Risk financial definition of risk

Post on: 29 Март, 2015 No Comment

Risk

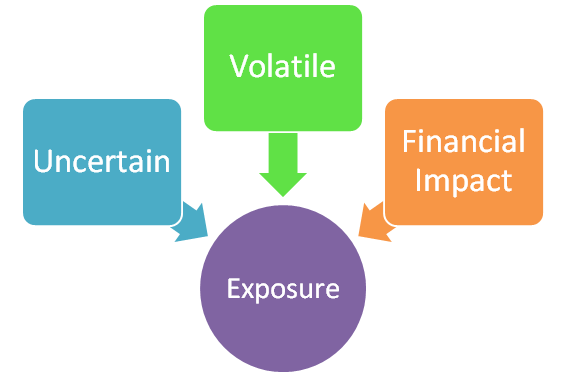

The uncertainty associated with any investment. That is, risk is the possibility that the actual return on an investment will be different from its expected return. A vitally important concept in finance is the idea that an investment that carries a higher risk has the potential of a higher return. For example, a zero-risk investment, such as a U.S. Treasury security. has a low rate of return. while a stock in a start-up has the potential to make an investor very wealthy. but also the potential to lose one’s entire investment. Certain types of risk are easier to quantify than others. To the extent that risk is quantifiable, it is generally calculated as the standard deviation on an investment’s average return.

risk

The variability of returns from an investment. The greater the variability (in dividend fluctuation or security price, for example), the greater the risk. Because investors are generally averse to risk, investments with greater inherent risk must promise higher expected yields.

Risk.

Risk is the possibility you’ll lose money if an investment you make provides a disappointing return. All investments carry a certain level of risk, since investment return is not guaranteed.

According to modern investment theory, the greater the risk you take in making an investment, the greater your return has the potential to be if the investment succeeds.

For example, investing in a startup company carries substantial risk, since there is no guarantee that it will be profitable. But if it is, you’re in a position to realize a greater gain than if you had invested a similar amount in an already established company.

As a rule of thumb, if you are unwilling to take at least some investment risk, you are likely to limit your investment return.

risk

Uncertainty regarding the possibility of loss.

Risk

What Does Risk Mean?

The chance that an investment’s actual return will be different from the expected return, including the ultimate risk of losing all of one’s original investment. Risk usually is measured by calculating the standard deviation of the historical returns or average returns of a specific investment.

Investopedia explains Risk

A fundamental premise of investing is the risk-reward trade-off. The greater the amount of risk an investor is willing to take on, the greater the potential return. The reason for this is that investors need to be compensated for taking on additional risk. For example, a U.S. Treasury bond is considered to be one of the safest investments and therefore provides low potential returns. Stocks are riskier; they offer no guarantee and thus can yield higher returns. After all, the U.S. government is unlikely to go out of business, whereas many companies fail every day. In the end, investors should expect to be rewarded for taking on additional risk.