Richard s Investment Pad Income Growth Planner Can SREITs still shine in 2015

Post on: 16 Март, 2015 No Comment

Saturday, 24 January 2015

Can S-REITs still shine in 2015?

Since the GFC in 2008, the US Fed has kept the benchmark interest rate at extremely low level for over 7 years. As a result, stock markets in US have had a good bull run. Likewise for Singapore local market.

S-REITs rised to its post-GFC peak in early 2013. ( Note that it is still lower than pre-GFC high level). S-REITs has since then retreated, and started to rise again in 2014 until now. (See the following chart: FTSE REIT index in blue color. STI in brown.)

The main driving factor for the S-REITs’ price volatility since May 2013 is the speculation and materialization of Fed’s QE Tapering off and interest rate normalization. Fed had officially ended QE in Dec 2014, and is generally expected to begin interest rate upward cycle no later than 3Q 2015

With this impending major policy shift, what will happen to S-REITs in 2015? So far, with stellar results in many REITs’ unfolding quarterly reports, Mr. Market has responded with pretty strong price advance.

But what will happen next?

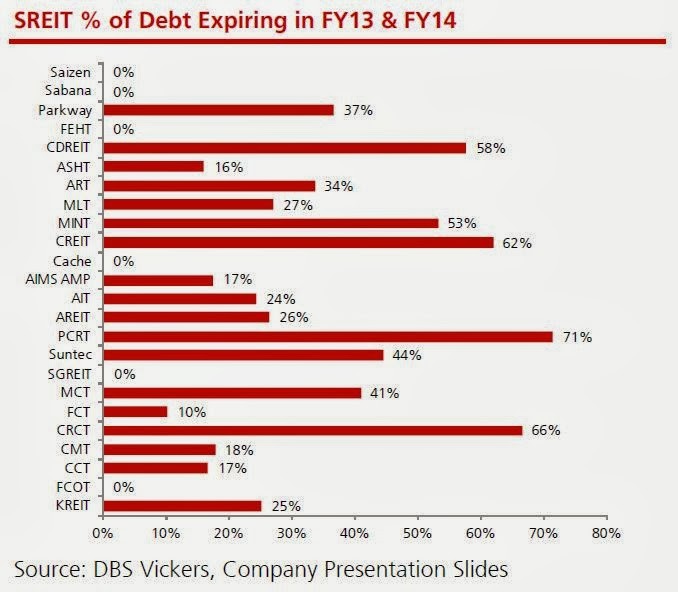

The interest rate normalization is duely expected and has been prepared for. Most S-REITs have strengthened their balance sheets by reducing gear ratio and fix loan interest rate.

As it says, if it is known, it is not a risk. Besides, Fed has been stressing in pain that the pace and process of interest rate rise will accommodate economy condition and labor market in every step. The base scenario is that sudden and drastic interest rate rise is unlikely. What’s more, the wretched oil price, together with other falling commodity price, has lowered inflation expectation, which in turn makes central banks including Fed worry more about deflation than inflation.

While the US is on the track of interest rate rise, Euro zone and Japan are expanding their QE! On 22 Jan 2015, Euro zone announced aggressive QE plan to stimulate its member countries’ stagnant economic growth. In response to that, Euro is now trading at 11 year low against USD. Bank of Japan have already conducted two rounds of QE since PM Abe came into office, pushing JPY to 7 years low against USD. Both EUR and JPY are believed to have more room to fall. China is expected to loosen its monetary policy this year to cushion economic slow down. China’s 2014 GDP growth rate of 7.4% is at her 20 years low. If China loosens, one can expect most Asia Pacific countries to follow.

The main point is that financial markets in the world will not suffer liquidity drain even when US Fed is turning off its own tap.

In fact, even with the background of impending US rate rise, Singapore Gov Bond yield went down in Jan 2015, possibly due to Euro zone’s QE program. Some analysis already claimed that it is partly the reason why interest-rate -sensitive counters(including REITs) in local market has gone up recently. The latest monthly SG inflation rate has turn into negative territory due to lower oil price. Hence, MAS is believed to allow or even encourage SGD to depreciate slowly. All these factors have conduced a benign monetary environment for S-REITs.

