Risks And Rewards Of Margin Investing (AAPL)

Post on: 29 Июнь, 2015 No Comment

What if you see a great-looking investing opportunity, but don’t have the money to put in? It is possible to borrow the money to make the investment – a practice called investing on margin. As the saying goes: buyer (and borrower) beware.

Ordinarily, most people borrow big sums to invest in their homes. In that case, the home is the collateral on the loan. As long as the payments are made, the homeowner gets to stay and the loan amount drops. Meanwhile, if the value of the property rises quickly enough, the investment will grow, though most of the time homeowners break even at best.

Investing on margin works in a similar way, except here the collateral is the stock or other securities that you buy. (For more, see: An Introduction to Margin Trading .)

Buying on margin has something of a bad reputation. In the 1920s, the practice was a factor in the stock market crash as margin calls came in and triggered a massive sell-off.

How It Works

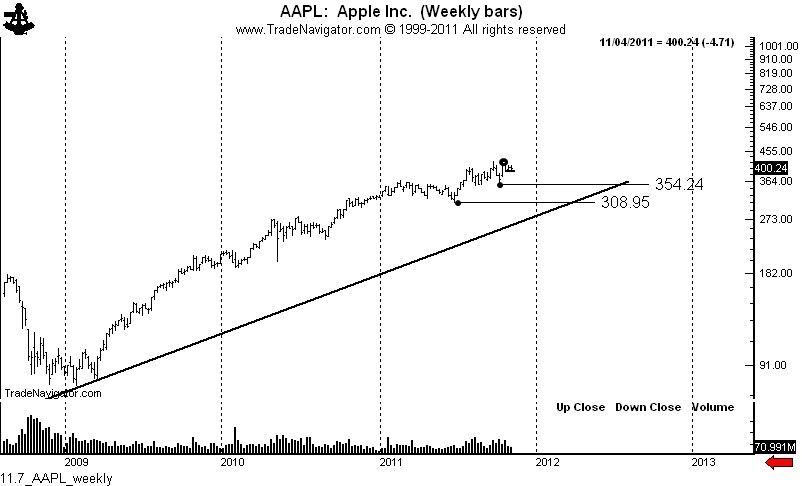

So how does it work? An investor might want to buy 150 shares of Apple Inc. (AAPL ), because he or she thinks the share price will rise. They don’t have the money to buy the 150 shares, which are $100 each. So the investor puts up $10,000, enough for 100 shares. The brokerage loans the other $5,000 with the shares themselves being the collateral.

The amount loaned is usually based on the initial margin requirement, which itself is a percentage of the invested amount ($10,000 in this case) that a brokerage wants the investor to have as equity – basically shares or cash that can be sold to cover the loan. Brokerage houses’ requirements will differ, but generally it starts at 50%. It might be slightly more for first-time customers.

In this example the broker’s requirement is 50%, so the amount loaned is a maximum of $5,000. If the requirement were 60%, that would cut the biggest possible loan down to $4,000 (100% — 60%) x (invested amount). (For more, see: 7 Investing Mistakes and How to Avoid Them .)

Brokers will also have what’s called a maintenance requirement. which is how much has to be in equity to prevent the shares from being sold to cover the loan while the investor waits to see if their bet is a good one. That means the stock bought on margin can go down, but only so much before the brokerage starts demanding money or securities to cover that debt. Maintenance requirements vary, but are generally 30-40% of the amount borrowed.

Loading the player.

So if the Apple shares mentioned above rise to $120, the investor might want to sell them and take the profit, since the shares are now worth $18,000. They would get $13,000 total, because $5,000 was put up by the brokerage house and it has to be paid back. In reality there would be some interest as well. Absent the margin trading, the profit would only have been $2,000 or 20% on a $10,000 investment. (For more, see: Find Your Margin Investing Sweet Spot .)

Margin Calls

But in the opposite scenario, if Apple were to fall to $50, the total value of the shares is now $9,000. That leaves the broker with a $5,000 outstanding loan covered by shares that are worth much less. To remedy that, the brokerage will ask the investor for more money — in this case, $2,500 — or it will sell the shares. This is known a margin call. If the investor can’t come up with the money or securities in 24 hours everything is sold to cover the loan and pay the investor back at a loss. The investor would lose $5,000 owed to the brokerage plus the shares, and would be left with $4,000. The total loss: $6,000 plus whatever interest was charged on the margin loan. Had this same investor simply bought the 100 Apple shares and sold immediately when the price hit the $50 mark (not a good strategy in any case) the losses would have been limited to $5,000. (For more, see: The Dreaded Margin Call .)

How To Equate

If you want to know the price at which you’re going to get margin calls, a useful equation to remember is:

Price at which margin calls come in = (price of shares when bought) x (1-initial margin requirement) / (1-maintenance margin requirement).

This sounds complex but it really isn’t. In the above example we assume the brokerage has a 30% maintenance requirement. In this case, the $100 shares would be multiplied by (0.5) / (0.7) or 0.7142, so the price at which margin calls would come in is $71.42.

Investing on margin has to be assessed in terms of how much one can afford to lose, just like other equity investing. The added twist is that it’s borrowed money, and there are fewer options to wait and hope a stock recovers if it suffers a slump. Having some cash socked away or other stocks can help if a margin call comes in. A quick sale would allow you to keep the margin-bought shares. (For more, see: Finding Your Margin Investment Sweet Spot .)

The Bottom Line

Margin investing can boost your profits if the bets are good. If not, it can crank up losses and cost you your shirt. For most investors buying on margin is a risky business and probably shouldn’t be done without some kind of mitigation strategy in place, such as a stop loss. (For more, see: The Stop-Loss Order: Make Sure You Use It .)