Risk and Reward

Post on: 29 Июнь, 2015 No Comment

Submitted by admin on Thu, 11/18/2010 — 12:17

Upswings in the market are pretty good, no doubt about it! But sticking with your long-term investment strategy when the markets are performing poorly is easier said than done. That’s why it’s important to keep things in perspective and determine how much risk you’re willing to take.

Based on the chart Investment returns 1926-2009. you can see the average annual returns for stocks, bonds and short-term reserves. Different types of investments come with different risks and rewards.

Source: The Vanguard Group.

The performance data shown represents past performance, which is not a guarantee of future results. When determining which index to use and for what period, we selected the index that we deemed to fairly represent the characteristics of the referenced market, given the available choices. For U.S. stock market returns, we use the Standard & Poor’s 90 Index from 1926 through March 3, 1957;the Standard & Poor’s 500 Index from March 4, 1957, through 1974;the Wilshire 5000 Index from 1975 through April 22, 2005; and the MSCI US Broad Market Index thereafter. For U.S. bond market returns, we use the Standard & Poor’s High Grade Corporate Index from 1926 to 1968; the Citigroup High Grade Index from 1969 through 1972; the Lehman U.S. Long Credit Aa Index from 1973 through 1975; and the Barclays Capital U.S. Aggregate Bond Index thereafter. For U.S. short-term reserves, we use the Ibbotson U.S. 30-Day Treasury Bill Index from 1926 through 1977; and the Citigroup 3-Month Treasury Bill Index thereafter. Unlike stocks and bonds, U.S. Treasury bills are guaranteed as to the timely payment of principal and interest. Index performance is not illustrative of any particular investment because you cannot invest in an index.

All investing is subject to risk. Investments in bond funds are subject to interest rate, credit and inflation risk.

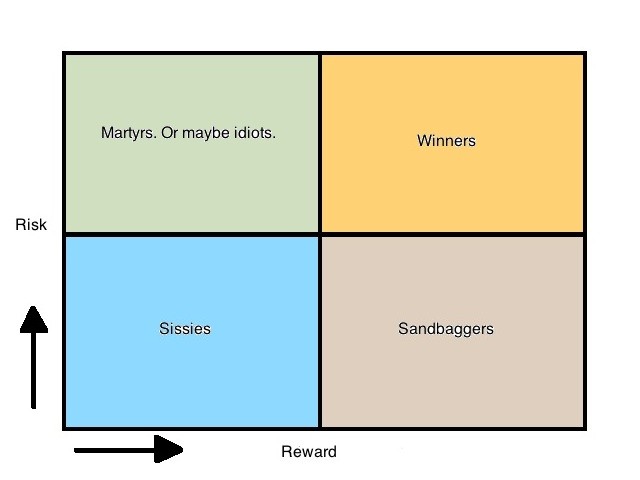

Using the investment principle known as the risk/reward trade-off, you can realize potentially greater returns when you assume greater risk. Of course, the reverse is true as well. You realize potentially less return if you assume little risk.

Take a look at the chart Stocks versus bonds 1926-2009, which shows the performance of different types of investments. It’s important to keep focused on your goals when determining your investment mix and to know your personal level of risk tolerance.

Take the Investor Questionnaire to help you determine the level of risk you’re able to tolerate.

See Chart: Stocks Versus Bonds 1926-2009

For a practical, down-to-earth explanation of why it’s a good idea to maintain a long-term perspective when it comes to market gyrations, read this blog from Craig Stock (head of Vanguard Corporate Marketing and Communication department): The zoom theory and market gyrations. It might just give you additional food for thought.

Are you trying to time the market?

A cautionary note … Attempting to time the market can be dangerous. Predicting market movements is close to impossible. Timing the market is considered more of a gamble than a sound investment strategy. Why? Because chasing performance can be hazardous to your wealth. The purpose of investing is to accumulate wealth, right? Be careful not to hinder your effort to achieve your investment goals.

Vanguard has established policies to keep down costs, discourage short-term trading and to help eliminate the negative impact of market timing. A frequent trading policy applies to all investment funds in the 401(k) Plan, with the exception of Vanguard Prime Money Market Fund Institutional Shares and Vanguard Retirement Savings Trust.