Even if interest rate could stay relatively low and will only go up in a steady manner, we still have to face the final challenge: What if interest rate level normalizes as it eventually will be?

Interest rate impacts REITs in two ways.

1. Profit. Higher interest expense can reduce income, if revenue stay the same. But if, as Fed implies, the interest rate rise slowly in accordance with gradually improving economic condition, higher rental should offset higher interest expense. The impact to profits should not be over worried. ( Many quantitative analysis report studied the relation between DPU reduction and bps increment. These fine reports are very powerful in mathematics. But there are too many assumptions. Even so, these reports generally show that the impact is not that severe as commonly perceived) What I believe is that: For good Reits with quality assets that have proven earning power, even when interest rate goes up with booming economy, they are able to sustain their DPU and price, because they could enjoy both handsome rental lift from tenants and nice borrowing rate discount from lenders. (as illustrated by CapitaMall Trust in 2004-2007. See below)

2. Valuation. Yield spread compensation. Many argues that if base rate rise, investors who demand the same risk premium would require their REITs’ yield to go up to maintain the same yield spread. For yield to go up, REITs price will go down. So that’s a downside risk should investors have to liquidate their position for cash in such time. This argument went a long way and fooled quite a number of people. My comments: Only if we live in such a simplistic mathematical world! Why must the risk premium be the same? Investor’s psychologies are not computer programs.

L et the fact speak for itself. Take CapitaMall Trust (a good reit with longest historical data) for example.

During 2004-2007 when Fed Fund Rate went up, CMT’ price went up almost correspondingly! CMT price did not go down to compensate yield spread compression. In this case, it is because back then CMT improved its earnings and its property valuation went up. Investors were willing to accept lower yield to buy CMT. ( In fact, at one time, CMT yield was lower than bank’s promotional saving a/c rate!)

Of course, I am not attempting to use this example to establish any causal relationship. I am merely illustrating that market (or rather human) was able to ignore any mathematical model or assumption! Don’t take any seemingly correct statement for granted.

Not proud to say, Singapore does not have a generous pension system like those in Australia, Canada, Europe or metropolitan area in China. (In here, I will not discuss why? how come? or what to do? just simply state the fact). Hence, Singapore people, knowing that they can not rely on the CPF system to sustain their lifestyle, have been preparing themselves with more income sources: properties, self-paid life insurance, and of course, stocks that pay steady dividends. Luckily there are such good stocks available in local markets. So no matter how the investment theme changes, in Singapore, yield counters will always find avid and loyal investors. thereby good REITs will not see themselves stay mispriced for too long. For investors who intend to hold for dividends, there is no need to worry about the price fluctuation. But I must emphasize that this only applies to good REITs, and the quality of a REIT can change.

In Q4 Y 2014, I earned some moeny in FX speculation by Long USD/JPY and short EUR/USD. I used the profits to augment income portfolio for more regular cash flow. My primary purpose is to preserve value and provide steady, reliable cash flow. Hence, I was looking for REITs counters with solid earning power, growth prospects, relatively low gearing ratio and strong sponsors.

Mapletree Commecial Trust.(MCT)

Mapletree Greater China Commecial Trust(MGCCT)

Starhill Global (Starhill)

Frasers Commecial Trust(FCOT)

Mapletree Industrial Trust(MIT)

It’s a shame I sold MIT and FCOT too early. I did not consider Keppel Reit for its high gearing ratio and future loss of income support. I was interested in CapitaCommecial and Suntec too. But I did not add them, as I thought the price was too high and did not present good opportunity based on risk/reward analysis. But their price are much higher now. Well. As it says when a trend forms, it intends to proceed until it can not go any further. Nevertheless, I would not chase the counters that have advanced too far, as I did not trade, only hold for cash flow. I will wait to see if mean reversion happens.