Risk Return and Low Beta Stocks

Post on: 16 Март, 2015 No Comment

My article in last weeks Advisor Perspectives titled, The Greatest Anomaly in Finance: Understanding and Exploiting the Outperformance of Low-Beta Stocks , explores what the findings of a 2011 paper published in the Financial Analysts Journal called the greatest anomaly in finance. The issue at hand is one that I have written about in a number of articles including Why Low Beta Strategies are Worth Another Look, and one that Id like to explore further in todays blog post.

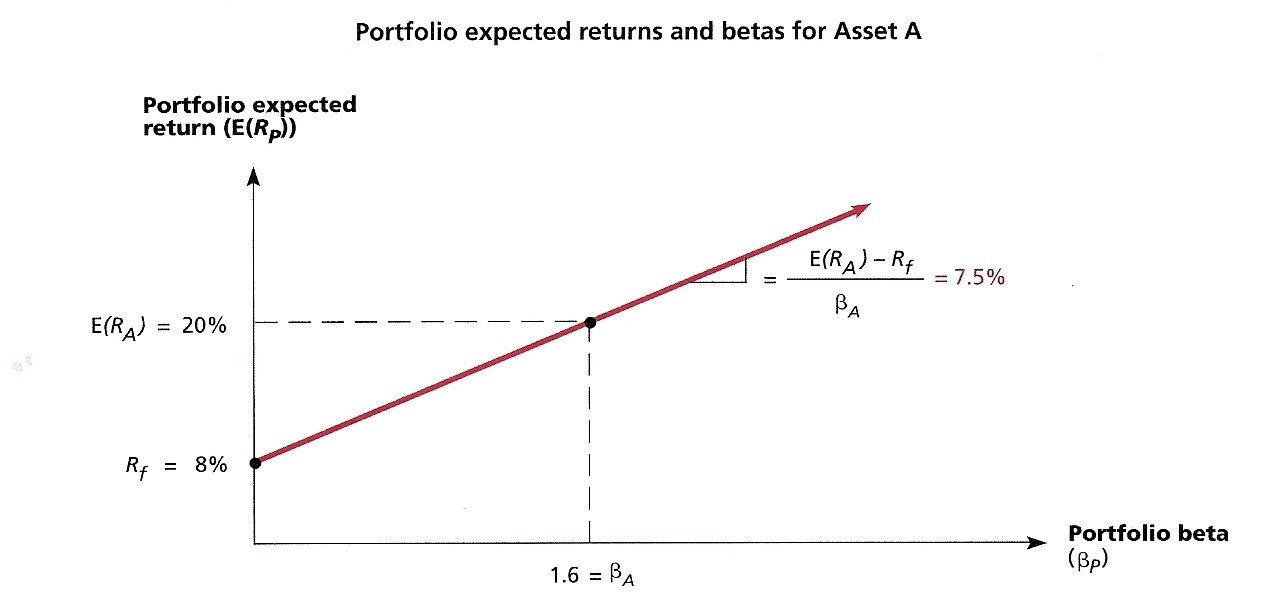

Financial theory suggests that risk and return go hand-in-hand. While higher-return assets do tend to be riskier than lower-return assets, there is a notable exception. If we look at all stocks available in the market and sort these on the basis of their historical volatility levels, lower-volatility stocks have generated higher returns than higher-volatility stocks. If we sort using beta, (a standard proxy for risk) rather than volatility, the low-beta stocks have historically generated substantially higher returns than their high-beta counterparts. The outperformance provided by selectively building a portfolio out of low-beta/low-volatility stocks is on the order of 2.0% per year, as compared to buying a portfolio in a market-cap weighted index such as the S&P 500 Index. Financial theory suggests that such a situation cannot exist for any appreciable period, but the authors of this study find that this effect has held up consistently over more than four decades. This study suggests that low-beta/low-volatility stocks will continue to outperform in the future. In addition, portfolios of low-beta/low volatility stocks exhibit markedly less sensitivity to swings in the stock market as a whole.

We have all been taught that to have a portfolio with a high expected return, you must take on high risk. This idea is intuitive. In a rational world, investors will own risky investments only because they expect that the payoff from risky investments will be higher than what they can achieve with a no-risk investment. Indeed, the idea that risk and return have a strong relationship is true if we look at long historical periods for a range of asset classes. In their research. the authors of the Financial Analysts Journal article show the average return and average annualized volatility for a series of asset classes over a 41-year period (see chart below).

This chart shows what we expect to see:

- Long-term government bonds have a higher risk and return than short-term government bonds.

- Small company stocks have higher risk and higher return than large company stocks.

- Stocks have higher risk and return than bonds.

It is also notable that the relationship between risk and return over this 41-year period is remarkably close to a straight line and that there is a linear relationship in which risk and return increase proportionally.

