibly low. If I am looking at it correctly, it is 2.9 basis points (0.029%). Thats starting to make me think that I shouldnt even contribute to our Roth IRAs anymore, and just put all the money into the TSP (they have Roth options as well).

Thinking about this has got me thinking about Betterment. How is using Betterment any different than using a paid for advisor that makes all my investment decisions? Actually, with Betterment, I have less choices than if I paid an advisor. Obviously, the cost is the biggest difference. But after that, Im wondering if I am giving up too much of my decision making power by using Betterment. I dont think theres any way to know that their selection of EFTs are better than me using a strict S&P index fund mixed with a government bond fund to make my asset allocation where I want it.

Do you have any thoughts on this? Thanks again for everything.

My question is regarding Future Advisor – what’s your take and opinion on it? To give you a little background, I use mint.com. but mint for some technical reason does not sync with my 401k through Paychex. As I was reading through the comments on mint’s site of people asking why isn’t it fixed yet (it’s been ongoing problem for few years now) – some commenters mentioned FA – which does include Paychex into the overview. So to get a whole view, I also ended up signing up for the basic account (free). It’s great to see my overall financial profile including the 401k.

However, FA also has a list chock-full of suggestions to make my portfolio better, stronger, more growth in the future, etc. It recommends selling off a bunch of stocks/bonds/etc (including the funds in my vanguard roth ira, and some of the Betterment allocations.) I’m confused as I know how everyone is riding the Betterment train (including myself) — however it did get me wondering what if… Do you have any experience with FA, or comparisons/contrasts to Betterment or other popular financial services as such?

Both Ace and Ursula ask some good questions. To respond to them, we are going to look at two things. First, in this article and the related podcast, well put robo-advisors into context and talk about some factors one should consider before using one. Second, in a follow up post, well compare some of the more popular robo-advisors and identify the pros and cons of each.

5 Things Investors Do (and that Robo Advisors can do for us)

The typical investor does (or should do) five basic tasks:

1. Develop an asset allocation plan. As we covered in Podcast 25. investors should develop an asset allocation plan. Our asset allocation plan is the map the shows us the direction of our investing. Without a plan, picking specific investments (mutual funds, ETFs, stocks, bonds) is like Ready, Fire, Aim.

2. Choose mutual funds and ETFs to execute on the plan. Once the plan is in place, the second task is to select the investments to execute on the plan. For some the focus is on low cost index funds. Others invest in actively managed funds, individual stocks, or a combination. Regardless, investments are selected in line with the asset allocation plan. We looked at how to evaluate mutual funds in Podcast 26 .

3. Invest in the funds and ETFs we’ve picked. The third task is to invest in the funds weve selected. While at first glance this may seem no different than selecting the investments, the purchase of these investments presents some unique challenges. For example, we ned to consider the investment options in a 401k, decide what types of accounts (traditional retirement, Roth, taxable) should hold each investment, and how much we are going to invest.

4. Rebalance (including dividend reinvestment). As the value of our investments change, we need to periodically rebalance our investments. Rebalancing insures that our investments stay in line with our asset allocation plan. We covered rebalancing in Podcast 51 and Podcast 52 .

5. Focus on Tax Efficiency. Finally, we need to consider tax strategies. This includes tax loss harvesting on taxable accounts, as well as tax gain harvesting as described in an excellent article by Michael Kitces.

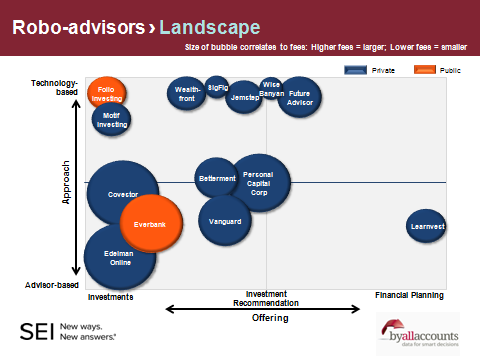

Ive walked through these steps because it helps break down how a robo advisor can help investors. For example, some robo advisors help in all of these areas, while others offer more limited help.

Two quick examples will help explain this:

1. Betterment —One of the more popular options, Betterment does it all. Investors select how much they want in stocks and how much in bonds, and Betterment does the rest. Theres no middle-of-the-road option here. This is a great option for those looking for complete help with investing. But what about those that just want some help with an asset allocation plan and selecting investments?

2. Future Advisor —While they can do it all too, just like Betterment, Future Advisor also offers a free tool to help investors with their asset allocation plan and selecting investments.

Target Date Retirement Funds

Understanding the roles a robo advisor can play also helps put them into the proper perspective. In some respects, robo advisors are just snazzier forms of target date retirement funds. These fund of funds as they are sometimes called handle many of the tasks listed above.

Target date funds take care of the asset allocation plan (the investor simply picks the fund matching his or her retirement date). The funds take care of the investing, rebalancing, and dividend reinvestment.

This raises a big question—why bother with a robo advisor?

Its an important question to consider. For many, a robo advisor may not offer distinct advantages of a target date fund. But there are several things to consider:

1. Robo advisors may be cheaper than many target date funds.

2. Robo advisors have created websites that often do a better job at educating investors.

3. Robo Advisors may offer more flexibility. For example, an investor can decide how much he or she wants to invest in stocks with Betterment. With target date funds, the options are typically more limited.

4. Some robo advisors will work with your existing investments.

Factors to Consider in Picking a Robo Advisor

For those considering a robo advisor, there are several factors to think about.

1. What do you want it to do?

As noted above, these automated investment tools have different approaches. Personal Capital is excellent for those wanting an automated way to monitor all of their investments in one place. Betterment and WealthFront are excellent tools if you want to turn your investments, including the asset allocation plan, over to their service. Future Advisor and JemStep are great options for those either looking for help with just the asset allocation, or those who want help in all areas of investing but with a little more control.

The key is to know how you want these services to help you.

2. Cost. Always an important consideration with investing, costs are equally important with robo advisors. The typical cost is 15 to 50 basis points. In some cases, the cost will depend on the size of the account.

3. Retirement vs. Taxable Accounts. These services have introduced sophisticated tax loss harvesting tools. One key consideration is the size of the account. Most offer these tools to accounts with a minimum balance.

4. Existing taxable accounts to transfer. Some services enable you to transfer investments in kind, rather than liquidating the investment first. While this isnt an important consideration with retirement accounts, with taxable accounts its critical. Transferring investments in kind avoids potential tax liability.

5. Human advisor. With the exception of Personal Capital, most robo advisors do not include investment advisors. The idea is that computers do the investing for you, thus reducing the cost. If you want an investment advisor, most of these options wont meet your needs.

My take

My take on the robo advisor craze is three-fold:

1. Im ready to off-load much of the work of investing. Ive been a DIY investor for than 20 years, and I can certainly continue doing what Ive done in the past. But its tedious. Id be happy never to rebalance a portfolio by hand again. But.

2. These services cannot help me with all of my investments. I cant move my 401k, for example, to Wealth Front or Betterment. So while I could use their services for some accounts, Id still be forced to do the work for a significant portion of my portfolio. This in turn defeats the purpose of the robo advisor in the first place.

3. Finally, my taxable accounts have significant gains. Its a result of my long-term buy and hold strategy. That limits, however, my options. I would never transfer these assets to Betterment, for example, because Id incur significant taxes.