Risk Management Is Essential In Cfd Trading Forex Success Traders

Post on: 27 Апрель, 2015 No Comment

CFD trading allows small investors to make big money without putting too much at stake. Those who are interested in entering the stock market but don’t have sufficient money to trade in shares can instead trade in contract for Difference or CFD. In this system the investor doesn’t have to pay the entire cost of the share but only a small percentage of it.

Learn About Risks Involved

CFD trading is an attractive prospect because even those who don’t have the extra money to earn from shares can benefit from the rise in share prices. If the value of stocks rise, the value of contract for difference also rises as it depends on the percentage of profit made by shares. However, it’s important to learn well about this kind of trading because it involves all the risks of the share market. In case the cost of a companys shares falls then the CFD value will also fall. If the drop in the share price is the same percentage as the cost of the contract for difference of the concerned share then the latter can result in 100% loss for the small investor. it’s important to learn about the market and how CFD trading takes place before one plans to invest in this area. Risk management is essential to trade safely and make the most profit from this market. it’s a good idea to open an account with a company which is involved in buying and selling contract for difference of shares. Most companies have their website where they allow their clients to open an online account. Though investors can trade directly through their bank account it requires a lot of time and a good knowledge of the market.

Trade Through A Separate Account

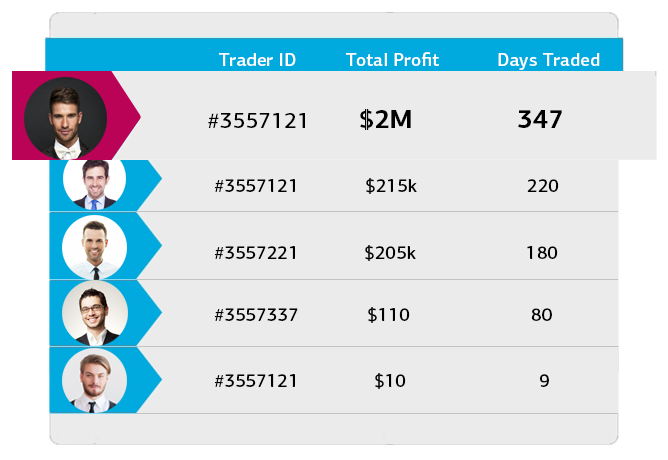

Companies involved in buying and selling CFDs employ financial experts who watch the market and monitor the companies whose shares are performing well. They also advise their investors to carry out CFD trading before the cost of the concerned shares rise too much and go beyond the means of the client. Every client has his own identity number and only the account holder can do the actual buying and selling as per the advice of the consultants. At the suitable time the advisors call up the client at his contact number and tell him the code to carry out the trading. At regular intervals the company also sends details of the clients CFD trading account status by email. it’s important to follow some essential rules while buying and selling CFDs so that the client never runs into huge losses. The most essential part is to open an account with the amount of money that the investor can afford to spare. Sometimes investors make the mistake of spending too much from their own pocket which is difficult to keep an account of. Especially those investors who want to trade directly through their bank account need to be extra careful.

Ideally one should trade under the guidance of companies which have experts who understand the volatility of the market and can accurately predict the financial future. Only after the investor starts making profits can he also increase the capital in his account. By taking necessary precautions one can use CFD Trading to increase his finances.

To make good profit from CFD trading open a separate account with spare finances to buy and sell CFDs and also keep a watch on the CFD market.