Rising Interest Rates and the Effect on Mortgage REITs (NLY AGNC)

Post on: 26 Май, 2015 No Comment

Rising Interest Rates and the Effect on Mortgage REITs (NLY, AGNC)

Weve seen a spike in the yield of 10 Year US Treasury Notes over the past month; the yield on the 10 year T-note jumped up from 1.59% to 1.93%. While that spike seems minimal, it still is the highest this note has been since May. Could this be a sign that interest rates are rise? If so, how could this development affect dividend investors with positions in mortgage-based real estate investment trusts?

The markets have been on the lookout for the potential rise in interest rates for a while now. Analysts are continually trying to predict the moment when these yields and interest rates will bottom out and bounce back to historically average numbers. A good indicator on the outlook of potential increases in interest rates is the yield on 10 Year US Treasury Notes.

As noted above, 10 year T-notes have seen quite a spike in yield in the past month alone. While maybe this just a fluctuation of the market, with no real long term implication, it could also be a sign that interest rates are in fact on the way back on up.

Goldman Sachs analysts see 10 year T-notes reaching yields of about 2.00% to 2.25% in the near future. If this ends up being the case and bond yields and interest rates start to rise, it could have an impact (both positively and negatively, depending on the point of view) on a variety of business sectors and the economy as a whole. More specifically, this will result in mortgage rates starting to rise therefore affecting the housing market and mortgage-based real estate investment trusts.

What About Mortgage REITs?

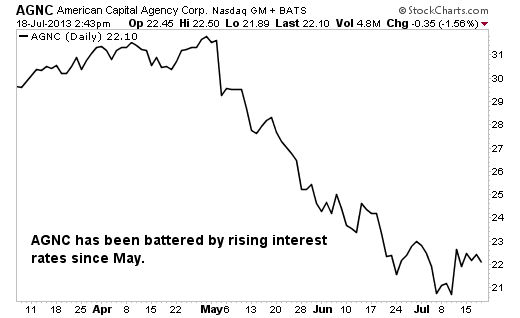

Mortgage-based REITs performed well in the first ten months of 2012, but started to see downward movement from October to the end of the year. For the full year, big mortgage REIT players American Capital Agency Corp (AGNC ) and Annaly Capital Management, Inc. (NLY ) were up only +2.92% and down -12.03%, respectively. Because of the recent hard times, these firms have had to cut dividends paid to investors. Looking forward, there is a possibility that more of the same is in store for these REITs if interest rates see some fluctuation.

High mortgage rates can be a positive for mortgage REITs, but they bring a downside as well. If mortgage rates do indeed rise, this could mean investors will start to see large fluctuations in mortgage REIT prices in the short term. Since these companies are involved in such a volatile market, they tend to not maintain a consistent dividend payment each quarter. This can be problem for dividend investors seeking consistent income from investments.

Another problem with a sharp increase in mortgage rates is the overall effect on the housing market and economy as well. If rates do indeed rise, this will put pressure on the housing market as buyers will be hesitant to borrow to buy a home. This lack of housing consumption would put a strain on mortgage REITs in the short term. It would also put a strain on the overall economy as well, as the housing market is a substantial driver of the future of the economy.

Potential Benefits

On the other hand, higher mortgage interest rates could end up benefiting mortgage REITs if all the pieces come together correctly. Higher mortgage rates will mean that these REITs will see higher returns from the mortgages they own; if the money they borrow to buy these mortgages is at a low enough rate, the spread (the difference between interest rate of money borrowed and mortgage rate) could increase. This large spread means higher returns to shareholders through dividend payments.

The Bottom Line

While we have seen a sharp rise in bond yields over the past month, it does not necessarily mean an overall market change is in store. However, investors should be prepared for the possibility that the market does in fact make a move towards higher interest rates. Another factor that makes this a possibility is the recent news that the Federal Reserve might ease up on its monetary policy of keeping interest rates low. If this were to occur, investors should be ready to see volatility from mortgage-based REITs and the dividends that are earned from such investments.

Be sure to visit our complete recommended list of the Best Dividend Stocks . as well as a detailed explanation of our ratings system here .