There are, of course, a couple of features of this chart that are clearly not consistent with the current state of the markets. Most notable: The historical annual return of short-term government bonds over this period is 5.7%. Today, bond yields are near historic lowsand there is literally no way that short-term bonds can generate this high a level of return going forward. In addition, the prevailing opinion is that a large-cap stock index like the S&P 500 Index is not likely to come anywhere close to the 10% annual return seen in this historical period.

Even though risk and return have a proportional relationship when we look across asset classes, the great anomaly here is that lower-risk stocks have higher returns than higher-risk stocks. The authors of the academic study that demonstrates this effect have proposed an interesting mechanism to explain why this anomaly persists.

The Great Anomaly

Fund managers are often judged based on the level of tracking error that their funds exhibit relative to some benchmark. The S&P 500 Index is a common benchmark for domestic equity funds and the MSCI EAFE Index is a common benchmark for international stock funds. Tracking error is a statistical measure of how far the returns from a fund vary around the benchmark. Low-beta and low-volatility stocks tend to increase tracking error, so that even if a fund manager has a fairly strong belief that low-beta and low-volatility stocks are under-valued, he or she is quite likely to not add allocations to their portfolio.

I have explored the issue of low-beta/low-volatility stocks using Monte Carlo simulations. In a Monte Carlo simulation, you generate thousands of simulated future returns on individual assets (stocks, indexes, funds) and you also account for the relationships (or correlations) between these assets. The chart below shows the simulated long-term relationship between risk and return for a series of asset classes:

The Monte Carlo simulation used three years of historical data through January 2012 as its only input, but the projected relationship between risk and return across asset classes is remarkably similar to the 41-year history shown in the previous chart. The major difference here is that the average returns are uniformly lower for all asset classes. Short-term government bonds are projected to return 1.7% per year, far less than the 5.7% return over the 41-year history.

When I create portfolios of low-beta/low-volatility stocks in the Monte Carlo simulations, projected returns are higher than those for a portfolio built out of stocks weighted on the basis of market capitalization, which is consistent with the research study in the Financial Analysts Journal. It is notable, however, that I do not assume that low-beta/low-volatility stocks are undervalued. These stocks’ future returns are simulated with a risk/return relationship that is the same as for all other securities. The benefit of a low-beta portfolio arises from the low correlation between these stocks. Low-beta stocks have low correlation to the broader market (beta is closely related to correlation). Stocks with a low correlation to a common benchmark also have a low correlation to each other. The low correlations between these stocks reduce risk in the portfolio, without reducing average returns. The end result? A portfolio with a higher expected return for the total portfolio risk. This is a different mechanism than the one proposed in the Financial Analysts Journal. but the magnitude of the benefit in my Monte Carlo analysis is generally consistent with the journals results.

What’s the Punch Line?

A range of research over the years has found that portfolios made up of low-beta / low-volatility stocks generate higher returns than standard financial theory would suggest.

The 2011 paper in the Financial Analysts Journal that is the basis of my recent Advisor Perspectives article, adds additional weight to the historical evidence for this anomaly, as well as proposing an interesting new mechanism to explain why this effect persists. It would not surprise readers if low-beta/low-volatility stocks had out outperformed over recent years, because investors have become increasingly risk-adverse. During this same time period, bonds have also outperformed stocks substantially. The historical period over which this effect is documented in the Financial Analysts Journal paper is, by contrast, one in which higher-risk assets out performed, on average.

Far more investors are aware of the ‘value’ and ‘size’ anomalies made famous by Eugene Fama and Kenneth French, but the low-beta/ low-volatility anomaly is as impressive in its historical performance. While we cannot be certain of the mechanism by which this anomaly gains its advantage, there are a number of plausible explanations. Regardless of the mechanism, however, adding a low-beta tilt to an equity portfolio appears to provide some performance benefits while also reducing the exposure of the portfolio to big swings in the broader market.

Folio Investing offers a Defensive Strategy Folio thats designed using low beta principles. The Folio was launched in February 2008 and now has four years of performance history. In our original research conducted in 2007, we projected that this portfolio would outperform the S&P 500 Index with less risk. Over the four years since its launch, the Defensive Strategy Folio has returned 6% in average return with 22.7% in annualized volatility vs. the S&P 500 Index which returned 1.8% on average with 28.5% annualized volatility. To learn more about the Defensive Strategy Folio, visit Folio Investing .

Related Links:

(Disclosure: Investments in Exchange Traded Funds (ETFs) and Folios are subject to investment risk including the loss of the principal amount invested. Investors should consider the investment objectives and risks of ETFs and Folios as well as the fees and charges associated with them before investing. The prospectus of an ETF contains this and other information about the ETF. For more information regarding the Folio referenced in this article, please visit Folio Investing. Past performance does not guarantee future results. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.)

Folio Investing The brokerage with a better way. Securities products and services offered through FOLIOfn Investments, Inc. Member FINRA/SIPC.