Risk Neutral Pricing of Derivatives Risk Learn

Post on: 16 Март, 2015 No Comment

Risk Neutral Pricing Introduction

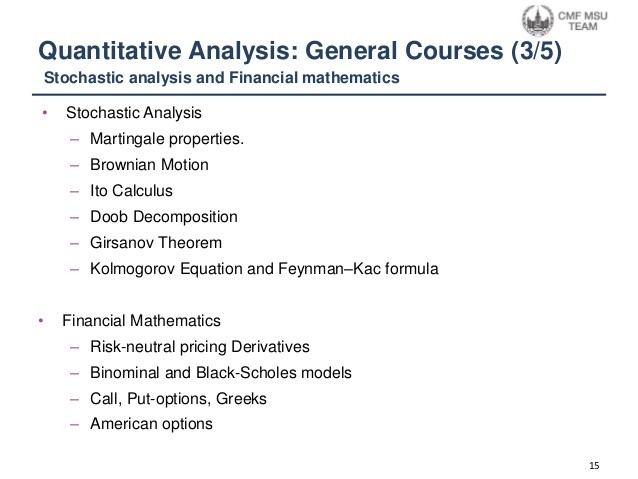

Our focus will shift to option pricing over the course of the next few articles, starting with risk neutral pricing in this first article. Risk neutral pricing is a very important concept to understand and is a fundamental building block in the overall knowledge needed for derivatives pricing. Risk Neutral pricing is a complicated topic and our aim is to present the main points in an easy to understand way for students that are new to the subject. We will look at the overall topic of option pricing in the following order in a series of articles:

- Risk Neutral Pricing of Derivatives

- Portfolio replication / No arbitrage pricing

- Binomial Option Pricing

- Black-Scholes

Clearly this will assume that the reader has some prior knowledge of derivatives, mainly pertaining to the basics of definition and some idea of their uses. If the reader is unfamiliar with these concepts we would recommend a quick refresher on the basics before carrying on with the current series of articles and videos. These articles aim to try and provide a grounding in these core concepts which are very important for any student of derivatives pricing. Their very nature makes them complicated to understand, but we will try to keep them as simple as possible. We will also aim to provide spreadsheets wherever possible as examples are one of the best ways to learn in our opinion (a spreadsheet with risk neutral pricing examples is attached at the end of this article). The articles follow a logical step going through each of the building blocks leading up to gaining a good understanding of the basis of derivatives pricing, beginning with risk neutral pricing.

Risk Neutral Pricing Background

One of the key concepts that students in finance come across is the CAPM theory and the relationship between risk and reward. One of the key tenets is that investors will demand more reward for the greater risk that they bear on riskier assets this being the risk premium. This picture is further complicated when you introduce the idea that there are investors with different risk appetites risk averse, risk neutral or risk loving.

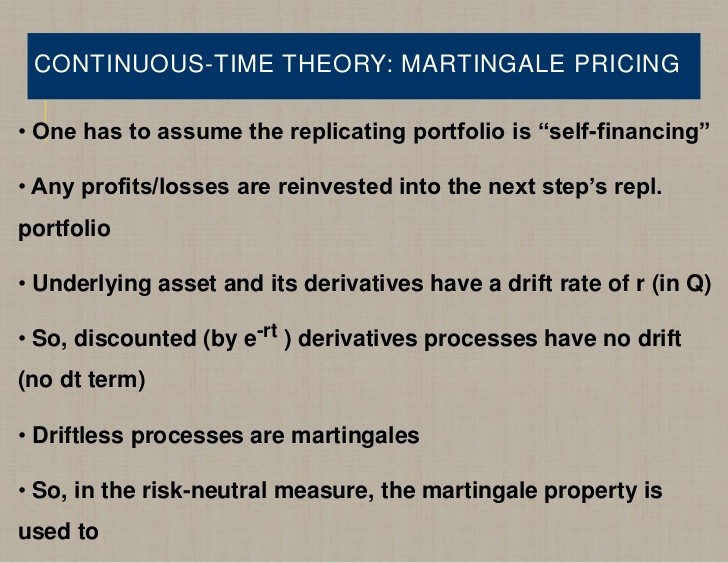

You can imagine that in the world we have described above with multiple expectations and risk profiles we would have a tough time pricing assets. This is where risk neutral pricing comes in. The very simple intuition here for derivatives pricing is that risk can be eliminated by dynamic hedging in a situation where there is no arbitrage possible. Once risk is eliminated in this way the expected return becomes equal to the the risk free rate for all investors. Now we have a consistent method to price derivatives assets can be assumed to grow at the risk free and also discounted at the risk free rate. This approach was first proposed by Cox, Ross and Rubinstein and this was pretty much one of the most important advances in derivatives pricing after the Black-Scholes. This approach opened up Binomial Tree pricing and other numerical methods such as Monte Carlo. This in turn led to the development of more complex and exotic derivatives structures.

Risk Neutral Pricing Replicating a portfolio

Within the context of risk neutral pricing let us now look at an example of portfolio replication. We have a stock which is trading at $100. In six months it can be either at $110 or at $90. A 6-month call option struck at $105 would have two outcomes:

- If shares go to $110, then call is at $5

- if shares go to $90 then call is worth 0

This is shown in the diagram below :

We can now set up a portfolio to replicate the payoff given that we know no arbitrage is possible and the portfolio must earn the risk free rate. We now need to work out the delta, Δ, of the shares that we must hold. The potential value of the shares and option are as follows:

- 110Δ 5 (from being short a call option)

- 90Δ

therefore :

- 110Δ 5 = 90Δ

- Δ = 0.25

Which means that our riskless portfolio is :

- Long 0.25 shares

- Short 1 call

Whatever happens to the stock price this portfolio has the same value :

- 110 * 0.25 5 = 22.5

- 90 * 0.25 = 22.5

Next we also know that given the portfolio will have a value of 22.5 in 6 months time, the value today must be 22.5 discounted at the risk free rate. If we assume that the risk free rate is 5%, then the value would be :

22.5e -0.05*0.5 = 21.94

Next we know the portfolio today is (f is option value):

100 * 0.25 f = 25 f = 21.94

hence f = 3.06

We can see that in a risk neutral pricing framework we have worked out the value of the option as 3.06 in a risk free context.